Reform to help level playing field

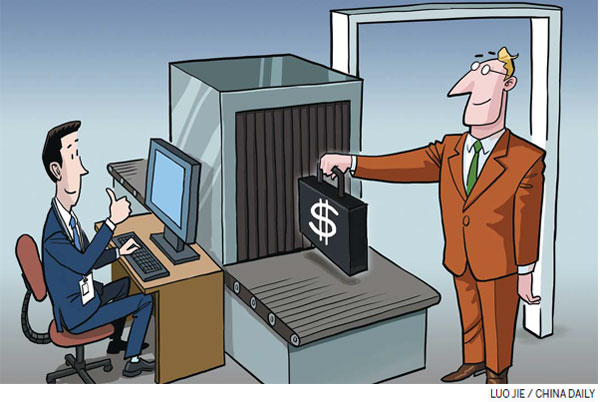

Draft Foreign Investment Law shows China's commitment to opening up, keeping up with international norms, streamlining regulation and protecting national security

China recently took a major step forward in the reform of its foreign investment regulation. On Jan 19, the Ministry of Commerce released a draft Foreign Investment Law to solicit public opinion.

The law draft is supposed to replace three decades-old laws that regulate foreign investment in China, namely the Sino-foreign Equity Joint Venture Law, the Wholly Foreign-owned Enterprise Law and the Sino-foreign Contractual Joint Venture Law.

Although the draft will take time to take effect and revisions are expected before it becomes a law, the draft itself is already an important landmark that demonstrates the country's strong commitment to opening up, keeping up with the international foreign investment regulatory framework, providing a level playing field for both domestic and foreign companies, strengthening investment scrutiny in line with international practices and fixing loopholes in old laws.

The most eye-catching change in the draft is the adoption of the negative-list regulation system. According to the draft, foreign investment in China will no longer be approved case by case. Foreign investors will enjoy pre-entry national treatment and will need to have their projects and companies approved only when the investment is on the negative list, which enumerates areas off-limits for overseas investors without an individual approval.

The adoption of the negative list in a national law represents a major breakthrough in the country's opening-up and reform, breaking away from the pre-entry, approval-based investment regulatory mechanism. The move will greatly simplify procedures, shorten the time of application and significantly facilitate foreign investment.

However, the draft law doesn't currently include a negative list because a list applicable to the entire nation is still being discussed. Clues, however, are provided by the negative list released by the Shanghai Free Trade Zone, which can serve as a good reference point because the zone is designed to be a pilot for national foreign investment regulation reform.

China also is negotiating bilateral investment treaties with the United States and the European Union. Talks with the US will focus on the content of the negative lists of both nations this year. The negative list to be agreed upon in the talks is expected to be the one China will adopt.

The concept of "actual controllers" also is highlighted in the proposed law. Whether a company is a foreign-invested company can be determined by its real controller. If the actual controllers of a company are Chinese nationals, the company can apply to be treated as a domestic company. But Chinese companies that are actually controlled by foreigners, through methods such as variable interest entities, will be treated as foreign companies and hence subject to possible negative list reviews.

The draft has not clarified how to handle situations when existing Chinese companies controlled by foreigners are found to be conducting businesses that are on the negative list. The Ministry of Commerce stated that it would further discuss this issue based on public opinions it collected. But this serves as a warning to foreign investors that China will look into the root of the ownership to prevent foreign investors from bypassing due scrutiny.

The restrictions for foreign investors mainly lie in two areas. One involves anti-monopoly regulations, which are under a different law. The other is national and industrial security, which, in terms of general investment, limits foreign businesses. The draft law lists, but is not limited to, the following sectors as having special safeguards: national defense, key technologies, information and cybersecurity, energy, grain and similar resources. Whether foreign companies are controlled by a foreign government also is a factor to be considered. Foreign investors cannot appeal rulings made by the Chinese authorities in this regard.

All these measures are a result of China's experiences in learning from developed countries, especially the United States. After a few high-profile cases in which Chinese companies were blocked from investing in the US market on the grounds of national security, China is now adopting similar legal frameworks to check foreign investors, too. This is a smart move.

In addition, a reporting system is established in the draft, requiring foreign companies to report to authorities their basic information upon registration, as well as major changes.

Generally, a report is required upon establishment of the foreign investment. Reports are then required on an annual basis. A quarterly report of business operations and financial information is required if the company's total assets, sales or revenue exceed 10 billion yuan ($1.6 billion), or if it has more than 10 subsidiaries. In addition, if a foreign company buys shares of a domestically listed company, the foreign company needs to report.

This reporting system is created to help authorities collect information, check commercial operations and standardize business ethics, especially as the system of pre-approval requirements is abolished. The reporting system is a step for authorities to strengthen after-entry regulation.

Other than the aforementioned special requirements, a foreign-invested company will be treated like a domestic one. According to the draft law, the special treatment for foreign companies in terms of company structure and organization will be scrapped. They will be obliged to adjust their organizational structure to conform to the Company Law within a grace period of three years. The major alterations may include installing a supervisory board and trade union. Those changes help clear away the differences between foreign and Chinese companies.

Generally speaking, the proposed Foreign Investment Law will make it much easier for foreign investors to access the Chinese market, allow Chinese authorities to better regulate inbound investment, protect strategic and sensitive industries and make the legal framework more international.

However, the draft will take some time to become a law. After public opinion about the draft is collected, the draft will be revised by the Ministry of Commerce before being subjected to the State Council. After the State Council submits it to the National People's Congress, it will be further reviewed by the congress before it is deliberated upon by the Standing Committee of the NPC. For such an important law, three rounds of deliberation may be needed, and it really depends on how fast the central government wants to push for it.

Since three rounds of deliberation alone usually take at least a year, it may take years for the draft to become a law. The Foreign Investment Law was placed in category II of the NPC's legislative agenda, meaning "the law could be subject to NPC review when conditions are ripe". Given that the 12th NPC ends its tenure in March 2018, it is possible for the law to be passed within the term.

Given that, foreign businesses will have enough time to adapt. There are a few things they may want to do.

A study of China's Company Law is highly recommended, because foreign companies will be governed by the law in the future. A change of equity structure may be needed for some to make sure they won't be subject to possible national security checks because of their actual controllers' nationalities.

The author is a researcher at the Chinese Academy of International Trade and Economic Cooperation in Beijing. The views do not necessarily reflect those of China Daily.