-

News >World

GM $13b IPO to cut US Treasury stake to 43%

2010-11-04 11:02NEW YORK - General Motors on Wednesday finalized terms for a stock offering of about $13 billion to repay a controversial taxpayer-funded bailout and reduce the US Treasury to a minority shareholder.

GM's filing with the US Securities and Exchange Commission is the final step before it begins marketing what is expected to be one of the largest-ever IPOs. The investors are expected to span the globe and include sovereign wealth funds.

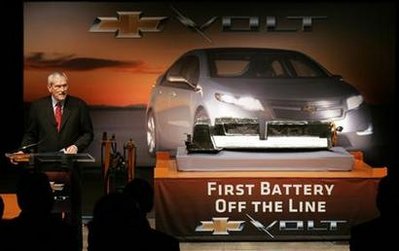

General Motors Chairman and CEO Ed Whitacre talks about the first assembled lithium-ion battery for the Chevrolet Volt electric vehicle during a news conference in Brownstown Township, Michigan Jan 7, 2010. [File photo/Agencies]The automaker plans to sell 365 million common shares, or 24 percent of its common stock, at $26 to $29 each, raising about $10 billion at the midpoint, according to updated initial public offering papers filed with the SEC.

In addition, GM said it planned to sell about $3 billion of preferred shares that would convert to common shares under mandatory provisions, a less risky form of equity that could attract dividend and growth-fund investors.The IPO would value GM at just over $41 billion at the midpoint of the price range, making it all but certain that US taxpayers would face a loss on the automaker's still controversial bailout. GM needs a market value of roughly $70 billion if US taxpayers are to break even.

At $41 billion, GM would also be priced at about a 16 percent discount to its smaller but more successful rival Ford Motor Co, which has a market capitalization of more than $48 billion.

"That would make sense," said Bernie McGinn, chief investment officer at McGinn Investment Management in Alexandria, Virginia, who owns Ford stock. "Ford has done everything right, and GM is a year out of bankruptcy and it has a new CEO."

McGinn said the discounted value for GM also reflected the urgency for the Obama administration to exit its investment in the US automaker.

"I think this is a political thing. It's being driven by Washington," he said. "They just want to get out. And if you talk about eating $10 billion in losses, this is a city that can eat trillions of dollars."

One source familiar with the offering said, "(The Treasury) decided they wanted a massive upside." The source was not authorized to speak with the media and declined to be named.

"The tough actions that the Administration took to get the auto industry back on its feet and save over one million jobs played a crucial role in putting our economy on the path to recovery. Today's development represents another important step forward in our oft-repeated policy of exiting these investments as soon as practicable and recovering funds on behalf of the American taxpayer," the US Treasury said in a statement.

GM, which will have 1.5 billion outstanding common shares following a planned 3-for-1 stock split in the IPO, would need to trade at roughly $50 per share in the market to reach the $70 billion break-even threshold.

The Treasury, which holds a 60.8 percent stake in GM as a result of its $50 billion bailout, will take a loss of up to $4.9 billion on its sale of shares in the IPO.

The Treasury plans to cut its stake to just over 43 percent, excluding the overallotment option.

Treasury officials led by former Lazard Freres and Co banker Ron Bloom have indicated that they are willing to take an initial loss on GM as part of the Obama administration's stated goal of exiting from the government's investment as "quickly as practicable."

Underscoring the political sensitivities still surrounding GM's bailout, Senator Chuck Grassley in a statement on Wednesday urged the Treasury to ensure "taxpayers get their money in full."