Clearing house sees bright future in Brazil

|

|

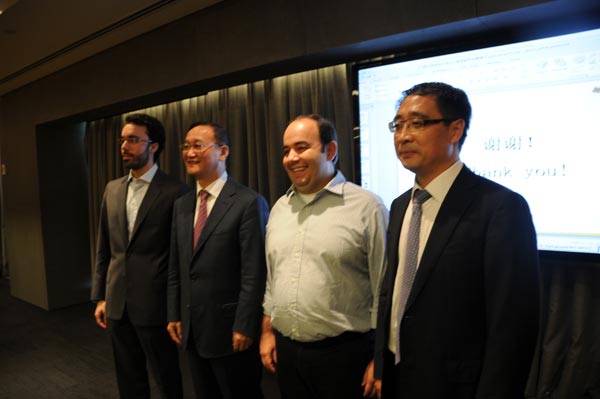

Pedro Lima (left), a representative from BTG Pactual, Latin America's largest private investment bank, Xu Chen, chairman of the Shanghai Clearing House (SCH), and Wang Guicai, president of Brazilian subsidiary of the Industrial and Commercial Bank of China Ltd, participated in the SCH meeting on Dec 19 in Sao Paulo. WANG ZHENGRUN / XINHUA |

There are numerous opportunities for cooperation between Brazil and China in the financial market, especially in the field of over the counter derivatives for agricultural products, said Xu Zhen, chairman of the Shanghai Clearing House (SCH).

At a meeting with Brazilian financial institutions in Sao Paulo on Dec 19, Xu and his team discussed the development of the clearing house, the concept of the Shanghai International Financial Center, as well as the Shanghai Free Trade Zone.

Founded in 2009, the SCH is an interbank clearing house set up for the settlement and clearing of financial products. The China Foreign Exchange Trade System, the China Government Securities Depository Trust & Clearing Co, the China Banknote Printing and Minting Corp and China Gold Coin Inc all hold stakes in the SCH.

Xu said the Sao Paulo meeting marked the first time that the SCH was in Brazil to discuss future cooperation.

"The two sides are still contacting and getting to know each other. But we could see that the Brazilian side shows great interest in such cooperation," Xu said.

In discussing financial cooperation between the two BRICS countries, Xu said that trade between China and Brazil was highly complementary, and he said the two countries will have more opportunities to cooperate in the financial market in the future.

Pedro Lima, who attended the meeting as a representative of BTG Pactual, Latin America's largest private investment bank, said the bank attached great importance to Asia, especially to the Chinese market.

With the increase in trade between Brazil and China, the two countries’ cooperation in the financial market also will be further deepened, he said. He also announced that the bank is preparing to open an office in Shanghai.

Wang Guicai, president of Brazilian subsidiary of the Industrial and Commercial Bank of China Ltd, acknowledged that currently Brazilian companies and financial institutions still are not totally aware of China and its financial products. But he said participation at the SCH meeting by Brazilian financial institutions, some of which came from other cities in the country, demonstrated that they are very interested in cooperation with China.

After meeting with Sao Paulo’s Securities and Futures Exchanges, Xu said he was optimistic about the development of agricultural OTC derivatives.

This year the SCH launched the central counterparty clearing services for the renminbi (RMB) iron-ore swap and steaming-coal swap and next year the same services in food and oil will also be started.

China has been Brazil's largest trade partner since 2009 and Brazil is China's ninth-largest trade partner worldwide and the largest in Latin America. However, bilateral trade is slowing down. In the first half of this year, between the two countries increased 7 percent year on year, a sharp drop from the 43.6-percent growth in the same period three years ago.

Sun Yanfeng, a researcher with the China Institutes of Contemporary International Relations, stressed that trade alone was not enough to push forward the two countries’ economic ties. "What is more important is cooperation in investment, financing and joint contracting, which could become the new engines for the economic ties," he said.

During Chinese President Xi Jinping's visit to Brazil in July, Brazilian President Dilma Rousseff welcomed broader investment by Chinese enterprises, particularly in finance, transportation, infrastructure, agriculture, information, logistics and science and technology.

Financial cooperation among the BRICS countries has been active recently. In a major cooperative move this year, in July the member countries announced formation of the New Development Bank (NDB) with headquarters in Shanghai. The bank’s aim is boost infrastructure and sustainable development projects in BRICS countries and other emerging and developing economies.

The BRICS Contingent Reserve Arrangement (CRA) also was also established to finance development projects in member countries and help them weather global financial crises.

Bilateral financial cooperation between Brazil and China is also prospering. In July, China and Brazil signed a agreements and memoranda in finance and other areas.

One example is the framework agreement signed by the Export-Import Bank of China and Brazil's mining giant CVRD, under which the Eximbank would provide $5 billion in three years to support the Brazilian company’s purchase or lease of equipment, vessels and related services from Chinese enterprises. The Bank of China also signed a memorandum to help CVRD arrange global financing for three years.

Contact the writer at readers@chinadailyusa.com