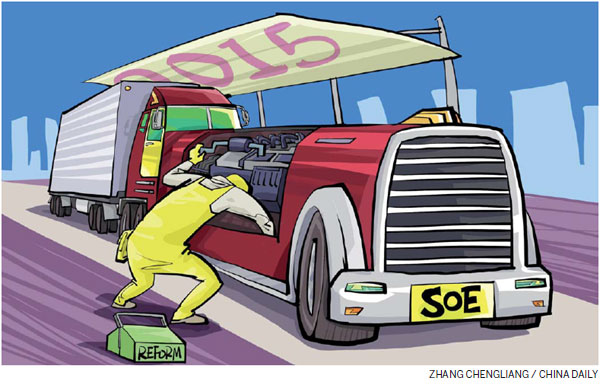

SOE reform gathering pace

Mixed equity in state enterprises to play key role in overseas investment

It is often said that if the world looks at Shanghai to see China, China looks at Shenzhen to see the world. The saying certainly holds true when applied to the long-promised reform of China's state-owned enterprises, which is set to accelerate in 2016.

Shanghai was once known as a paradise for adventurers; it is now a paradise for foreign and state-owned enterprises. Its state assets exceed 12 trillion yuan ($1.85 trillion; 1.68 trillion euros) - equivalent to Russia's entire GDP in 2014. Shenzhen, while still holding state-owned assets of 960 billian yuan, has long been a pioneer of reform, opening up to foreign capital in the 1980s, more than a decade before Shanghai's doors nudged ajar.

These two metropolises are now leading the way in SOE reforms. The Chinese authorities have published a series of policy documents on how the reforms will take shape, with guidelines that encourage mixed ownership of SOEs, as opposed to a single state-owned entity, taking center stage. Other policy papers are set to follow in which new measures such as strengthening corporate governance will be published.

But what do these changes mean in practice? An article in The Economist in September concluded that China's SOE reforms were yielding "a whimper not a bang". However, a careful perusal of how this complex web of reforms is playing out on the ground in Shanghai and Shenzhen reveals evidence decidedly to the contrary. China's SOE reforms are about to have a far greater impact on China itself and European businesses and policymakers than is currently being acknowledged.

In August 2015, Shanghai's largest real estate company began trading on the stock exchange as Greenland Group. Its complex ownership structure highlights the emergence of the trend toward "mixed ownership", which could be about to provide a wealth of investment opportunities for foreign companies. The story lies in the detail.

Greenland's listing was achieved through an asset injection and issuing of new shares in a backdoor listing (referred to in Chinese as "borrowing the shell") of a Shanghai-traded company, Jinfeng Investment. Prior to this, Jinfeng was controlled by state-owned Shanghai Real Estate Group.

Shanghai Real Estate Group, a company fully-owned by Shanghai SASAC, the state asset administrator, also shared ownership of Greenland Group following an early 2014 capital expansion of 12 billion yuan to five "private" equity funds. These five funds created a limited partnership to purchase shares as strategic investors. As a result, the Shanghai state holdings of Greenland fell below 50 percent for the first time. Under strategic guidance, Greenland injected more than 65 billion yuan of assets into Jinfeng's shell, which had market capitalization of only 4.5 billion yuan.

In addition to the involvement of private equity, the reorganization of Greenland in 2014 also had major implications for the employees who held shares in the company prior to listing. They kept their shares and are now the largest shareholder through a limited partnership formed by the Employee Shareholding Committee.

This marks a radical departure from normal practice, allowing profits to be shared by the owners of both capital and labor. It is also an explicit use of the market principle that providing employees with incentives makes them work in the interest of the company. While not detailing how future employee shares will be allocated, traded and disposed, it shows signs that, on a basic level, Chinese state businesses are adopting elements of Western practice in this regard.

The injection of the entire Greenland Group into the "shell" of Jinfeng is also significant for what it reveals about China's move toward mixed ownership of its SOEs. Shanghai SASAC has been joined by central and local state investors in a comingled ownership of Greenland. "Private equity" is a misnomer here. "Mixed equity", a neologism, is more appropriate.

