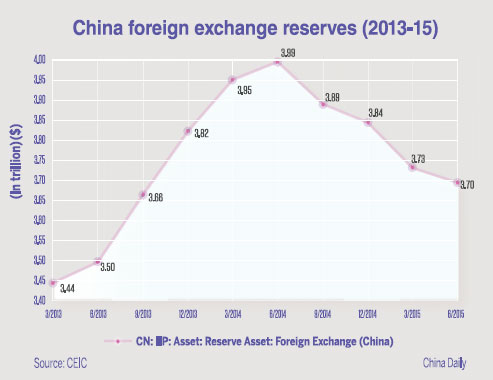

China's forex reserves fall to three-year low

China's foreign exchange reserves -the largest in the world - fell to their lowest level in nearly three years last month as capital outflows from the mainland continued to rise and could increase if the US Federal Reserve raises interest rates as expected, analysts said.

China's foreign exchange reserves fell to $3.44 trillion at the end of November, dropping by $87.2 billion from October, according to the People's Bank of China (PBOC), the country's central bank. It was the lowest figure since February 2013's $3.40 trillion. Reserves have declined by an average of $50 billion a month over the past four months, taking the total reduction this year to $404.7 billion.

"It seems that most of the decline is from capital flight and that capital flight may be about three times the amount of reserves used to prop up the Chinese currency," said Paul Sullivan, a professor at the National Defense University and at Georgetown University in Washington. "When and if the US Federal Reserve increases its target federal funds rate, which will affect many other interest rates, capital outflows from China into the US would be expected to increase."

Analysts believe that the PBOC may be selling dollars to keep the yuan from falling faster than it did when the yuan was depreciated in August. The Federal Reserve meets next week and is expected to increase interest rates for the first time in nine years.

"The pick-up in capital outflows appears to have been predominately driven by increased expectations for renminbi (yuan) depreciation," said Julian Evans-Pritchard at Capital Economics according to Reuters. "A rise in offshore interest rates due to the increased likelihood of a December Fed rate hike will also have added to outflow pressures."

"Money flows to where the highest returns can be found with corrections for risk expectations. It may be that many in China see the risk of keeping large amounts of money in the US to be a lot less than keep it in China in the longer run. The anti-corruption campaign has added greater perceived and actual risk for some," said Sullivan.

He added that flows from other areas of the world into the US may also increase, most particularly from the European Union where many bank and other interest rates are negative.

As money flows into the US due to the interest-rate hikes, the dollar will get stronger compared to the yuan, said Sullivan.

"It is inevitable that the Federal Reserve Bank will increase interest rates at stages over the next few years to possibly as high as 3-5 percent in order to unwind the massive holdings in mortgage-backed securities and Treasury bills it accumulated during its expansionary monetary policy and quantitative easing in the Great Recession," Sullivan said.

"Without getting interest rates back up again, monetary policy simply cannot work properly."

paulwelitzkin@chinadailyusa.com