AIIB to benefit all stakeholders

The United Kingdom has sought to join the Asia Infrastructure Investment Bank as a founding member, with France, Germany and Italy planning to follow in its footsteps.

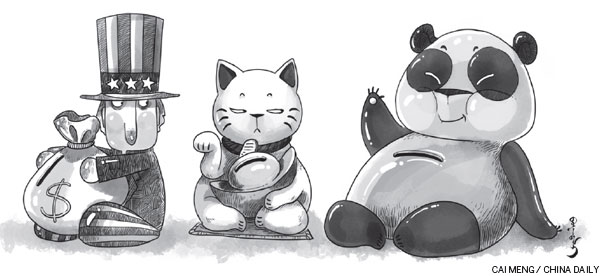

Their plans to join the China-proposed regional investment bank with an initial capital of $50 billion have come as shock to the United States, because they are long-time US partners and G7 members. Little wonder then that the AIIB has been widely interpreted as a potential rival to the World Bank, headquartered in Washington, and the Japan-led Asian Development Bank.

But unlike the wild speculations, the establishment of the AIIB is neither an affront to the US-led global financial order nor a move intended to challenge established global institutions such as the World Bank, the International Monetary Fund and the ADB.

At best, the establishment of the AIIB is a logical step for China to lead its Silk Road Economic Belt and 21st Maritime Silk Road initiatives to success and aimed at boosting regional development.

The AIIB is based in China and focused on infrastructure development, which many Asian countries are badly in need of. Given the existing global financial system, which is being driven by Asian economies, one of the most valuable gifts that a rising China can offer to the Asian community is its four decades' expertise in infrastructure building.

The ADB has estimated that to maintain its economic growth in the next decade, the East Asia region will need infrastructure investment of at least $8 trillion, which means there is a huge financial gap that needs to be filled. Unfortunately, none of the major lending institutions, including the World Bank and the ADB, will be able to fill this gap because of, for instance, the World Bank's restrictive lending policies targeted at poorer countries.

The AIIB, as China's Foreign Ministry spokesman Hong Lei said on March 13, will complement the existing multilateral development banks and support the infrastructure and economic development in Asia. And given its nature of investment, the AIIB will be open to government as well as private capital both from Asia and outside. In other words, unemployed capital and foreign exchange reserves can thus be put to better use, which in Asia's case will be investment in infrastructure.

Despite the US' remark on March 12 that the UK has been constantly accommodating China, London is no fool to join the AIIB as one of the founding members. Given its GDP of more than $2.8 trillion in 2014, the UK will be able to export more advanced infrastructure materials and public goods to Asia. This is not only a financially profitable business, but also one that can create more jobs in the country.

Indeed, the AIIB faces some challenges. For starters, the bank's articles of agreement, which will include its shareholding and lending policies, should be carefully designed to protect the interests of all participants. Plus, the bank is expected to be innovative enough in its operations to cooperate with established institutions such as the World Bank, whose president Jim Yong Kim welcomed the establishment of the AIIB last week.

More importantly, Beijing has to convince Washington of the AIIB's complementary role to existing financial institutions, as well as the pressing need to reform the current global financial system that it has led since the end of World War II.

Apparently, the US is still not prepared to accept China's rising global influence or, in its own words, proactive attempts to be a "responsible stakeholder" instead of being a "free rider". If that is still deemed as a challenge by the US, then challenge it is, for the economic well-being of a vibrant Asia.

The author is former director of the World Economy Institute, China Institutes of Contemporary International Relations. The article is an excerpt from her interview with China Daily's Cui Shoufeng.