Service sector shines in February, while manufacturing moseys along

China's service sector brightened in February, boosted by post-holiday business activity, but the overall economic prospects are still shadowed by a continuing slowdown in the manufacturing sector.

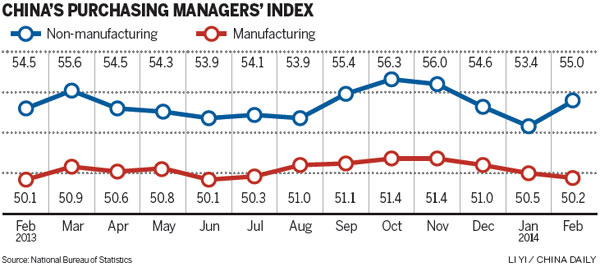

The official non-manufacturing Purchasing Managers' Index, a key indicator of service activities, rose to a three-month high of 55 in February from 53.4 in January, according to a Monday statement from the China Federation of Logistics and Purchasing.

Meanwhile the HSBC manufacturing PMI, also out on Monday, stood at an eight-month low of 48.5, down from 49.5 a month ago, signaling further deceleration in economic growth, while the official figure on Saturday by the China Federation of Logistics and Purchasing was barely above the critical 50mark.

A PMI reading above 50 indicates expansion on the previous month while anything below indicates contraction.

Analysts said the distinction was largely a result of the Spring Festival, China's lunar New Year, in early February, which created seasonal demand for service activities but closed down small factories, which form the major sample for HSBC's index survey.

China Federation of Logistics and Purchasing Vice-Chairman Cai Jin attributed the rebound in the services PMI mainly to robust business activity after the spring festival. "Rising activity, especially in the service sectors, laid a solid foundation for steady economic growth," Cai said.

The non-manufacturing PMI covers services including retail, aviation and software as well as the real estate and construction sectors.

But judging from the manufacturing sector, HSBC chief China economist Qu Hongbin said signs are becoming clear that "the risks to gross domestic product growth are tilting to the downside", which calls for policy fine-tuning measures to stabilize market expectations and steady the pace of growth in the coming quarters.

Hu Yuexiao, chief macroeconomic analyst with Shanghai Securities, said activities in the manufacturing sector may rebound in March as more small factories open after the holiday, but he ruled out the possibility of policy relaxation because, he said, the control of risk still has more priority than stabilizing growth.

Hu's view was echoed by Chen Guanglei, chief macroeconomic analyst with Hongyuan Securities. He said: "Considering the pressure of deleveraging in the country's financial sector, the policy stance will remain generally stringent in the short term."

Despite mixed prospects for the world's second-largest economy, the Shanghai Composite Index rose by nearly 1 percent on Monday, closing at 2,075.24. Chen said the capital markets are fully aware of the weak data and were therefore not affected much. "The market has reached a consensus for a mild economic slowdown," said Hu.

Yang Weixiao, a senior analyst with Lianxun Securities, said a recovery in China's manufacturing sector will have to rely on external demand from foreign markets. He suggested exports will expand in the coming months because of a recovery in developed markets and the weaker yuan.

The Chinese currency suffered its largest weekly fall in 20 years last week by losing a significant 0.9 percent. Yi Gang, the deputy governor of the central bank, the People's Bank of China, said the fluctuation was normal and the fundamentals of China's economic growth are good. But, at the moment, manufacturers are finding every way to cope.

"It is essential for companies to make use of their own advantages to minimize their costs," said Zhang Bin, general manager of a Shanghai-based manufacturer and exporter of steel products.

"Upgrading the product structure has also been a regular task for the company," Zhang said, adding the company would remove certain unpopular items from the shelves on a monthly basis. "Overseas demand is set to increase because most of the export manufacturers will resume operation of their production lines by mid-March. More orders are expected to come in then," said Jiang Kexing, the manager of a Zhejiang-based logistics company.

"We have been quite busy so far this year moving cargo within the country because local retailers are buying large amounts of goods to stock up for the first half of the year," said Jiang.

Contact the writers atweitian@chinadaily.com.cn and yuran@chinadaily.com.cn