Domestic solar market to expand

Plan intends to promote PV industry as production capacity goals set

BEIJING - China is aiming to reduce the cost of domestic solar power and expand the domestic market to better develop the photovoltaic (PV) industry during the 12th Five-Year-Plan period (2011-15), said the Ministry of Industry and Information Technology on Friday.

According to the industry plan announced by the ministry, the country will reduce the cost of solar power to 0.8 yuan (12 US cents) per kilowatt-hour by 2015 and 0.6 yuan per kWh by 2020 and increase production of solar panels.

Meanwhile, the plan said the government requires China's leading polysilicon manufacturers to reach annual production capacity of 50,000 tons by 2015. Solar panel makers will have to reach 5 gigawatts of annual production capacity by the same year.

"It is time for integration of the industry," said Wu Zhonghu, an expert at the China Energy Research Society. "The PV solar industry has a prosperous future, but at present, there are many obstacles, including high costs, shrinking overseas markets and a lack of related laws and regulations to supervise the industry."

Wu said many small Chinese companies have started producing PV solar panels to pursue profits in the domestic market because their technology and production lines do not meet the standards applied overseas.

In addition, it will not be easy to enlarge the domestic market. If the government suspends subsidies to the solar companies, it will be difficult for them to sell in the domestic market because of high prices, he said.

In China, government subsidies result in most PV solar products being used in rural areas. If cities are able to use more PV solar power, it will create a huge market which would be beneficial for Chinese producers who are struggling in overseas markets because of trade disputes.

"The government regulations and policies play an important role in the development of the industry," said Wu.

The government will also help companies in the solar sector increase annual sales. It aims to have at least one company reaching 100 billion yuan in sales by 2015, and between three and five companies reaching 50 billion yuan by the same date.

"The plan will bring opportunities for thin-film PV panels," said a staff member, who declined to be named, at Hanergy Holdings Group Co Ltd, a producer of thin-film PV panels.

According to the plan, China will put more effort into the production technology for Building Integrated PV in the coming years.

"The thin-film PV panels have many advantages for BIPV projects, so the plan will be beneficial for the company's future production and sales," said the staff member. "In fact, polysilicon solar panels and thin-film PV panels should not be competitors in the market. Instead, their markets are different."

In terms of solar technology, China aims to increase the conversion efficiency of monocrystalline silicon solar cells to 21 percent, polysilicon cells to 19 percent and amorphous silicon cells to 12 percent by 2015, according to the plan.

Eighty percent of solar equipment and auxiliary materials will be produced domestically, according to the plan.

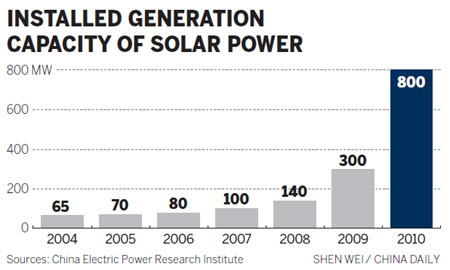

During the 11th Five-Year-Plan (2005-10), China's solar panel production grew at more than 100 percent annually. The country's total output reached 10 gW in 2010, accounting for half of global production.

However, more than 90 percent of the products are exported to Europe and the United States. The industry's strong reliance on overseas markets has prompted concerns from industry experts who hope that China will provide more incentives to expand the domestic market.

China Daily