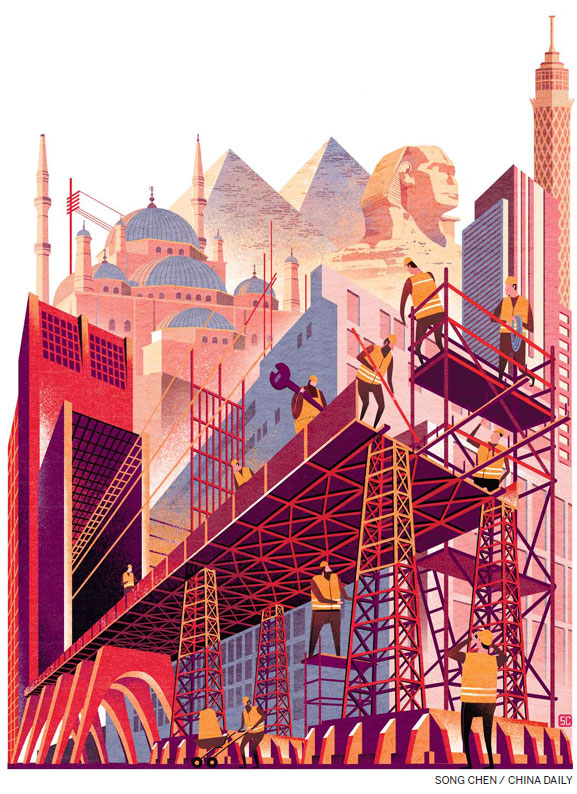

Egypt's capital investment

Chinese make major commitment to help build new smart city east of Cairo

Egypt is determined to have a new administrative capital located between Cairo and Suez, about 45 kilometers east of the current capital. Two Chinese companies have already signed agreements with President Abdel Fattah el-Sisi's administration to fund and build the second phase of the city.

The $45 billion project, which will cover approximately 700 square kilometers, is expected to be the engine of economic growth in a country whose resources have been put under immense pressure.

According to the Egyptian government, the new capital will help decongest the old city, which is plagued by pollution and a lack of affordable housing. Few job opportunities are available to the burgeoning young population, with the unemployment rate standing at 13 percent and young people falling dangerously into poverty.

According to official statistics, the country's population has surged to 92 million, having grown by 2 million within a year. Cairo alone has a population of 9.51 million and the poverty rate has risen from 26 to 28 percent.

Questions linger, however, over whether the new capital will be the silver bullet required to boost sluggish economic growth, which has slowed to 4.9 percent, a drop from 6.8 percent in July 2014. The feasibility of completing the project in five years has also been called into question.

The scheme was unveiled in March 2015 during the Egyptian Economic Development Conference, attended by such influential global figures as United States Secretary of State John Kerry and International Monetary Fund Managing Director Christine Lagarde.

The aim was to market the country as an attractive investment destination and turn on foreign direct investments to stimulate growth and employment.

China became involved during President Xi Jinping's January visit to Cairo. He expressed Beijing's willingness to support Egypt's bid to have a new capital.

The first company to sign an agreement with el-Sisi was China State Construction Engineering Corp (CSCEC), which committed to invest $15 billion. In October, China Fortune Land Development Company (CFLD) secured its first project in Africa by committing $20 billion.

To jump-start the ambitious project, the Egyptian government awarded contracts to four local construction companies to build the administration block. This stage includes 14 new government buildings and a major conference center, to be completed in two years.

A spot check at the site shows that most structures are already up. Trucks emblazoned with the logo of EGG, a Qatari-based company, can be seen on site. The Foreign Affairs Ministry is expected to be the first to start operating from the new capital, by the end of next year.

According to media reports, this first phase is an Egyptian-Chinese venture which includes Arab contractors and the CSCEC.

Egyptian experts are bullish that the new partnership with China will be fruitful and that relocation to the new political and economic capital will be successful.

"I believe the population, especially the private sector, will move closer to easily accessible government services. This is what was lacking in previous attempts to decongest the old capital when two satellite cities, 6th of October and the 5th Settlement, were constructed. I also think that the new location will trigger innovation and the emergence of startups that will address the unemployment challenges facing the country," says Mohamed Higazy, a former Egyptian assistant foreign minister.

The career diplomat believes the foreign firms will deliver.

