Medical and healthcare investment soars

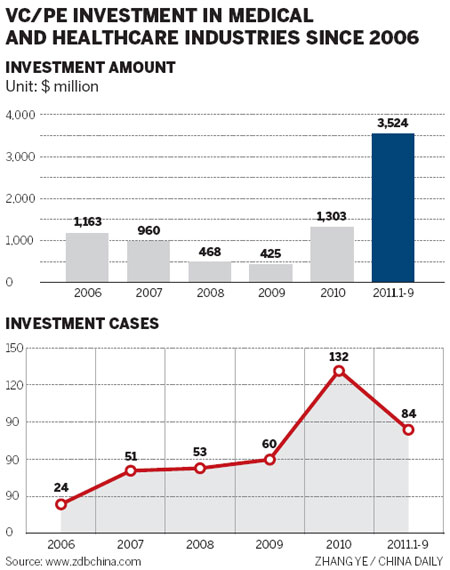

BEIJING - Investment in China's medical and healthcare industry reached a record $3.5 billion in the first nine months of the year, 2.7 times more than the total amount over the whole of 2010, according to a leading consultancy in the venture capital (VC) and private equity (PE) industry.

The 132 investments in 2010, more than double the 60 registered in 2009, totaled $1.3 billion, the Beijing-based Zero2IPO Group said in a report on Friday to the China Bio & Healthcare Industry Investment Forum 2011, held in Beijing.

This year, investors, both at home and abroad, have shown a stronger interest in promising medical and healthcare projects. Ni Zhengdong, founder and chief executive officer of Zero2IPO Group, described the period as having "an explosive increase".

According to the report, the major incentive for the increase in investment was that more people are now included in China's medical insurance system.

The government announced guidelines for healthcare reform in 2009, aiming to establish a medical care system for all Chinese residents by 2011. More than 96 percent of residents, or 1.29 billion people, have joined the system so far, the report said.

An aging population and rising individual incomes have increased demand for medical and healthcare products and services, said Xiao Jun, an analyst with Zero2IPO.

Those aged 60 or over accounted for about 13.3 percent of the country's total population in 2010, a rise from the figure of 10.3 percent seen 10 years ago, according to the Ministry of Health. Meanwhile, the disposable income of urban Chinese residents climbed threefold to 19,109 yuan ($3,000) between 2000 and 2010.

Zhang Zhenzhong, director of the development research center at the Ministry of Health, said that areas such as drug development and production, medical equipment manufacture and healthcare insurance could be profitable and promising market segments for investors.

"We are particularly interested in research into traditional Chinese medicines and their production, which we see is enjoying a rapid growth in revenue," said Xu Xiaolin, general manager of the wealth management department at CCB International (Holdings) Ltd.

CCB launched a medical industry fund in 2009 and has invested in 12 projects so far.

Foreign investors have also been keen to invest in China's medical and healthcare industries. Antony Leung, chairman of Greater China at Blackstone Group, the world's largest private equity firm, said Blackstone is very interested in investing in China's consumer industry, especially in such sectors as healthcare and medical services.

The US-based VC company IDG Capital Partners has already invested in 12 Chinese medical enterprises.

China Daily