CNOOC vows strict cost controls

Updated: 2015-05-22 08:37

By Felix Gao in Hong Kong(HK Edition)

|

|||||||||

China National Offshore Oil Corp (CNOOC) - the mainland's third-biggest State-owned oil company - has pledged to exercise extra prudence in its operations and resort to strict cost controls to make itself more competitive amid dwindling oil prices.

Speaking in Hong Kong on Thursday, Yang Hua, who replaced Wang Yilin as CNOOC's chairman on Tuesday, said lower oil prices have put pressure on him, and he will focus on the company's strategy development to help achieve value for shareholders.

He said the volatility in oil prices is partly due to the imbalance between supply and demand, and it's difficult to predict the future trend.

CNOOC's five-year plan aims for a compound annual growth rate of 6 to 10 percent from 2011 to 2015, and this will remain unchanged.

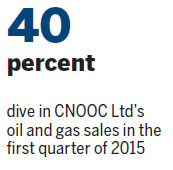

CNOOC Ltd - the oil giant's Hong Kong-listed arm - reported that its oil and gas sales in the first quarter of this year slipped by almost 40 percent to 35.5 billion yuan ($5.7 billion) - from 59.1 billion yuan a year ago - as energy prices dropped.

Realized oil price - the average price the company earns for each barrel sold - fell by 49 percent to $53.4 a barrel in the first quarter from $104.63 a barrel in the same period last year.

Brent, the benchmark for half of the world's crude trading, has declined by 43 percent in the past 10 months.

It shows that the average gas price achieved rose by 5.5 percent to $6.68 per thousand cubic feet, while spending in the first quarter fell 16 percent, led by a 35-percent drop in exploration costs.

"Under the harsh circumstances, the company's overall production and operations remained stable in the first quarter. Our cost control and enhanced efficiency measures were executed effectively and achieved good results. We will continue to strengthen our internal operations management, exercise strict cost control and enhance efficiency to proactively respond to the impact of low oil prices and to effectively promote various production and operational plans," said CNOOC Ltd's Chief Executive Officer Li Fanrong.

CNOOC has pledged to cut spending by roughly one-third compared with a year ago.

The group's net oil-and-gas production growth slowed in the first quarter to 9.4 percent year-over-year - to 118.3 million barrels of oil equivalent - compared with nearly 15.5-percent growth in 2014.

Overseas production growth was flat, held down by falling output at its Canada operations.

Li said the company has no plans to adjust its production target. As the Asia-Pacific region, especially the mainland, pays more attention to clean energy, natural gas will see heavier long-term demand on the mainland, and the company will step up natural-gas exploration, he said.

CNOOC Ltd's share price added 0.97 percent at the close of trading on Thursday.

felix@chinadailyhk.com

|

With sagging oil prices and worsening market conditions, Chinese mainland oil giant CNOOC has pledged to cut spending and pay more attention to clean energy and natural-gas exploration. Forbes Conrad / Bloomberg |

(HK Edition 05/22/2015 page7)