Lifting the elderly out of poverty

Updated: 2016-07-04 08:01

By Joseph Li(HK Edition)

|

|||||||||

|

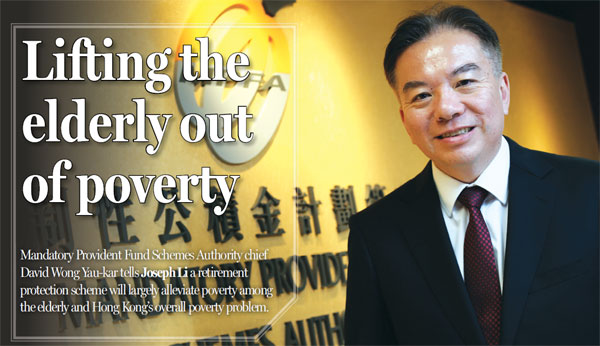

David Wong Yau-kar, chairman of the Mandatory Provident Fund Schemes Authority (MPFA), says the MPFA has a duty to strengthen the MPF scheme to fulfill its retirement protection function and protect the city's labor rights. Photos by Edmond Tang / China Daily |

Mandatory Provident Fund Schemes Authority chief David Wong Yau-kar tells Joseph Li a retirement protection scheme will largely alleviate poverty among the elderly and Hong Kong's overall poverty problem.

The Commission on Poverty, chaired by Chief Secretary for Administration Carrie Lam Cheng Yuet-ngor, recently completed a six-month public consultation exercise on growing calls for a universal retirement protection scheme for Hong Kong.

In an unusual move, the Mandatory Provident Fund Schemes Authority (MPFA), as a statutory regulatory body without a policy-making portfolio, submitted its views on retirement protection to the government with the consent of its management board.

But, in an exclusive interview with China Daily, MPFA Chairman David Wong Yau-kar says it's not unusual for the authority to make submissions to the government.

"It's not an unusual practice although Carrie Lam did not ask us to submit our views," he explains. "A considerable part of the public consultation paper touches on the role and the rather important role of the MPFA in the retirement protection plan, as well as several issues related to the MPFA, especially ways to improve the MPF scheme.

"Therefore, we, as a responsible organization, hope to contribute our views that are helpful to public discussions as we intend to improve Hong Kong's retirement protection system."

Wong reckons that although poverty alleviation and retirement protection are rather two different issues that should be specially dealt with, they are related to one other in many ways.

"For example, the proportion of elderly poor people is significantly high because of inadequate retirement protection. So, retirement protection cannot be handled separately from the problem of poverty among the elderly," he argues.

"If there's adequate retirement protection in Hong Kong, the elderly poor problem will be largely alleviated, so will the poverty problem as a whole."

On the main points submitted by the MPFA to the Commission on Poverty, Wong stresses that the MPF is a very important pillar of retirement protection but it can only work well in conjunction with other pillars, such as personal savings and elderly services (such as in the form of housing and healthcare).

On the "hot potato" of whether to scrap the statutory mechanism allowing employers to offset severance pay and long-service payments with their MPF contributions, he says it's a very controversial, complicated issue that involves relations between employers and employees.

In his view, the government should handle the issue properly, but he declines to say whether the offsetting mechanism should be removed.

Wong notes that the reality is whenever an employee is made redundant or changes jobs, an employer uses his portion of the MPF contribution to settle severance pay or long-service payment.

This happens to low-income workers earning less than HK$7,100 a month and are not required to make MPF contributions. As a result, employees' cumulative MPF benefits are offset by the employers if they have been laid off several times, with very little or no money left in their accounts.

Over the years, more than 90 percent of employers' contributions have been used to settle severance and long-service payments, Wong notes. In 2015, a staggering HK$3.3 billion in MPF contributions was used to offset severance payments, accumulating to HK$28 billion over the years since the MPF scheme was launched in December 2000.

"The loss of MPF benefits is highly unsatisfactory for employees because it does not fulfill the aim of retirement protection," he remarks.

"The government must tackle this problem urgently, but the MPFA does not hold an official position (as to removing the offsetting mechanism or not). Just because this is an acute, contentious issue, the government and employers cannot set it aside and the need to respond to employees' demands is pressing."

In his 2012 election manifesto, Chief Executive Leung Chun-ying vowed to gradually lower the ratio of the amount to be offset (with a view to cancelling the offsetting mechanism in the long run).

In Wong's view, employers, however, have the right to offset severance pay and long-service payments with part of their MPF contributions because this is allowed under the law and has a historical background.

In the past few decades, several measures to protect labor rights have been enacted, such as the introduction of severance pay in 1975, long-service payment in 1985 and the launch of the MPF system in 1995.

"However, the functions and interrelationship of these measures has not been clearly defined, resulting in huge complications and controversy today," Wong points out. "In fact, the offsetting principle is not wrong because it was introduced when the severance pay arrangement was put into place."

He earnestly hopes that the community will adopt a calm, rational and pragmatic attitude to find a solution that should be fair and without creating an extra burden to any party.

On the question of retirement protection, Wong reserves his comments as to whether it should be "universal" or "not universal" in nature, but admits that society remains deeply split on whether retirement protection should apply to everyone or just those in financial need.

He adds that the MPFA has a duty to improve the MPF scheme to fulfill the aim of retirement protection and protect labor rights, while not disrupting Hong Kong's business environment.

Contact the writer at joseph@chinadailyhk.com

(HK Edition 07/04/2016 page6)