R&D: the right chemistry?

|

A pharmaceutical exhibition in Nanjing, Jiangsu province. An increasing number of multinational pharmaceutical companies are eyeing the Chinese market as part of their global R&D chains. An Xin / for China Daily |

|

A pharmaceutical exhibition in Shanghai. The increase in cooperation between foreign and domestic companies in R&D is a win-win solution, according to analysts. Shen Jingwei / for China Daily |

Overseas pharmaceutical firms are conducting more research in China as the country's medical market expands and the West's health sector shrinks

NANJING - It took preliminary talks lasting more than a year, innumerable onsite investigations and seemingly endless negotiations, but all the effort ultimately led to a contract covering hundreds of pages.

That intensive groundwork resulted in cooperation between the international pharmaceutical company Bristol-Myers Squibb Co (BMS) and the Jiangsu-based Simcere Pharmaceutical Group, who in December 2010 reached a strategic partnership to co-develop an oncology compound (the creation and development of a cancer treatment).

One year later, with research and development (R&D) into the compound still at an early stage, BMS announced that it will expand the strategic partnership to tap a new area - cardiovascular diseases.

Unlike their previous sales-centered strategies, an increasing number of multinational pharmaceutical companies are eyeing the Chinese market as part of their efforts to boost their global R&D chains.

In 2011, BMS also established R&D collaborations with Wuxi AppTec Co Ltd for stability studies into small-molecule new-chemical entities and with Crown Bioscience Inc on the development of cancer treatments.

BMS is not the only international drugmaker actively seeking R&D cooperation with Chinese companies. A number of overseas businesses have enthusiastically embraced the idea of conducting joint R&D, especially with biopharmaceutical companies.

Pfizer Inc, the world's largest drugmaker by sales, has entered into collaboration with MicuRx Pharmaceuticals Inc, a Chinese biopharmaceutical company specializing in the development of antibiotics to treat drug-resistant bacteria, and with Cumencor Pharmaceuticals Inc to discover therapeutic agents for multi-drug-resistant tuberculosis (MDR-TB).

Merck Sharp & Dohme Corp (MSD) - known in the United States and Canada as Merck & Co, the world's second-largest drug producer by sales - recently reached a deal with Shenzhen-based BGI (formerly known as Beijing Genome Institute) to combine the research institute's sequencing and bioinformatics capabilities with MSD's expertise in drug development to identify a new generation of personalized therapies.

Chinese companies will benefit from collaborative partnerships with the multinationals that are exploring new approaches to advancing the clinical development of innovative products in China, on sound molecular pipelines (the number of products under development), extensive experience in R&D management, strong funding support and global R&D resources, said Guo Fanli, an analyst from China Investment Consulting Co Ltd.

Meanwhile, international drugmakers may benefit from rich clinical trial resources, locally tailored products for Chinese patients, technological support for their global R&D networks, cost reductions and easier access to registration and approval, Guo said.

However, challenges exist for both sides, such as cultural differences, analysts said.

Moving to China

Flat demand for medicines and the sluggish economic conditions in developed markets have prompted many multinationals to move their R&D activities to China.

Pfizer closed its R&D facility in the United Kingdom in early 2011, resulting in job losses for more than 2,400 engineers. Meanwhile, Novartis International AG announced in April 2011 that it will cut nearly 550 jobs at its UK R&D center by 2014. Both companies have recently increased their R&D capabilities in China. Pfizer set up its second facility in Wuhan, in Hubei province, in October, to complement an earlier facility in Shanghai. The new unit, where 200 staff will be employed by the end of this year, is also a platform for Pfizer to conduct cooperation with local companies, academic institutes and universities.

At the end of 2010, Novartis AG said it would invest $1 billion in China within five years to enhance its R&D strength in cancer treatments, and its local partners will be engaged in helping to increase efficiency in the research and commercialization of the products.

According to Liu Xue, a professor at the Guanghua School of Management at Peking University, the comparative slowdown in sales of medicines in developed markets means that it makes little economic sense to continue R&D investment in those countries.

