Crowdfunding off table in Shenzhen

Updated: 2016-04-14 08:26

By Chai Hua in Shenzhen(HK Edition)

|

|||||||||

|

Crowdfunding offers speculators a slice of the property pie for a small outlay, but the Centaline Property Research Center director in Shenzhen noted that profit from short-term investments depends solely on prices continuing to climb rapidly. Edmond Tang / China Daily |

After stringent homebuying rules, new funding curbs reflect official resolve to further tighten market

Amid falling transaction volume and average price since last month's introduction of new tighter regulations for homebuyers, authorities in Shenzhen have suddenly called off crowdfunding in the real estate market in a sign of determination to continue the tightening process.

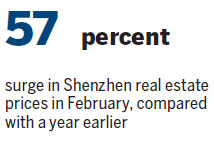

The steps come after Shenzhen became the hottest property market in the country earlier this year, with prices up nearly 57 percent in February from a year earlier, sparking fears of overheating and a property bubble.

The Shenzhen Internet Finance Association on Tuesday issued a notice to local web finance companies, asking them to stop all crowdfunding business related to property projects.

Local companies, or companies with crowdfunding property projects in Shenzhen, have seven days to clear all related online and offline projects, including using crowdfunding to buy or rent residential premises, retail stores, factories and commercial apartments.

The notice ruled that all funds raised from crowdfunding platforms should be returned to investors without any service fees charged.

Zeng Guang, general secretary of the association, told Southern Metropolis Daily that they have about 12 registered crowdfunding companies focusing on property projects, with total capital accumulated around 800 million yuan ($123.6 million).

Crowdfunding offers property speculators in Shenzhen a chance to get a piece of the housing pie with little investment. Shenzhen-based platform ifangchou.com at one point promised annual returns of 15 percent or above in three months for a minimum investment of 100 yuan.

The website still listed 324 projects as of Wednesday, including hotels, stores and parking lots, as well as apartments in Guangzhou and Shenzhen, about 98 percent of which have been sold.

The platform became particularly popular as local home prices continued to go through the roof in the last several months. However, "profit from such short-term investments depends solely on home prices continuing to climb rapidly," pointed out Wang Fei, director of the Centaline Property Research Center in Shenzhen.

The market in Shenzhen began to show signs of cooling this month, as both trade volume and quoted prices shrank after the government last month tightened policy restrictions on home purchase and down-payment ratios.

According to the Urban Planning, Land & Resources Commission of Shenzhen, deals for 509 new homes were signed in the week between April 4 and 10, down by about 22 percent from the previous seven-day period.

The average price level softened by 7 percent week-on-week to 46,100 yuan per square meter, the commission's data showed.

Some industry analysts believe the new curbs may lead to further dips in housing transactions and prices in the short term, but others have adopted a much more positive attitude.

Song Ding, director of the Tourism and Real Estate Industry Research Center at Shenzhen-based think tank China Development Institute, said the policy will help guide the market along a positive track by targeting speculators.

"Demand is still exuberant," Song noted. "If some projects can stimulate the market with reasonable price, it can become active again."

grace@chinadailyhk.com

(HK Edition 04/14/2016 page9)