China Telecom calls for investors

|

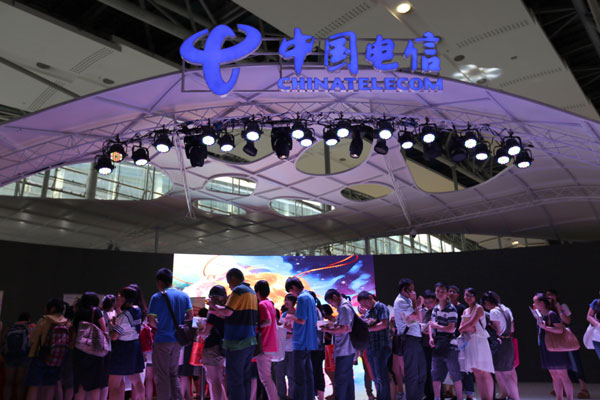

China Telecom promotes its 4G services in Guangzhou, Guangdong province. The company is seeking private investors for emerging telecommunications services such as online payments and social networking. Liu Jiao / For China Daily |

Government is said to be pushing reforms to add mixed ownership

China Telecom Corp Ltd is seeking private investors for emerging telecommunications services such as online payments and social networking, company executives said on Tuesday.

Several joint ventures - through partnering with local Internet companies - will be announced later this year as the nation's third-largest telecom operator tries to dilute the percentage of State-owned shares.

"Joint ventures and acquisitions are both possible ways for us to cooperate with private firms," said Wang Xiaochu, chairman of the Hong Kong-listed company.

"We are ready to leave operating rights to smaller but more capable shareholders even when China Telecom controls the majority of shares."

Wang's remarks came after an announcement by the central government that it would be trying out mixed-ownership reforms for huge, State-owned enterprises.

China Telecom, along two other telecom carriers, has received more autonomy in introducing private capital in areas such as Web-based instant messaging, social networking and online payments.

All of the services in the industry had been tightly controlled by the government. On May 9, industry regulators waived price guidance for the telecom industry and said the market should determine the country's telecommunications charges.

China Mobile Ltd, the largest carrier by user number, is scheduled to release new, and most likely cheaper, package deals Wednesday for its fourth-generation-service (4G) users.

"Chinese carriers are mulling new business models that fit the mobile Internet era and modern-day market competition," said Huang Shuhe, vice-chairman at the State-owned Assets Supervision and Administration Commission of the State Council. Mixed ownership in the telecom industry will strengthen carriers' competitiveness in the gradually liberalizing market, Huang added.

China Telecom has created a number of mixed-ownership subsidiaries with which to expand its business. Yixin, a mobile messaging and social networking platform jointly launched with Web company NetEase Inc, is hosting 80 million users.

The company also owns China's largest online audio bookstore, which boasted a subscriber number exceeding 200 million in the first quarter of 2014.

China Telecom has roughly 200 million mobile subscribers, nearly as many as the United States' telecom giant AT&T Inc. It also has 100 million broadband users in the country.

In addition to private investors, China Telecom is seeking partners from State-owned enterprises as well. The company on Tuesday inked a deal with energy giant China National Petroleum Corp to provide online payments and advertising services at gas stations. Details of the partnership were not disclosed.

Analysts said China Telecom's explorations outside the traditional telecom industry indicate that there is heavy reform pressure from the top.

Earlier this year, Ministry of Industry and Information Technology chief Miao Wei urged the Big Three telecom operators to speed up reforms to power growth in the information technology segment.

The move was a part of a central government attempt to revive the flagging economy. Oversight of equity structure reforms should be put in place, industry insiders suggested.

"Super-large SEOs should be able to build a company fit for market competition," said Zhang Wenkui, an analyst with the Development Research Center under the State Council. "That is the driving reason for equity structure reforms.

"Introducing private capital shouldn't be a means to erode State-owned assets," he added. "Rather, it is an attempt to strengthen the competiveness of State assets."

gaoyuan@chinadaily.com.cn