-

News >Bizchina

Tightening property policies to continue

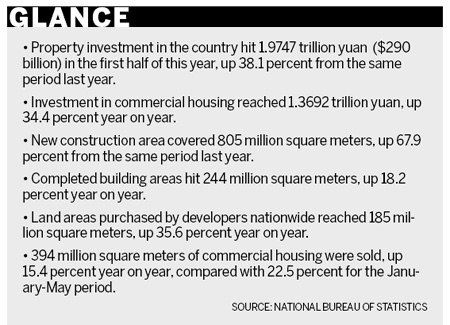

2010-07-13 09:10BEIJING: The country will continue its tightening policies for the property sector, even as housing prices in June saw the first monthly fall since February last year, the Ministry of Housing and Urban-Rural Development said on Monday.

In a statement on its website, the ministry said it will strictly apply different mortgage policies and curb speculative purchases, as well as increase the supply of affordable homes and low-rent housing.

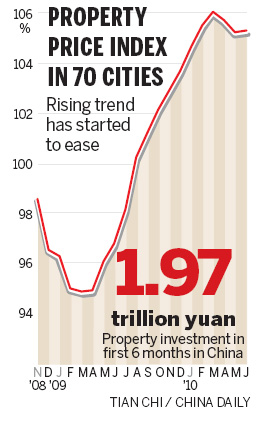

Property prices in 70 major cities nationwide edged down 0.1 percent month-on-month in June, the National Bureau of Statistics said on Monday. The year-on-year increase in prices slowed to 11.4 percent last month, compared with 12.4 percent in May and 12.8 percent in April. [China's housing prices grow slower in June]

The figures indicate that government measures to cool down the sizzling property sector have kicked in, analysts said.

"Generally speaking, this round of tightening measures has met targets, as evidenced by falling property sales, stabilized prices and people's expectations of price trends," said Qin Hong, the ministry's deputy research head.

To rein in runaway property prices, the government in April raised down payments, ended mortgage discounts, tightened rules on loans to developers and made it harder to buy more homes.

The property sector usually accounts for about 10 percent of gross domestic product and construction consumes half of the nation's output of steel and 36 percent of the aluminum that it makes, JPMorgan Chase & Co estimated.

Property sales in Shanghai, Nanjing and Hangzhou halved in the first six months of the year, while those of Beijing dropped 40 percent, statistics from the policy research center under the housing ministry and China Index Academy showed.

Similarly, land prices in 103 cities fell 9 percent in the first half of the year.

"Aside from insisting on some fundamental rules such as increasing land supply and changing the land bidding system, we should also fine-tune some temporary policies as the situation changes," Qin said.

Authorities should publish the timetable for levying any property tax as soon as possible and ease curbs on second-home purchasers who are buying property for their own use and not for investment, Qin said.

"They should be allowed to renegotiate contracts with banks to get lower mortgage rates, provided they sell their first homes within a year," she said.

A number of banks in major cities, including Beijing, Shanghai and Shenzhen, had reportedly resumed making mortgages on third homes.

The central government has entrusted professional institutions to investigate property markets to pave the way for laying out policies in the following months, industry sources said.

Ren Zhiqiang, chairman of Beijing-based Huayuan Property, said the government's current real estate policy will last for a long period of time.

"The government will not ease its policy lightly, and a growing supply of housing and tighter cash flow will force developers to cut prices over the next few months," Ren said.

Sun Mingchun, chief economist of Nomura China, said the nation's real estate policy may loosen after the average property price drops 10 to 20 percent in 12 to 18 months

"I believe such a price fall will have limited impact on China's economy and we maintain our forecast of GDP to grow at 10.5 percent in 2010 and 9.8 percent in 2011," Sun said.