Share of imported oil to rise at 'modest pace'

China will import about 60 percent of the 500 million metric tons of oil it uses next year, government officials said on Thursday.

"The country's use of crude oil will continue to increase in the coming years but at a modest pace," said Gao Shixian, assistant director-general of the energy research institute of the National Development and Reform Commission.

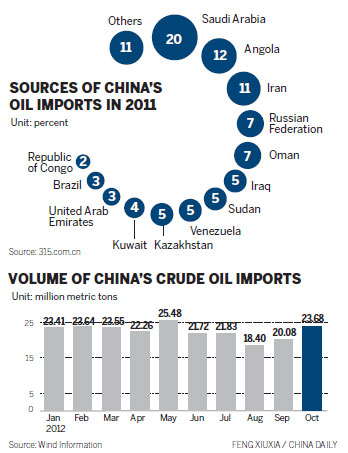

This year, China is expected to import about 280 million tons of crude oil, or 57 percent of all of the oil it uses, according to an industrial report from China National Petroleum Corp's Economic and Technology Research Institute.

Since China became a net importer of crude oil in 1993, it has gone from importing 6 percent of the oil it consumes to more than 50 percent in 2009.

"The relationship between China and the world in the oil industry will become even deeper," said Zhong Shan, vice-minister of commerce, during the first China International Oil and Gas Trade Conference, held in Shanghai on Thursday.

China is calling for greater cooperation with foreign companies that are engaged in oil and gas exploration.

He added that emerging economies' increasing demand for crude oil, including China's, has helped bring stability to the global crude market.

In 2011, China, India, Brazil and Russia used 880 million tons of crude, a fifth of world consumption. China's share of the global figure was 11.4 percent, he said.

The country will continue to import increasing amounts of crude oil from Russia and the Middle East, said Li Li, senior analyst at the energy information consultancy ICIS C1 Energy. At the same time, it is now trying to find suppliers in other areas in the world, she said. And Africa, South America and the Caspian Sea are all expected to supply more to China in the future.

"That's especially true for South America, which is the source of 10 percent of China's crude imports and is increasing its crude exports to China by 20 percent a year," she said.

This week, the International Energy Agency predicted that the United States will become the world's largest producer of crude oil by 2020, overtaking Saudi Arabia. That, in turn, will lead international crude traders to direct their attention more to Asia, it said.

Among crude-oil markets in Asia, foreign oil companies have their eyes most on China.

"We have been shifting our business from Japan to China because China is consuming more crude in Asia, and we want to sell as much as we can to this market," said Yousef M. Al-Sulaiti, managing director of the crude oil business of Qatar International Petroleum Marketing Co Ltd, the country's national oil company.

He said up to about 80 percent of the company's crude output is sold to Asia and China has begun to buy a larger portion of that.

"I'm worrying about how China's economic slowdown will affect its crude demand," he said. "And I do hope that its economic growth will rebound in the fourth quarter."

Taking into consideration the state of the global economy and international market, Al-Sulaiti predicted the Middle East's crude output will decrease next year.

Gary Ross, chief executive officer of the consulting company PIRA Energy Group Inc, said the crude output of the Organization of the Petroleum Exporting Countries, an intergovernmental organization, will be slower in 2013.

At the same time, he predicted non-OPEC countries' output will increase.

Adrian Binks, chairman and CEO of Argus Media Ltd, an agency that reports prices in the energy and commodities markets, had similar thoughts.

"The growth in non-OPEC crude production will be 700,000 barrels a day in 2013, up from 240,000 (barrels a day) this year," he said.

dujuan@chinadaily.com.cn