Will Alibaba, Amazon clash?

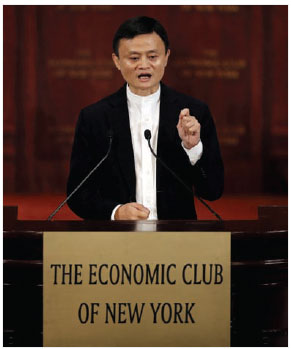

Alibaba Executive Chairman Jack Ma, in a speech to the Economic Club of New York last month, said he wasn't here to challenge Amazon and other US online players, but as e-commerce becomes more global, such competition may be inevitable, William Hennelly reports from New York.

It's not about competing with US companies, it's about feeding the consumer desires of China's burgeoning middle class.

That's how Alibaba Group Holdings Ltd Executive Chairman Jack Ma spun his trip to the United States last month as he looked to drum up business for the Chinese e-commerce giant.

"My purpose coming here is we need more American products in China," Ma wrote in a June 8 op-ed for The Wall Street Journal. "We have a hungry 100 million people coming to buy every day. We did not come here to compete. We came here to bring small business."

Speaking to the Economic Club of New York on June 9, Ma said he is often asked: "What's your plan in America? When are you going to come to invade America? When are you going to compete with Amazon? When are you going to compete with eBay?

"Well, I would say we show great respect for eBay and Amazon," he said. "But, I think the opportunity and the strategy for us is helping small business in America go to China, sell their products to China."

Alibaba's Tmall and Taobao are often seen as the Chinese equivalents of Amazon and eBay, respectively. Some will likely see the US entry as a salvo into the backyard of Amazon and other American online players.

"The difference between us and Amazon is that we do not buy and sell," Ma said. "But we help small business to buy and sell. We have 10 million small businesses on our site buy and sell every day. And we do not deliver our packages, ourselves, though we have more than 2 million people help us to deliver over 30 million packages per day.

"We do not own warehouses, but we manage tens of thousands of warehouses for other small, medium-sized delivery companies," he said. "And we do not own inventories.

What you see...

"Amazon is a shopping center, you go there, you buy things you want, exactly (what) it looks like. But on Alibaba on the picture you see it looks like this, but when you buy it, it's different. People feel surprised, whoa it's different. And they love it," he said, eliciting laughs.

Ma, whose goal is $1 trillion in gross merchandise volume by the end of the decade, looks at the US move as a way to feed China's ravenous appetite for merchandise. The Chinese have a proven desire for Western - particularly American - goods.

And it's not only US business that Alibaba is after. The company announced on June 24 that 11 countries - the US, New Zealand, Australia, Switzerland, France, Britain, Spain, Singapore, Thailand, Malaysia and Turkey - now have country "pavilions" on TMall Global.

For its part, Amazon maintains websites in Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, the Netherlands, Spain, and the United Kingdom.

Alibaba, founded in 1999, also is now the most valuable retail brand in the world, surpassing Amazon and Walmart, according to the 2015 BrandZ top 100 rankings of the most valuable brands.

With the pace of China's economic growth cooling a bit, Ma's international strategy seems logical. Overseas revenue for Alibaba represents only 2 percent of total revenue. Ma wants that number up around 40 percent.

Amazon's international operations contribute 35 percent of revenue, but only a small amount of that (about 3 percent) is from China.

What will be interesting to watch is if Alibaba does better in the US than Amazon has done in China. And with e-commerce becoming increasingly globalized, the big players likely will meet on the cyber battlefield someday, despite the competition angle being downplayed.

"Amazon in China seems to be focused on bringing Western brands over to China as well, so there will definitely be competition," Scot Wingo, executive chairman of e-commerce software firm Channel Advisor, told China Daily. "I do think that as part of their long-term plan, Alibaba will open a directly competing marketplace in the US, just probably not in the near future."

"Alibaba's rates are very competitive, which should allow many more retailers to get on the platform," Gil Lauria, a technology analyst with Wedbush Securities in Los Angeles, e-mailed China Daily.

"US sellers that have a direct business in China will be able to supplement that business by selling on Alibaba's Tmall," he said.

Some recent news, however, shows that Alibaba could face difficulty when it operates in the US, as Alibaba announced that it would sell its US website 11 Main to rival OpenSky. 11 Main did not go over well with merchants.

Alibaba will keep a stake in the combined entity. Alibaba last year started 11 Main, perceived as a shop window for small US sellers and an alternative to Amazon and eBay.