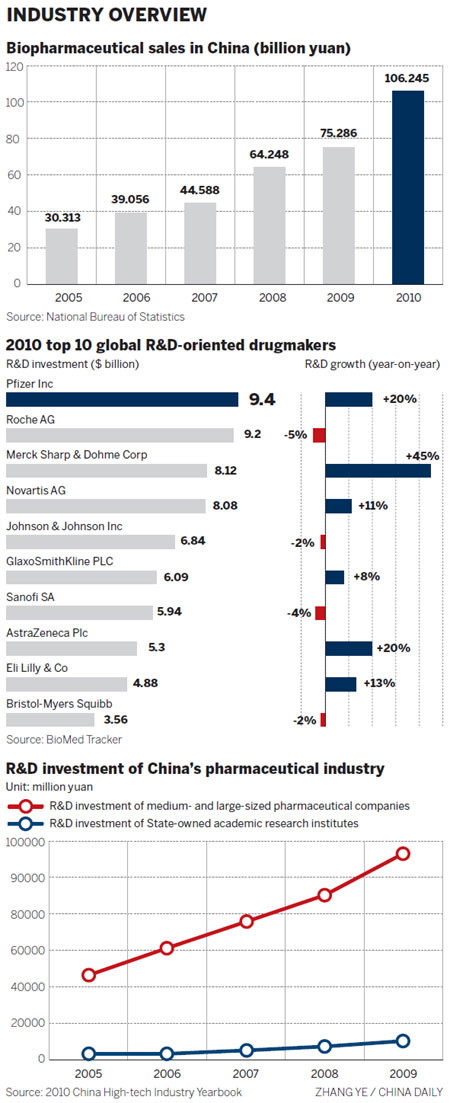

According to the international healthcare market researcher IMS Health Inc, China became the world's third-largest pharmaceutical market in 2010. Sales of medicines are predicted to grow 25 to 27 percent year-on-year to exceed $50 billion in 2011. The researcher forecast that the market will grow at an average annual rate of 20.1 percent to reach 694 billion yuan ($110 billion) by 2015.

Apart from the size of the market, foreign companies are also drawn by China's rapidly improving R&D environment, said Liu, adding that cooperation with local partners allows companies to develop locally tailored products and make it easier for them to get industry registration and approval for their research activities.

The biopharmaceutical industry is one of seven strategic sectors for which the Chinese government has promised support in its 12th Five-Year Plan (2011-2015). The country, with the goal of becoming a major research hub in the international pharmaceutical sector, has already allocated 105 billion yuan to key drug-creation programs, launched to support local R&D projects with a view to developing 30 new treatments in 10 major therapeutic areas by 2020.

That government support has prompted overseas companies to further tap into the sector. However, Lydia Xu, a researcher on the pharmaceutical sector with the Samsung Economic Research Institute, said that the majority of the funds will be invested in State-owned researchers or academic institutes and universities.

Although cooperation with Chinese companies will not allow multinationals to access the funding, the domestic environment, which favors biopharmaceutical development, is a bonus in obtaining registration and commercialization approvals for treatments, analysts said.

Jean-Christophe Pointeau, president of BMS China, said that the company had to take registration and approval issues into consideration. Meanwhile, the higher price of self-developed drugs in the Chinese market was also an important element when the company decided to focus on self-developed medicines rather than high-quality generic products.

The ongoing reforms to China's healthcare system have focused on lowering drug prices and healthcare costs in general. Prices should be lower for generic drugs, because they require no technological innovation. However, "for a new innovation-originated product or a specific therapy for a serious disease, for example cancer, a higher price is acceptable, because the cost of R&D is high and it (the medicine) can save lives and bring benefits to the public", said Pointeau.

Common interest

Simcere's President Zhang Yehong said that the cooperation with BMS is based on mutual trust and common interests. Mark Pavao, president of BMS Emerging Markets and Global Access, said the partnership is exciting and hopefully will be a win-win situation.

"We have been committed to building up our R&D capability and are willing to invest significant financial and human resources (in China)," said Zhang, adding that Simcere invests between 7 and 8 percent of its sales in R&D every year.

Founded in 1995, the company now has almost 4,000 employees, with one-tenth of them working in R&D.

"Simcere is a leading Chinese company, a listed company (on the New York Stock Exchange) and very active in global partnership discussions," said Pavao. "We are pursuing 'selective integration' when choosing partners."

Regarding the company's second cooperative project in China, he said: "Our experience over the past year is that everything Simcere said they would do, they have done, ahead of schedule and with very high quality results, which made our companies think maybe we should talk about another one (project)."

According to the agreement, Simcere will receive exclusive rights to develop and commercialize the molecules in China, while BMS will retain exclusive rights in all other markets. The companies will jointly determine their strategic development plan to explore the potential of compounds to treat diseases.

At present, BMS provides molecules for Simcere. "Simcere will provide development expertise and resources to collect high-quality data, data that will stand up to potential applications around the world," said Pavao.

Some observers have said that BMS has an unfair advantage when cooperating with its Chinese partner: All intellectual property rights and income outside China will go to the overseas company, while the Chinese side is responsible for the whole R&D process, including financial investment and human resources.

