A remedy for the healthcare system

|

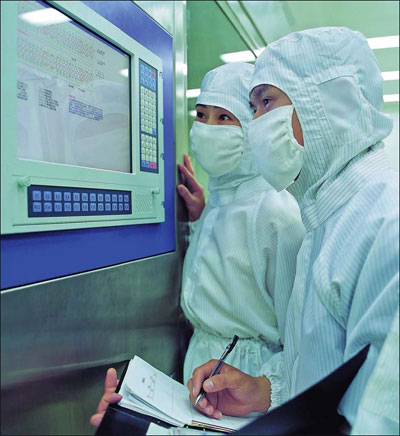

Advanced technology is being used at Tasly Group's production plant. Provided to China Daily |

Traditional Chinese drug company wants to make inroads in US market

No longer satisfied with being part of the huge "world factory" of producing only cheap clothing and Christmas decorations, Chinese companies are marching into the United States to tap fields where few predecessors have ever been - such as pharmaceuticals.

Tasly Group, one of the major pharmaceutical companies in China, debuted in the US by investing $40 million on a research and manufacturing operation in Maryland, which is expected to open in May.

Sun He, chairman and president of Tasly America Inc, says the construction and renovation of the base will cost $15 million. The remaining $25 million will be spent on clinical tests that will start in August.

Established in 1994, Tasly is a comprehensive pharmaceutical company covering the fields of research and development, herb planting, manufacturing and distribution. Its signature product is Tasly Danshen Plus Capsule, a drug that protects the heart and helps it function with ingredients such as Notoginseng and other traditional Chinese herbs.

The medicine will also be the first product Tasly introduces to the US market, Sun says. Currently the capsule has passed the phase 2 test by the US Food and Drug Administration (FDA).

"It takes another one- and- half years for us to do the FDA (phase) 3 tests. Once it is approved, our product can enter the pharmacy," Sun says.

Based on Tasly's previous accomplishments, the drug will be approved by then, Sun says with confidence. "The medicine has been approved in 26 countries as a prescription drug, so I believe it will pass this time."

However, doing pharmaceutical business in the US requires different strategies because of fundamentally different medical systems, Sun admits.

In China, the public is bombarded by medicine commercials and is deeply influenced by them; but here, the FDA strictly regulates drug advertisements.

"You need to convince the FDA and medical professionals that your drug is safe and effective, rather than persuading the public," Sun says.

Currently, the biggest barrier is that there is no clinical history for traditional Chinese medicine in the US, analysts say. Most people are only familiar with Western medicine and therefore suspicious of TCM's effectiveness.

|

|

Gu Jiaji, an expert in the pharmaceutical industry before she became vice-president of REES Star Continuing Care Group, says Americans have slowly started to accept TCM, but it's mainly popular in Asian communities. The mainstream market is still in favor of Western medicine. Plus, she says, insurance companies don't usually cover the costs of TCM.

Ann Alquist, a director at the National Center for Media Engagement, who studied Medicare systems as a Fulbright Scholar, says as a consumer she has heard of Chinese medicine and considers it "homeopathic, but so not scientific".

"I've never asked for Chinese medicine as a treatment from my doctor. I tend to trust things the FDA approves. I rely on my personal network as well to refer me to non-traditional Western medicine. I'll try most any remedy within reason, because I don't like taking pharmaceuticals to begin with."

Like most Americans, Alquist doesn't usually go to the doctor unless she needs prescription drugs. "I buy over-the-counter medicines, like ginseng capsules, Echinacea, green tea, things like that."

Warren Wang admits that introducing TCM to the US market will be very difficult. Wang is a pharmaceutical regulatory consultant and a business associate with the Maryland International Incubator. He holds a doctorate in chemistry and has worked in the chemical and pharmaceutical industry for 30 years.

"In China, TCM has been practiced for thousands of years, and people accept the principles and buy into the philosophy," he says. "But here people don't have the necessary cultural background.

"Here doctors and patients are highly result-oriented, they believe only in test results from professional institutes. Celebrities have little role to play in commercial persuasion to the general public."

To tackle this issue, Tasly is arranging congressional hearings to tell the public that "TCM is no longer the small dark shop hidden in the corner of Chinatown; it has evolved with time and modern technology", Sun says.

He cites acupuncture, which didn't used to be mainstream, but is now accepted by many people in the US.

"This is partly attributed to Richard Nixon's visit to China," he says. During his trip with the former president, New York Times reporter James Reston received acupuncture after an emergency appendectomy.

Reston was so impressed with the post-operative pain relief that he wrote about his experiences, which gained wide attention from Americans.

"So, to persuade the authority is the key," Sun says. "The top down strategy is much more effective than bottom up, given the US medical system."

Sun plans to tell Congress that TCM options can be a financial relief for the Medicare burden, by making a comparison between costs for treating angina, a heart condition.

"While on average a brand name medicine costs $325 a week, the similar TCM costs only $5. Chinese medicine is especially good at aged diseases and gynecological diseases, which happen to be the most expensive part of the medical system," he adds.

Besides introducing TCM to policymakers, Tasly is making connections between Chinese and US doctors to work on the same clinical case to inform Western counterparts about TCM treatments.

Although the approaches seem to work in the US, Wang says other ways can be adopted to develop the pharmaceutical business in the US market, especially considering Chinese medicine is still in its infancy on the continent.

For example, Wang says "made in India" has gradually become accepted in the mainstream market because drugs have been manufactured there for US brand names and have gained a good reputation over time.

"It takes time, and you cannot expect to break the balance and become a brand name overnight. But it is much easier than starting from nothing," Wang says.

Another approach, Wang suggests, is to acquire niche drugs that target very specific diseases. "These drugs don't have a large patient group, but are indispensable in certain areas. Chinese companies can acquire these medicines and turn them into their own brand names."

He says no company can reach the top of the pyramid very quickly in the pharmaceutical industry, but one can at least enter the pharmacy, which is the first step.

wangchao@chinadaily.com.cn