Report confirms HK as leading financial conduit

Updated: 2015-06-26 07:47

By Oswald Chan in Hong Kong(HK Edition)

|

|||||||||

The SAR, as a premier business center, plays vital role in facilitating the flow of capital in international markets

Hong Kong has been ranked second in global direct investment inflows and outflows in 2014, reaffirming the city's role as a super-connector and a conduit to mainland and multinational companies for direct investment, according to United Nations Conference on Trade and Development's (UNCTAD) World Investment Report 2015.

Hong Kong's FDI (foreign direct investment) inflows in 2014 increased 39.2 percent from a year before to $103 billion. The city was ranked second after the Chinese mainland ($129 billion) but ahead of the US ($92 billion), the UK ($72 billion) and Singapore ($68 billion).

This growth in FDI inflows was driven by a surge in equity investment associated with several large cross-border mergers and acquisitions (M&As), such as the purchase of a 25 percent stake in local retailer A.S. Watson Co Ltd by Singapore's Temasek Holdings Private Ltd for $5.7 billion, according to UNCTAD.

Mainland FDI inflows edged up only 4 percent, and was mainly driven by an increase in FDI to the services sector, while FDI fell in manufacturing, especially in industries that are sensitive to rising labor costs.

FDI outflows from Hong Kong also jumped 76.5 percent to $143 billion last year, putting Hong Kong as the world's second largest FDI outflow source after the US ($337 billion).

"Both mainland and multinational corporations use Hong Kong as a springboard to make direct foreign investments," said Simon Galpin, director-general of investment promotion at Invest Hong Kong (InvestHK).

"Mainland companies use Hong Kong to access opportunities elsewhere, while foreign enterprises use Hong Kong to access the mainland and Southeast Asian markets," Galpin added.

Looking ahead, InvestHK will devote more resources in mainland's second-tier cities to attract small- and medium-sized enterprises to come to Hong Kong. Another focus will be capitalizing on the "One Belt, One road" initiative to conduct more investment promotion programs in Southeast Asian, Central Asian and European regions.

"The US and European economic recovery will remain fragile. On the other hand, the economies of Asia Pacific region, including the Chinese mainland, can still register higher growth rates. We see more emerging economies investing in other emerging markets as well, eliciting more global FDI inflows to the Asia Pacific region and FDI outflows from the region," said Raymond So Wai-man, dean of Business School at Hang Seng Management College.

"The FDI inflows and outflows essentially are long-term portfolio investment that bets on the long-term economic growth in Asia Pacific region," So added.

According to the UNCTAD report, international investment in infrastructure has been rising, with intra-regional FDI being a major driving force in East and Southeast Asia.

Global FDI fell 16 percent to $1.23 trillion in 2014, the UNCTAD report said, due to the fragility of the global economy, policy uncertainties and elevated geopolitical risks. The amount of gross new investment was offset by some large divestments.

oswald@chinadailyhk.com

|

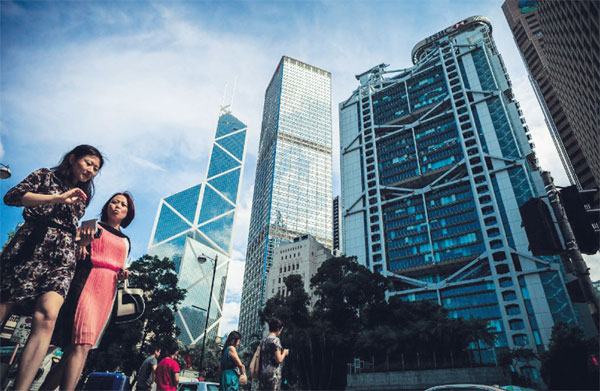

Hong Kong was ranked second in global direct investment inflows and outflows in 2014, after the Chinese mainland but ahead of the US, the UK and Singapore, according to a recent report. The strong FDI (foreign direct investment) inflows and outflows are due to long-term portfolio investment that bets on the long-term economic growth in Asia Pacific region, experts say. Asia News Photo |

(HK Edition 06/26/2015 page9)