It is significant, too, for foreign companies seeking to invest in China. Greenland's listing involves the entire Greenland Group rather than a subsidiary. While known as a real estate company - now rivaling Vanke as the largest in China - Greenland has subsidiaries in energy and finance, as well as construction, hotels and commerce. By listing the group, all of its subsidiaries are now under the scrutiny of the market while its diversified owners - rather than a sole group parent - make decisions on strategy and governance. This serves to increase transparency and strengthen corporate governance - and boost foreign investor confidence.

The involvement of mixed equity in state enterprise ownership is set to play a key role in transforming the way Chinese enterprises invest overseas.

Jinjiang Hotel is a historic building located in the former French concession of Shanghai. Jinjiang International Hotels Group is the owner of the Jinjiang Hotel and now one of the five largest hotel chains in the world. It achieved this beginning in 2014 through a strategic tie-up with private equity investor Hony Capital. Following Hony's purchase of 12 percent of its shares, Jinjiang acquired Louvre Hotels, one of the largest hotel chains in Europe, relying no doubt on Hony's prowess in international acquisitions.

Of even greater significance was Jinjiang's purchase in September last year of an 81 percent share of Plateno Group for 8.3 billion yuan. Plateno Group is well known for taking the 7 Days Group, a NYSE traded firm, private in 2013. The merger gives Jinjiang 6,000 hotels and 640,000 rooms, making it the fifth-largest hotel chain in the world.

To pay for this, Jinjiang announced in November that it would privately offer 150 million shares at 29.93 yuan each to its controlling shareholder, the Hong Kong-listed Jinjiang International Hotels Group, Hony Capital, two Shanghai SASAC-controlled companies (Shanghai Guosheng Group and Shanghai International Group), Great Wall Asset Management, and Hua An Future Asset Management.

While charges of unending expansion and unwise overseas asset purchases are sometimes leveled at state enterprises, Jinjiang represents something new. Mixed ownership in the form of strategic partnerships with private equity involves both foreign and state capital.

Jinjiang and its immediate parent are both listed, mixing in "social" capital. Beyond providing "a warm bowl of congee" wherever Chinese travelers go, as Alex Zheng, Plateno's co-chairman, recently told Travel Daily Asia, Jinjiang's reach at home and abroad represents a commingling of vested interests that complicates a simple picture of state ownership. Policymakers in Europe and elsewhere should take careful note as Jinjiang-style ventures become increasingly commonplace outside of China.

In another direction for state enterprise reform, Shenzhen is creating new platforms for reorganizing state investment. This is fertile ground for exploring another pillar of reform: "managing capital".

The first move into mixed ownership reform of state enterprises in Shenzhen was a capital increase by state-owned Shenzhen High Tech Investment group. Yuanzhi Fuhai, using a limited partnership fund, which included 202 million yuan from the privately run and listed company, Fu-an-na Bedding and Furnishing, bought 20 percent of the Group for 1.42 billion yuan. Founded in 2013, Yuanzhi Fuhai is an acquisition fund management company. Its shareholders are a mix of privately run companies, publicly owned companies and state-owned enterprises.

The purchase of 20 percent of Shenzhen High Tech Investment Group by the mixed ownership fund, rather than directly by Yuanzhi Investment, which already held over 10 percent of the firm, illustrates the road that new reform of the state enterprise sector capital markets may take. The creation of local government "capital operations platforms" is a trend that is being pushed nationwide. We will hear a lot more about them in the coming years and, again, they represent another major investment opportunity for foreign companies.

The flurry of state enterprise reform documents signals a new direction for China's state enterprises. While much of the mainstream media have underplayed their significance, real change is afoot in ownership, capital operations, the role of limited partnerships and investment funds, employee compensation and corporate governance. The stakes for European businesses and policymakers are high.

Policymakers will need to give careful consideration to the provenance of the incoming Chinese investment they are hungry for, broadening EU competitive frameworks and incorporating state business to yield more global corporate governance, sustainability and capital markets that benefit economic growth.

The author is assistant professor of China Business at the School of Contemporary Chinese Studies, University of Nottingham, UK.

The views do not necessarily reflect those of China Daily.