Strong US dollar pushes renminbi to a six-year low

Updated: 2016-07-19 07:21

By Lin Wenjie in Hong Kong(HK Edition)

|

|||||||||

Experts see further depreciation of Chinese currency and fresh monetary easing measures to buoy slowed economy

The Chinese yuan slipped to a six-year-low on Monday after the People's Bank of China (PBOC) set the yuan fixing rate to the weakest level since October 2010 in response to the dollar's broad gains against a basket of major currencies last Friday.

The retreat has strengthened market expectations that further depreciation of the Chinese currency is on the horizon.

Analysts believe the yuan will continue to depreciate in the near future, with the Chinese mainland likely to cut interest rates, and the US raising rates following the latest upbeat jobs and retail data that suggest that the US economy may be back on track.

The yuan fell 0.2 percent to 6.7014 per US dollar as of 5:34 pm in Shanghai, having dropped to 6.7021 earlier - the weakest level since September 2010 - according to data compiled by Bloomberg. The currency traded in Hong Kong's offshore market was little changed at 6.7112.

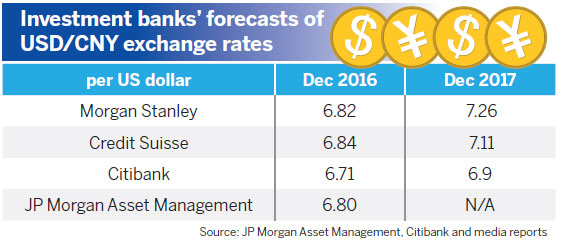

"However, we don't think there'll be a sharp depreciation of the yuan because the US Federal Reserve is unlikely to raise rates within this year, keeping a lid on the US dollar in the second half," JP Morgan Asset Management's global market strategist Ben Luk said n Monday. "We expect the yuan to depreciate mildly to 6.8 against the US dollar at the end of 2016, following a basket of currencies."

Luk acknowledged there's the possibility that a US rate hike will happen in December. "But given the high levels of uncertainty in the global market, the next rate hike will more likely to happen in 2017," he noted.

He said the possibility of a rate cut in China will be higher than a reduction in the reserve requirement ratio, signaling possible cheaper credit later this year to boost investment and support the property market, a pillar of the Chinese economy.

The lukewarm property market was gaining momentum in the first half of this year, helping the nation's gross domestic product grow 6.7 percent.

"We believe there will be a rate cut of 25 basis points if the mainland's property and infrastructure investment stagnated amid an economic slowdown in the next half year," he said.

Other investment banks have come up with even more pessimistic views.

Citibank expects the yuan to depreciate to 6.65 per US dollar within the next three months, and a further drop to 6.71 can be expected by year-end, due to potential monetary-easing measures to be taken by the nation's central bank to buoy a slowing economy growth.

"China's central bank is likely to cut the reserve requirement ratio by three times for the rest of the year, each by 50 basis points," said Catherine Cheung, head of investment strategy and portfolio advisory at Citibank Global Consumer Banking.

The Shanghai Composite Index fell by 10.73 points at the close of trading on Monday, or 0.35 percent, to 3,043.56. The Hang Seng Index gained 0.66 percent.

cherrylin@chinadailyhk.com

(HK Edition 07/19/2016 page9)