-

News >Bizchina

Demand slows in auto market

2010-07-19 14:30

Carmakers are stepping up marketing efforts as dealer inventories build. [Yang Shen / For China Daily]

Stimulus measures may have pulled demand forward - and now sales are slowing

As expected, tremendous growth registered in the first quarter of 2010 proved unsustainable in the second as the light vehicle market continued to slow through June.

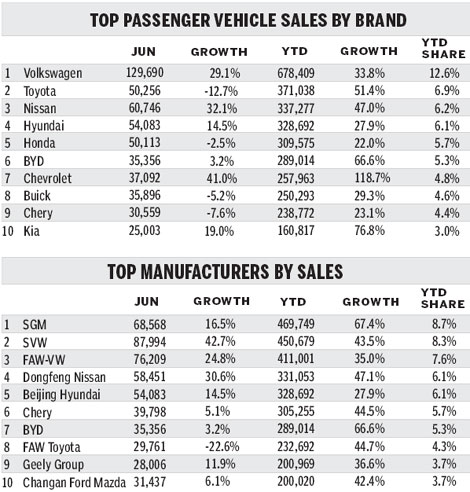

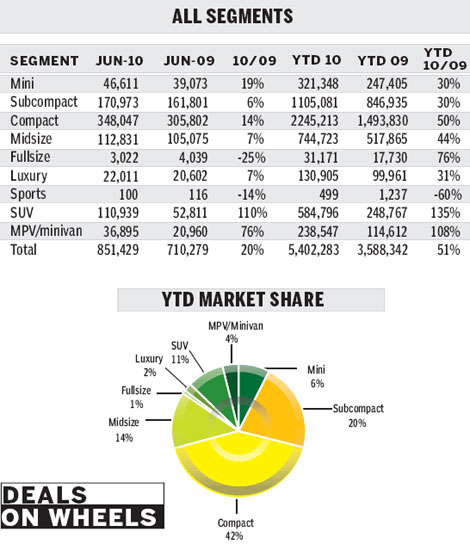

Light vehicle demand in June grew 23 percent over the same month last year to 1.33 million units, a little lower than May figures, bringing the first half total to 8.5 million, up 46 percent from the same period last year.

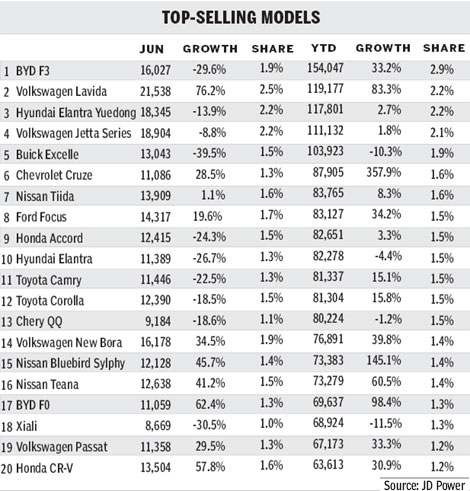

Passenger vehicle sales grew 22 percent over June last year to 902,000 cars, finishing the first half with sales of 5.7 million units, up 52 percent compared with the first half of 2009.

Light commercial vehicle sales rose 24 percent to 430,000 units, resulting in 2.8 million sales year to date, up 36 percent year on year.

Faced with increasing pressures on inventory, even the most aggressive companies like BYD, Chery and Wuling have started to cut production to reduce the burden on dealers.

Total inventory in the industry, according to China Automotive Tech & Research Center, increased from a 43-day supply at the start of the year to 55 days in June.

Ambitious annual sales targets are now putting increasing pressure on dealers as inventories build. Strong growth in 2009 and through the first quarter of 2010 boosted confidence across the industry and drove up expectations for the year.

More vehicles rolled off recently expanded assembly lines and a bewildering array of new models hit the showrooms. Despite softening in the market since March, most carmakers are reluctant to slow output for fear of losing market share should demand rebound.

Slowing demand

Slowing demand in June could be due to seasonal factors such as bad weather, high temperatures, floods in the south and the FIFA World Cup, all resulting in fewer consumers entering showrooms.

Yet we think there is also a payback factor following the frenetic growth of 2009.

Growth in the mini, subcompact and compact cars segments shrank below the 20 percent mark in June - while all soared by more than 40 percent in 2009.

This could indicate that the government sales tax cut pulled forward future demand rather than creating new demand. The rapid decline in mini buses sales is also likely due to advance purchases that have already been made.

Though sales in the smaller vehicle segments weakened, SUV and MPV sales remain strong. Both segments saw demand in the first six months of the year more than double from the same period a year ago.

Benefiting little from subsidies, their growth reflects actual new demand, which comes from the emergence of second-time vehicle buyers whose income has risen quickly with the growth of the economy.

Some argue that strong double-digit growth could last for many years, given China's low vehicle density and strong GDP growth - but we don't think so.

We see little vehicle sales growth in large cities such as Shanghai, Beijing and Guangzhou, given the increasing traffic congestion, limited parking and volume control measures.

Many also see rural communities and smaller cities as relatively untapped pools of demand with low vehicle ownership levels. Yet many of these markets are experiencing rapidly increasing living costs and unemployment levels, both of which do little to support vehicle demand.

With the ending of the stimulus programs and the slow progress development of the highway system, indications are the market is unlikely to continue the rampant growth seen through 2009 and the start of 2010.

While opinions differ over the rate China's vehicle market will grow, without question the market will continue to grow.

The economy remains strong and the government will use all the tools at its disposal to ensure the automotive industry remains one of its pillars.

The author is a senior analyst at JD Power Consulting (Shanghai) Co Ltd