Solar panel industry weighs the future

|

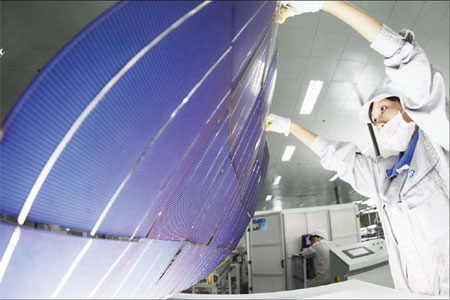

A worker checks a solar panel product to be exported to Europe. Analysts say the European solar market will shrink and the Chinese market will take the lead. Si Wei / for China Daily |

Resolution of trade dispute with Europe leaves many questions in the air

The European Union has announced that it has reached an amicable solution with China in the trade dispute over solar panels. The feud had dragged on for a year, affecting solar panel exports from China to the bloc worth 21 billion euros ($28 billion) a year.

The EU Trade Commissioner, Karel De Gucht, said he had tabled a draft decision to accept the solution, reached after talks with the Chinese Ministry of Commerce and the Chinese Chamber of Commerce.

The settlement, in which Chinese manufacturers agreed to sell domestically produced panels at minimum, near spot market prices, came after six weeks of negotiations that began when the EU imposed provisional anti-dumping duties averaging 47.6 percent on imports of Chinese solar panels, cells and wafers.

Since June 6, EU imports of Chinese solar products have been subject to a punitive 11.8 percent duty. On Aug 7 the duty would have risen to 47.6 percent if the two sides had not resolved the dispute.

"The Chinese suppliers have agreed to a voluntary price ... and to keep prices above a certain floor," De Gucht said. "In return, those companies who participate in this engagement do not have to pay the anti-dumping duties."

The European Commission was scheduled to adopt his proposal on August 2.

De Gucht said this undertaking would apply only for an annual volume that covers part of the overall European market. For any Chinese exports exceeding this annual volume, the average anti-dumping duty of 47.6 percent will have to be paid from August 6.

Under the deal, China will be allowed to meet about half of Europe's solar panel demand, at last year's levels, an EU diplomatic source was quoted by pvXchange, an online marketplace for photovoltaic components, as saying. EU consumption was about 15 gigawatts last year, and under the deal Chinese companies would be able to provide 7gW without being subject to tariffs.

The China Chamber of Commerce for the Import and Export of Machinery and Electronic Products and the European Commission have not confirmed whether those terms are part of the deal.

The Chinese Ministry of Commerce said China welcomed the deal, which "showcased pragmatic and flexible attitudes from both sides and the wisdom to resolve the issue".

A spokesman for the Ministry of Commerce, Shen Danyang, called the agreement "open, cooperative and stable". He said the dispute's resolution has led to a sustainable economic and trade relationship.

But following the dispute's resolution, many questions remain for the industry.

Industry insiders said the EU market will shrink and the Chinese one will take the lead globally this year.

Chinese solar panel production quadrupled between 2009 and 2011. BSW-Solar, a German solar energy industry group with more than 800 member companies, said the global capacity of the solar PV industry was about 100gW last year. Germany ranked first with 32 percent of market share, the United States 7.2 percent and China about 7 percent.

From 2011 to 2013 the Chinese market will have grown fourfold to 9.3gW, while the German market will shrink from 7gW last year to 5gW this year.

This year the association predicted that China will surpass the US and Germany to become the country with the highest level of solar power on stream.

Many Chinese companies have shifted back to the domestic market, and the world's largest solar panel maker, Yingli Green Energy Holding Co Ltd, has reduced its sales target in Europe from 60 percent of global revenue last year to 40 percent this year. It plans to focus on the Chinese market to make up for that.

The new EU rule is likely to accelerate the shakeup in China's PV industry.

JA Solar Holdings Co Ltd, a major manufacturer of solar power products, said it accepts the deal between China and the EU and that it will promote the healthy development of the middle streams of the solar industry in China and the downstream in the EU.

The company says that with the floor price of solar panels set at 0.56 euro ($0.74) a watt, demand will fall, and the EU market will shrink, because solar panels will become a less attractive proposition financially.

Nevertheless, the outcome of the dispute is a lot more palatable to the Chinese industry than anti-dumping duties of 47.6 percent, which would have played havoc with the solar panel market in the EU, with few, if any, winners.

"For the Chinese solar panel manufacturers, it's good to have a minimum price," says Xie Jian, chief operating officer of JA Solar Holdings.

"Although our shipments may fall slightly, we will enjoy the benefits of higher prices. So our total gross profits will rise."

In addition, domestic manufacturers will now focus on improving quality and service instead of offering goods at low prices to attract more buyers, he said.

Against the backdrop of the European dispute, many Chinese photovoltaic manufacturing companies have been switching their attention to other markets, including Japan and South Africa.

Dany Qian, the global branding director of JinKo Solar Co Ltd of Shanghai, says that because of the EU tariffs it has halved its European market share for this year. The company will now concentrate on South Africa, she says.

JA Solar says it will reduce its sales target in Europe and focus on Japan, the Middle East and Southeast Asia.

In March, after the EU started to clamp down on Chinese solar product imports, the top three Chinese companies signed a deal with German company Siemens for five solar projects in Israel, three in the Arava Desert and two in the Negev Desert.

Some European companies are worried that the retreat by Chinese companies may bring price increases in Europe and compromise the continent's plans for renewable energy.

One of the arguments put by plaintiffs in the anti-dumping case was that because of overcapacity in China, its manufacturers were flooding Europe with solar panels at prices below production cost.

However, Dennis Gieselaar, managing director of Oskomera Solar Power Solutions BV, says the EU's renewable-energy objectives can only be achieved if there is access to suitably priced, high-quality solar modules.