"Inspired by the shopping experience found on Main Streets across America, 11 Main is a new online destination for specialty shops and boutiques" its website says.

"It is a mish-mash of Etsy, Amazon and whatever and whoever wants to sell," Joel Young, who sells iPhone cases and docking stations, told Bloomberg. "11 Main thought they could come in with big money and disrupt. Boy, were they wrong."

But Ma has said he always looks five years into the future, so Alibaba likely will be patient in the US.

"I think it will be successful over the long run," said Wingo, who added that small businesses "are very interested in selling into China, but need more help with the logistics, tariffs and other complexities". (ChannelAdvisor partners with Tmall Global, which helps import products to China.)

"It will take a while to put all of this together for SMBs (small-to-medium businesses), but in 18-24 months, I think it will be much more common for US SMBs to sell into China via Alibaba," Wingo said.

Cost of entry

Frank Lavin, founder and CEO of Export Now in Akron, Ohio, which provides consulting services for businesses accessing China's e-commerce platforms, said that China is the easiest market for US companies to enter, but smaller companies - in the $1 million to $10 million range - will have a tough go.

To get online on Alibaba, a company would have to design and build a Chinese-language website, pay for trademark registration and put up a deposit, which could cost companies from $50,000 to $100,000, Lavin told China Daily. To advertise, companies may have to spend another $100,000 to $200,000, he said.

"I would say, in terms of value, cost-benefit for a company, that's fantastic," Lavin said. "That's one of the best deals a company's ever going to see. But again, if your total sales are $2 million, and it's $50,000 to $100,000 just to get in the game, that's 5 percent of your total sales."

"It is difficult for either of these platforms (Alibaba and Amazon) to replicate their success in the other market," Lavin said. "So the natural tactic for Tmall in the US is not to compete directly with Amazon in selling into the US market, but to offer US merchants a path to selling in China."

Tmall charges sellers much less than Amazon does on sales. Taobao's consumer-to-consumer marketplace is free to use, but Alibaba makes money by selling advertising and providing other services.

"There is less cost in the Alibaba ecosystem," Wingo told cnet.com. "The Alibaba business model has proven to work against eBay and Amazon in China."

If Ma's main US goal is to bring more products to his home country, he will be doing it with a company that has a far better profit margin and a competitive advantage costwise over its main e-commerce rival Amazon.

Alibaba has grown exponentially without the cost pressure of managing its own warehouses and inventory. Amazon owns warehouses and distribution centers and some of its own products and inventories.

Considering the companies as investments, Alibaba has a profit margin of about 32 percent. Amazon is operating at a loss, with a trailing 12 months' margin of -0.44 percent.

The companies are fairly comparable on market capitalizations, with Alibaba's at $212.7 billion as of June 25, when shares closed at $85.24 on the New York Stock Exchange. (The NYSE also is where Alibaba raised a world-record $25 billion in its initial public offering in September 2014).

Amazon has a market cap of $203.2 billion, and its shares, which are up 45 percent year to date, closed at $440.10 on June 25. The stock has a forward price-to-earnings ratio of 164.22, which means it is pricey, but investors are obviously willing to pay for future growth.

Alibaba's forward P/E ratio is only 22.91, according to Capital IQ. The forward P/E on the bellwether S&P 500 index is around 20.

Amazon China

Will Amazon try to counter Alibaba's US advance with a stronger presence in China?

"Amazon is already trying to compete in China, but for now with little success," Lauria said.

Amazon had just a 1.3 percent share of the total business-to-consumer market in China in the third quarter of 2014, nearly a 14 percentage-point loss of market share from the same quarter in 2008, according to a wsj.com report.

Started by Jeff Bezos in 1994, Amazon has been in China since 2004, when it bought Joyo for $75 million. In 2011, Amazon China's Chinese name was changed from Joyo Amazon to Amazon China.

Brian Olsavsky, Amazon vice-president of finance, was asked about the company's international business, especially in China, during an April 23 first-quarter earnings call.

"You're seeing a lot of invention from us in China right now," reported Investor's Business Daily. "We're doubling down now with an Amazon Global Store on our own site, which gives Chinese customers access to over 1 million Amazon products globally."

Amazon opened an online storefront on Alibaba's Tmall in March.

"We continue to be selective in our investments there, but we're taking the long-term view, and we have hopes for the new initiatives with the Global Store and the Tmall flagship store," Olsavsky said.

