Insurers left reeling as UnionPay cap blow lands

Updated: 2016-02-04 07:39

By Luo Weiteng in Hong Kong(HK Edition)

|

|||||||||

|

Hong Kong-based insurer AIA Group, 30 percent of whose new premiums in the city come from mainland clients, slumped as much as 9.4 percent in early trading on Wednesday, driven by a new regulation effective from Thursday that will see insurance product purchase overseas by UnionPay credit and debit cards capped at $5,000 per transaction. Roy Liu / China Daily |

Worries mount that mainland capital curbs may dent HK insurance sector

Hong Kong's insurance sector took a nosedive in the local equity market on Wednesday amid fresh fears that the mainland foreign exchange (forex) regulator may ban residents from buying offshore insurance policies in Hong Kong.

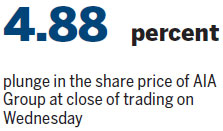

Hong Kong-based AIA Group tumbled 4.88 percent to close at HK$38.95 on investor worries after Beijing set a $5,000 limit per transaction on the purchase of insurance products in the SAR using the country's UnionPay credit and debit cards. Manulife Financial lost 5.07 percent, while British insurance giant Prudential Plc plunged 4.47 percent in Hong Kong.

The slump came as the mainland currency regulator capped at $5,000 single transactions using UnionPay bank cards for purchase of insurance products overseas, effective Thursday (today). The central government has been trying to plug capital outflows, which reportedly hit $150 billion in January alone.

However, UnionPay International said in a statement that the payment limit is by no means a "new policy". It is in accord with a State Administration of Foreign Exchange circular of 2010, which provides that insurers fall into a category of restricted merchants and are subject to a limit of $5,000 for each transaction conducted via mainland-issued bank cards.

Individual citizens' overseas travel spending will not be affected by the UnionPay swipe limit, the company added, easing concerns that Hong Kong's already struggling retail sector would take a further hit.

Many local insurance brokers have reportedly been urging cash-rich mainland customers since Tuesday night to purchase policies before the restrictions take effect.

Based on the current mainland forex administration system, individual citizens can bring out a maximum of $50,000 per year, meaning anyone wanting to spend more than that abroad must look for alternative ways to do so.

Insurance purchases through UnionPay cards, earlier exempt from such capital controls, have been aggressively marketed as a popular method to circumvent the restrictions on individual forex limits and raise money offshore, said a local agent for a Hong Kong-based insurance firm. "This is the major selling point that many Hong Kong insurance agents would highlight when touting for business in the mainland," the agent said.

Credit Suisse analysts in a note said that the restrictive measures may take their toll on Hong Kong insurers including AIA, 30 percent of whose new premiums in the city come from mainland clients.

Mainland customers brought an insurance bonanza to Hong Kong for another bumper year in 2015, being expected to spend a record of more than HK$30 billion on insurance policies in the territory - a six-fold increase from five years ago.

The payment limit is currently set for each transaction, so one can still pay several times a day to cover large premiums. "However if more strict controls were to be put in place, the impact could be more significant. In the extreme case, without business from mainland visitors, we expect AIA's overall value of new business growth to drop to 10 to 15 percent," said Jefferies Hong Kong equity analyst Baron Nie.

sophia@chinadailyhk.com

(HK Edition 02/04/2016 page8)