Property market cooling

More cities see home prices drop or remain unchanged as policies bite

BEIJING - More cities reported lower or unchanged real estate prices in August than in July, the National Bureau of Statistics (NBS) said on Sunday, in the latest sign that government efforts to cool the market are working.

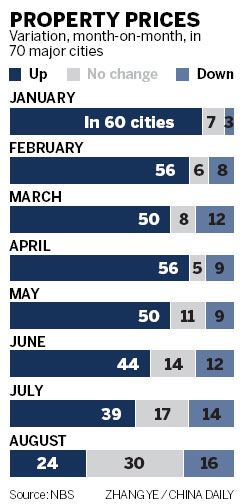

Property prices in August in 46 out of 70 monitored major cities declined or stayed flat. Just 31 cities reported similar market conditions in July, according to the NBS.

Property prices for new homes dropped in 16 cities in August, up from 14 in July.

Thirty cities, including Beijing, Shanghai, Guangzhou and Shenzhen, saw property prices remain unchanged, according to the NBS.

The figures mean that for two months running, July and August, the top four cities saw unchanged property prices, a clear indication that tightening measures have had consequences.

"Property prices may fall in the next 12 to 18 months as the government's rigorous real estate measures continue," said Vincent Lo, chairman of Shui On Land Ltd, a major property developer in Hong Kong.

Premier Wen Jiabao said at the opening of the 2011 "Summer Davos" held in Dalian last week that the country will maintain its prudent monetary policy as the economy is moving in the right direction.

This indicates that the government is not likely to ease real estate policies despite the global economic outlook, Lo said. Real estate is a key driving force behind China's economy.

"The tightening of bank loans and expanded home-purchase restrictions will see property developers face cash flow problems and this will finally prompt them to cut prices," Lo said.

The government has started to prepare home-purchase restrictions in second- and third-tier cities to prevent price increases.

Previously, the government restricted residents in major cities, such as Beijing and Shanghai, from buying second or third homes. Homebuyers were also required to pay higher down payments for mortgages. Property taxes have been levied in Chongqing and Shanghai.

Qin Hong, deputy director of the Ministry of Housing and Urban-Rural Development's policy research center, said at a recent forum that bank lending to developers has reached a record low.

"Property sales in first- and second-tier cities will experience negative year-on-year growth for 2011", and may decline further in the second half of the year, Qin said.

During the three-day Mid-Autumn Festival holiday earlier this month only 407 contracts were completed for residential apartments in Beijing. This represented a 70-percent drop compared to the three-day holiday in May, and a 50-percent decline from the corresponding period last year, according to the Beijing municipal commission of housing and urban-rural development.

September and October are traditionally busy periods for property sales.

Chen Zhi, deputy secretary-general of the Beijing Real Estate Association, said that the shrinking volume signals a cooling market.

Property developers, meanwhile, have taken different measures to deal with the sluggish market.

Cheung Kong Real Estate Limited will extend the time a customer needs to make a down payment to ease their cash flow concerns, director William Kwok said.

"For our new project in Beijing, the customer can pay 20 percent of the down payment when signing the contract, and then pay the remainder before the villa is delivered," said Kwok. "The period could be as long as two years, as opposed to the current one week."

China Daily

(China Daily 09/19/2011 page1)