-

News >Bizchina

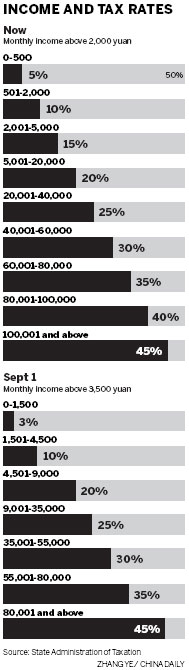

Taxing times despite new rate

2011-08-23 09:23

How they manage

Zhao Hengming, who works half-days at a machinery factory, sets out every afternoon for nearby markets in Nanjing, Jiangsu province. He usually compares prices at several markets to be sure he gets the best bargain. [Photo / China Daily]

Zhao, in Nanjing, is a prime example. His family can expect to pay about 150 yuan less in income tax next month, but he will hold to a routine that works for him.

Zhao, in Nanjing, is a prime example. His family can expect to pay about 150 yuan less in income tax next month, but he will hold to a routine that works for him."The best time for buying vegetables is before 8 am or after 8 pm in the supermarket, where sales are available. And it's better to buy meat after 4 pm at a food market where you can bargain with the sellers," he said.

Zhao, 50, started working half-days six years ago when production slowed at the machinery plant. Because his afternoons are free, he can compare the prices of food and daily products in different markets to make sure that what he buys is the cheapest.

He stays alert to information about discounts, and notices when prices change on everything from food and small commodities to clothes and appliances. He started eating more chicken than pork when the price of pork jumped nearly 60 percent early this year.

"Neither inflation nor the better personal tax policy will change my attitude toward saving money," Zhao said. "It is most essential for a family to keep and make good use of its fortune."

Kang Shiyang, 24, who teaches at a college in Shanghai, earns 2,500 yuan a month, which means he will directly benefit from the changes. Under normal circumstances, he is able to save about 500 yuan each month.

However, he said, "The new personal tax policy will not ease the high pressure from inflation and dramatically increasing consumption in the city, where it's nearly impossible for low-income people to survive.

"I've never expected that the improved tax policy will increase the amount in my saving account, so I have to be thrifty by eating less and riding bicycles instead of taking more expensive transportation," Kang said.

"I try to avoid going out for social activities with friends after work or during the weekend to save money for dating my girlfriend and preparing for a future family."

Ji Yanhong, 43, a cleaner at a commercial building in Shanghai, didn't know where her income put her on the tax tables. The hours and shifts she works change frequently, so her monthly pay varies, too. "I didn't notice how much had been deducted as personal tax."

After being told that her take-home pay will increase slightly next month, Ji felt delighted. She can save a few hundred yuan more to buy snacks for her children.

"More money is better than nothing, so I recognize it as a piece of good news for me," Ji said. "Hopefully there will be more benefits offered to us low-income workers in the future."

Chen Yang, a 25-year-old salesman, moved to Shanghai from Hubei province more than a year ago. He sees the 300 or so yuan he won't pay in tax every month as a drop in the bucket.

"My current monthly salary is 2,500 yuan including a bonus, and the basic expenses of rent, food and transportation nearly cost 2,000 yuan if I don't go out for any activities or short-distance travel."

To save money and send some to his parents, Chen chose to minimize his cost of rent and food as the main method to cut expenses.

He lives in a 5-square-meter room in a four-room apartment, sharing the bathroom and kitchen with 10 other people, and his rent and other bills run to 850 yuan a month. "The living conditions are much better than I used to have, when I had to share a tiny room with two other roommates."