Effects of supply-side reform take time to be seen

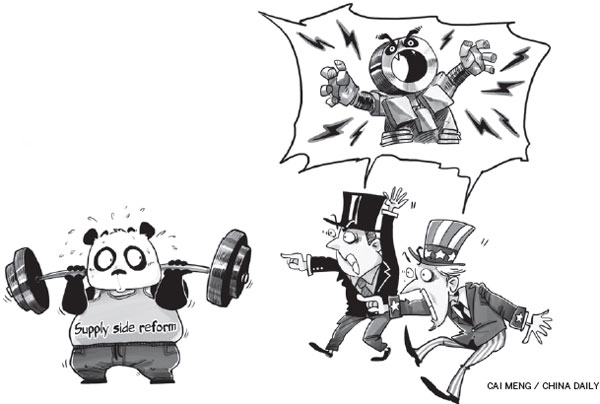

The government is serious about cutting the country's overcapacity, yet seldom do people consider how difficult it is for China to press ahead with supply-side reform at a time when the global economy is recovering slowly.

Even though China is determined to press ahead with painful reforms, some people in Western countries blame China's overcapacity in the steel industry for slumping steel prices and attribute the loss in the steel industries in European countries and the United States to China's dumping of steel products.

But this is unfair. Imbalances, in terms of the value of labor, occur between countries and are particularly apparent when we only focus on a single product category, say, steel products.

In the past years, China did produce more products than needed in some industries, but that is mainly the result of developed countries shifting these industries to developing countries, including China, with the intention of giving up low-end manufacturing and transferring it to less-developed countries.

At the same time, some developed countries failed to make improvements on the demand side while transferring production to developing countries. For instance, the United States badly needs to upgrade its infrastructure, but any proposal by President Barack Obama about investing in domestic infrastructure projects can hardly gain the approval of Congress. How can the developed countries revive their steel industry if there is little demand for steel?

Further, the EU's imports of steel from China are also a result of the withering steel industry in the EU. The EU steel industry can't shirk its own responsibility and place all the blame on China.

What is more, developed countries' demand for steel and other raw materials might increase if the global economy recovers. Any trade protectionism measures would be short-sighted. Supply side reform is not only China's economic restructuring, but also rebalancing its supply to better meet the changing demand in the global market.

European Commission President Jean-Claude Juncker has said steel overcapacity in China equals almost twice of that in Europe. But what is the exact level of China's overcapacity? Data from mysteel.com, a steel information website, shows that China was able to produce 1 billion tons of steel in 2014. But in fact only 800 million tons of steel was produced in 2015, with 700 million tons for domestic use and about 100 million tons for export. That means, overcapacity is a relative term. Should the possible overcapacity of 100 million to 150 million tons of capacity be cut, hundreds of thousands of workers in the domestic steel industry would have to find new jobs, which would be a much more acute challenge than the European steel industry faces. So it will take time to resolve this issue.

The steel industry, which is not profitable now, flourished because of China's massive infrastructure projects and housing boom in past years. While the Chinese government is determined to push supply-side reform and cut overcapacity, it will take time for the effects to be seen.

The developed countries should avoid trade protectionism and have more talks with China under World Trade Organization rules. It doesn't help if they politicize China's steel overcapacity and even deny China's market economy status.

Despite the suspicions of outsiders, China is ready to shoulder its responsibilities and press ahead with supply-side reform.

The author is former senior economist with Agricultural Bank of China.