Hong Kong's gateway status is now assured: HKEx chief

Updated: 2016-08-18 08:05

By Bloomberg In Hong Kong(HK Edition)

|

|||||||||

Charles Li says new Shenzhen-HK stocks link will see increased flow of mainland and global funds into SAR

With the long-awaited Shenzhen-Hong Kong Stock Connect approved by the State Council on Tuesday, Charles Li Xiaojia, chief executive of Hong Kong Exchanges and Clearing Ltd (HKEx), said he believes the second stocks trading link between the SAR and the Chinese mainland will help cement Hong Kong's status as the gateway to the mainland's multi-trillion dollar investor base.

In an interview with Bloomberg, Li said he now expects the flow of money from the mainland to increase.

The initiative would double daily limits for equity purchases from the mainland and will scrap total quotas, which were introduced with the launch of the first link - the Shanghai-Hong Kong Stock Connect - in late 2014.

The long-delayed Shenzhen connect is part of the mainland's efforts to open its capital markets and lift its global influence. The nation has about $20 trillion deposited in banks, of which about a half will be invested in equities and bonds in the next two decades, Li said.

"The long term significance of the connect is the southbound," said Li. "Hong Kong's job is to bring the world to Hong Kong, so the mainland can invest in the world at this full stop in Hong Kong."

Mainland investors have bought about 200 billion yuan ($30 billion) worth of shares in Hong Kong, using more than 80 percent of the aggregate quota, since the Shanghai link was started in November 2014, according to Bloomberg data.

The southbound and northbound total limits will be scrapped, according to Tuesday's announcement.

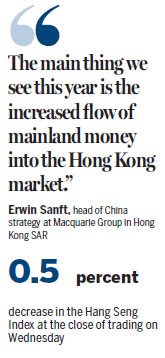

"The main thing we see this year is the increased flow of mainland money into the Hong Kong market," said Erwin Sanft, head of China strategy at Macquarie Group in Hong Kong SAR.

The announcement of the new stocks link "shows that the general fear of capital outflows is much lower" on the mainland, he said.

Li is looking to boost the attractiveness of Hong Kong stocks after the 30-day average value of shares traded in the city fell to an almost two-year low in June. While the benchmark Hong Kong equity gauge has rebounded back into a bull market after plunging in the wake of the mainland's 2015 rout, its longer-term performance is poor relative to global peers.

The Hang Seng Index has gained 13 percent in the past five years, behind the 37-percent advance by the MSCI All-Country World Index.

The Shenzhen link will lure foreign companies to list in Hong Kong, Li said, with the aim of pulling in mainland investor money. Seven international companies had initial public offerings on the bourse this year, raising about $1.3 billion.

"Hopefully, over time, we'll get more international listings, international products and then those products would become much more interesting for the southbound investors," Li said.

"And, we will be the primary destination."

The share price of HKEx dropped 4.7 percent to close at HK$191.2 on Wednesday, while the Hang Seng Index dropped 0.5 percent.

|

Hong Kong Exchanges and Clearing Ltd has pledged to boost the attractiveness of Hong Kong stocks, and get more foreign companies to list in the city, with the aim of pulling in Chinese mainland investment. Edmond Tang / China Daily |

(HK Edition 08/18/2016 page11)