However, Simcere's Zhang said he doesn't think the deal is skewed in favor of the overseas companies. "R&D collaboration is very complicated. Besides visible contributions, such as funds, equipment and human resources, there are many invisible things, such as the value of self-developed molecules, global resources and technological support," he said.

Zhang added that if a product is commercialized, Simcere will receive a "certain amount" of the revenue BMS generates from the medicine outside China, and in exchange, BMS will enjoy similar rights.

For many multinationals, their strong point is in early-stage molecular discovery, which requires a huge amount of money and can take decades of lab research. These relatively young Chinese biopharmaceutical companies can hardly be expected to discover those molecules by themselves, said Xu.

As a leading global biopharmaceutical company, BMS invests approximately 20 percent of its sales in R&D every year. Xu said that China has an advantage when it comes to clinical trials, because of the huge number of patients and the high standard of its R&D staff.

Challenges ahead

Biopharmaceutical development requires huge investment and carries high risks.

"What is important for people to understand is that each new drug costs approximately $1 billion and it takes an average of 12 years to develop a molecule into a medicine," said Chris H. Lee, president and CEO of Bayer HealthCare China, in an earlier interview.

"During the process, scientists filter the ideal drug out of millions of potential candidates, before selecting suitable candidates for clinical trials. Ultimately, only 5 to 10 percent of clinical candidates will receive regulatory approval," he said.

Many Chinese biopharmaceutical companies are very young and don't have the resources to devote to long-term development with huge investment, not to speak of shouldering the risk of the high possibility of failure, Liu said.

In collaboration with BMS, the foreign company has the resources for the molecular pipeline in its laboratory, but it does not have the resources for further development. "Partnering with us, they offer their early-stage technology and we focus on the next step, and our involvement greatly increases the possibility of success and reduces the risk of failure," said Zhang.

Cultural differences are also regarded as a potential hindrance for Sino-foreign R&D cooperation, Xu said.

There is a State-level biotech and pharmaceutical industrial base in Zhangjiang, Shanghai, which is known as China's "Drug Valley" and plays host to more than 100 drugmakers, including AstraZeneca Plc, Eli Lilly and Company and GlaxoSmithKline PLC as well as professional research institutions. Many of them have ongoing collaborative operative projects.

The administration committee at the Zhangjiang base has taken a number of measures - including hosting technology-transfer fairs, setting up specific departments to work as intermediary agencies and simplifying customs procedures for R&D equipment and biosample imports - to support partnerships between local institutions and foreign companies.

"It's a good way for Chinese academic institutions and enterprises to obtain funds to conduct more research and for foreign drugmakers to get reliable local resources to speed up their R&D in Zhangjiang," said Wang Lanzhong, general manager of the administration committee at the base.

Wang also said the heavy financial costs and long developmental period, coupled with the high failure rate in pharmaceutical R&D, have resulted in more than 500 local enterprises and institutions in Zhangjiang closing or moving out in the past decade.

Meanwhile, some projects don't last the agreed duration, mainly because the foreign and Chinese sides have different management ideologies and cannot compromise, said Liu, highlighting the importance of detailed and accurate contracts in addition to mutual understanding and communications.

"As market conditions continue to change, especially in China, where everything develops quickly, the partners should follow the changes and discuss appropriate responses, and then adjust their operations accordingly," Liu added.

However, Simcere's Zhang said he does not think the differences between Chinese and foreign cultures constitute a problem. "Cultural differences exist in all companies. There are differences between different multinational companies as between local companies. If two partners share the same philosophy and commitment, the problem will not be a problem at all."

Zhang received his college and business education in the United States. He worked for Merck for 12 years and served as the company's China president between 2007 and 2008. With experience in international consulting firms IMS Healthcare and McKinsey & Company, Zhang is knowledgeable about the Western style of business and the condition of China's pharmaceutical industry.

The pursuit of internationalization by Chinese companies and the sluggish market in Western nations have resulted in many Chinese professionals returning from overseas to work for local companies. These people - usually open-minded, flexible and with good professional training - are becoming the backbone of cooperative projects. These human-resource flows can help narrow the cultural gap between Chinese and foreign companies to some extent, said Liu.

"Good partnership means finding good partners. For BMS, finding good partners means finding someone who has good science, focuses on innovation and has the ability to conduct general scientific work," said Pavao.

"If any Chinese company wants to be innovation-oriented and R&D-focused in looking for treatments for serious diseases, we may have an interest in partnering with them," Pointeau said, signaling that BMS China is open to domestic companies while insisting on "selective integration".

China Daily