7.5% growth rate 'not low'

Premier Wen Jiabao said on Wednesday that the 7.5-percent GDP growth target for 2012 cannot be viewed as low.

Wen said that the slower growth fits targets set in the 12th Five-Year Plan (2011-15).

It can help shift focus on accelerating the transformation of economic development pattern, as well as making growth less polluting and less dependent on natural resources.

"We will make every effort to let ordinary people enjoy more benefits," Wen told a news conference after the conclusion of the annual session of the National People's Congress, China's top legislature.

This year's growth target is down from last year's 8 percent.

Yin Zhongqing, vice-chairman of the NPC's financial and economic committee, said there is no concern about a hard landing for the country's economic growth.

"The downgrading of the annual GDP target can prevent an over-heated economic expansion as in the past few years," Yin said.

Last year, China's GDP increased by 9.2 percent from a year earlier, cooling from 10.4 percent in 2010, mainly because of a sharp decrease in exports caused by the European sovereign debt crisis.

This external factor may continue to influence the world's second-largest economy in the coming years, causing uncertainties for the government's macroeconomic policy, according to Zhang Zhiwei, chief economist in China with Nomura Securities.

The lowered target increased economists' concerns about a sharp drop in fixed-asset investments. That may raise pressure on local governments to pay back loans and may undermine the financial sector.

Stephen Green, chief economist with Standard Chartered Bank, expected a decline of fixed-asset investments in the coming months, because of a decrease in land transfers to developers in February.

"It will feed through to tighter cash flow for infrastructure projects," he said.

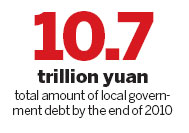

However, Wen said: "the government's debts are at a controllable and safe level".

He also vowed that the increase of new debts will be strictly controlled, based on the fairly lower debt-to-GDP and budget deficit-to-GDP ratios compared with many developed countries and emerging economies.

According to Wen, total local government debt was 10.7 trillion yuan ($1.69 trillion) by the end of 2010. The new debts last year were about 300 million yuan.

"The 7.5-percent GDP growth target is a signal that the government is not going to undertake a major stimulus or liquidity easing," said Wang Tao, chief economist in China with UBS Securities.

The current modest easing in macroeconomic policy is expected to remain to solve the financial difficulties for industrial production, especially for small and medium-sized businesses, Wang said.

Xinhua contributed to this story.

Contact the writer at chenjia1@chinadaily.com.cn