Positive US signals lend weight to Hong Kong's economic resurgence

Updated: 2016-08-09 07:39

By Peter Liang(HK Edition)

|

|||||||||

|

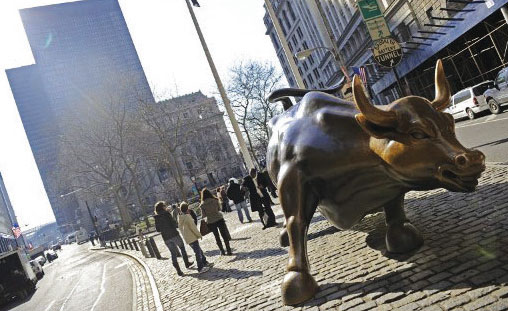

Pedestrians walk past the Wall Street Bull in New York. Taking the cue from the stronger-than-expected US economic performance in June, Hong Kong stocks surged to this year's high on Monday. Asia News Photo |

If you've been reading this column, you wouldn't be surprised by the robust performance of the Hong Kong stock market since the rally took off early last month. But if you're still wondering why it happened when the economic fundamentals have remained largely unchanged, keep an eye on Wall Street.

In the past few months, the local bourse has been marching in lockstep with that of the US. On Monday, the benchmark index of Hong Kong stocks surged 1.57 percent at the close of trading to reach a new high since late February this year, after Wall Street posted strong gains on Friday on better-than-expected job figures.

The US Labor Department said last Friday the economy had added 255,000 jobs last month, beating earlier forecasts of 180,000 by a considerable margin. July's job report has largely lifted the gloom cast by the poor economic data for the 2016 first half, prompting economic analysts to revise upwards their growth forecast for the second half.

The latest job figures could provide strong support for the US Federal Reserve to raise interest rates as early as September, rather than waiting till 2017 as expected earlier. But the sustained recovery of the world's largest economy is widely seen as a stabilizing force that can help avert a second global recession at a time when the European Union and Japan are teetering on the brink of a deflationary trap.

The stronger-than-expected US economic performance has underscored the strength of the Hong Kong dollar, which is pegged to the greenback. The strengthening Hong Kong dollar has, in turn, attracted a strong inflow of capital from regional investors looking for a safe haven for their wealth.

Hong Kong does not keep tap on capital flow, but the heavier daily stock market turnover is considered a sign of rising demand by overseas investors.

The increase in foreign investment in Hong Kong's real estate assets has been reflected in several highly publicized transactions in which overseas buyers were reported to have paid record prices for a number of trophy commercial properties. Strong overseas buying interest is said to have helped push up prices of luxury apartments in popular residential districts.

When the property market turns the corner, will the economy be far behind?

(HK Edition 08/09/2016 page11)