Amazon said in April that its store on Tmall "features thousands of Amazon China's popular, directly imported products. Additionally, Amazon Global Store selection on Amazon.cn has grown to over 1 million items".

But Amazon's international unit saw first-quarter sales fall to $7.75 billion, almost 2 percent. Amazon's decision to turn to Alibaba's Tmall platform reflects how tough it is to enter China's markets without a Chinese partner.

As for potential challenges Alibaba could face in the US?

"The regulation Alibaba needs to worry about is copyright and trademark protections," Lauria said. "This is an area of great sensitivity in the US market."

On June 24, Alibaba and The International Publishers Copyright Protection Coalition in China announced that they have strengthened their collaboration with a Memorandum of Understanding. The parties will cooperate to combat copyright infringement on AliExpress (a global business-to-consumer site with a strong presence in Brazil and Russia) and Taobao.

Alibaba has been making other inroads into the US. It set up offices near Amazon headquarters in Seattle last year, creating speculation that the site will be its US headquarters, IBD reported. In March, Alibaba announced that it was opening a cloud-computing data center in Silicon Valley, which will be run by Aliyun, Alibaba's cloud-computing arm.

"If Alibaba does bring its China business model to the US, there is a high likelihood they will be disruptive to incumbents," Wingo told IBD. "By planting these seeds with their investments, they are learning a lot about US consumers."

To reach $1 trillion of gross merchandise sales by 2019, Alibaba will need to almost triple the current volume of goods sold, according to Bloomberg.com. Annual gross merchandise volume this year through March 2015 was 2.44 trillion yuan ($393 billion), an increase of about 46 percent from year earlier.

Cross-border purchases by China's Web shoppers increased to more than $20 billion in 2014 from less than $2 billion in 2010, according to EMarketer.

Cross-border purchases by China's Web shoppers increased to more than $20 billion in 2014 from less than $2 billion in 2010, with the US preferred for clothing and personal care and baby products, according to EMarketer.

Ma's overseas push coincides with new policies that make it cheaper for Chinese to import goods and also with trial programs on TMall Global selling Washington state apple and cherries, Alaskan seafood and ice cream from Ben & Jerry's, Bloomberg reported.

"We want to help as many US entrepreneurs, small businesses, and companies of all sizes sell their goods to a growing Chinese consumer class," Jennifer Kuperman, Alibaba's vice president of international corporate affairs told Bloomberg. "Alibaba's international ambition is to help Chinese consumers get the American products they want, and in turn, create jobs and increase exports to China from the United States."

Another area where Alibaba is looking to compete is in the cloud. A bright spot for Amazon in the first quarter was its cloud computing business, Amazon Web Services, which recorded sales of $1.56 billion, up 49 percent.

Picture gets cloudy

On June 8, Alibaba announced that Aliyun would launch Marketplace Alliance Program (MAP), a global program that provides enterprises with access to Aliyun's cloud services and international partners.

The initial Aliyun's MAP partners include Intel, Singaporean telco Singtel and Equinix, a US provider of data centers and Internet exchanges.

"The new Aliyun program is designed to bring our customers the best cloud computing solutions by partnering with some of the most respected technology brands in the world," said Aliyun VP Sicheng Yu. "We will continue to bring more partners online to grow our cloud computing ecosystem."

According to IDC, which provides IT and consumer technology intelligence, worldwide cloud services spending will be $32 billion in 2015, up 28 percent from 2014.

Alibaba, though, has a long way to go on the cloud to compete with Amazon. The US cloud market will be a $75 billion business in 2018, while China's cloud is expected to be only $2 billion, according to IDC.

But that will change if CEO Daniel Zhang has his way.

"We believe data is oil in the new economy," Zhang told a consumer conference on June 24 in Washington.

"Considering the number of people on TMall each day, their promotions give us a level of publicity we could never afford to pay for," Alexa Tonkovich, international program director for the Alaska Seafood Marketing Institute, told Bloomberg. "We see online commerce in China as having excellent potential for Alaskan seafood."

"Alibaba's opportunity in Brazil and Russia and other places like that has grown substantially, so they're looking to penetrate what is the other extremely large e-commerce market in the world, which is the US," Zia Daniell Wigder, research director of e-commerce at Forrester Research told China Daily.

Amy He in New York contributed to this story.

|

Jack Ma, founder and executive chairman of Alibaba Group Holding Ltd addresses the Economic Club of New York at the Waldorf Astoria hotel in New York on June 9. Provided to China Daily |