"These are very reputable companies that have identified the commercial value of this mega project," Higazy says. "Budget overruns are also something Cairo wants to keep to a minimum, and I think we can achieve this with Chinese partners."

Access to cheap loans back home makes the Chinese firms favorable partners.

"Return on investment in Egypt is attractive," says Higazy. "We have a large population that presents a big consumption market. We also have very good infrastructure, which is a catalyst for economic growth."

He added that FDI inflows were still the highest in Africa at $18 billion in 2014, 2 billion more than oil-rich Angola.

It is estimated that about 1.5 million jobs will be created by this project.

He dismisses doubts about whether the first phase will be achieved within two years, saying the government is committed to helping the contractors ensure the time frame is met.

Higazy believes that Sino-Egyptian bilateral relations will soon enter a new chapter, as factories from the Asian giant relocate to the country. The North African nation boasts lower labor and energy costs, elements that could make Chinese businesses competitive.

The project is an extension of ties that have been strengthened over the years. Han Bing, minister counselor for economic affairs at the Chinese embassy in Egypt, says the countries maintain a very close relationship.

"The North African country is an important gateway to Africa and to Middle Eastern countries. It also plays a strategic role in China's Belt and Road Initiative so we are glad to see such ventures maturing."

China is Egypt's largest trade partner, with volume reaching $12.9 billion in 2015 alone.

Han adds that China's experience with rapid urbanization and population growth will be invaluable to Africa.

"In 1950, Shenzhen was a small fishing village, but now it is ranked among the top 50 mega cities in the world. This is because of strategic policies and regulations implemented by the government that triggered innovation and growth," Higazy says.

Scholarly exchange platforms are needed, he says, to help emerging cities avoid the pitfalls of rapid urbanization.

Nehad Adel, president of B2B, an investment and real estate consulting company, strongly believes that that the new project will contribute positively to Egypt's sluggish economy. The government projects that the GDP growth rate, urbanization growth and foreign direct investment inflow will be lifted, respectively, by 2, 10, and more than 15 percent.

"Besides a big population, we have a stable government that is committed to development. Our people love to spend and, on top of that, they are investing hugely in the domestic market. These are healthy indicators foreign investors weigh before putting in their money. I have to say that many of them are impressed by our recent progress," says the real estate guru, who has been in the business for the last 14 years.

He says recent credit ratings - by Standard & Poor's at B- with a stable outlook and Moody's at B3 - are indications that the country is shrugging off the effects of recession.

"I think we are on the right track, and the government is seriously implementing policies to make the country an attractive investment destination. Only recently, the government unveiled about 17 measures that reduced export and import taxes," he says.

Wei Jianqing, executive director of Egypt-TEDA investment Co, the company behind the construction of the Suez-Canal Economic Zone, agrees, saying that foreign investors also favor Egypt because it has signed lucrative agreements with major trading blocs such as the European Union, the Common Market for Eastern and Southern Africa and countries in the Middle East.

"All these will translate into Egypt's industrialization and job opportunities," he says.

Wei says the new capital will bring government administrative services closer to industries planning to set up shop there.

"Plans indicate that the city will be smart, meaning that resources are shared efficiently and wastage is kept to a minimum through green solutions such as wind-power technology. It is also an inclusive urban area and, by zoning, all income groups have been taken care of. I think our industrial zone will draw labor from there," he says.

There have been concerns that previous Egyptian projects such as the 6th of October and the 5th Settlement failed to cater for the needs of low-income groups, such as providing affordable housing and a seamless transportation network. Populations in these areas have remained low, failing to attract residents from the old city, which was the initial plan.

According to Wei, careful planning is needed. The company, which set up shop in Suez eight years ago, had to formulate an innovative strategy to suit the prevailing environment.

"Despite having vast and successful achievements back home, we had to design an overseas model because this is a different landscape. Back home, the government is strongly involved with mega developments, but not here. So the project has to be developed in phases, starting with those that have a quick return on investment such as real estate and commercial buildings. Study the market and learn its needs," he says.

However, he notes that $45 billion is a substantial amount of money. "But once it is secured, the projects will be completed on time."

He advises the Chinese firms to have a clear exit strategy that is also flexible.

Adel, the real estate guru, says government bureaucracy should also be addressed to ensure that the Chinese investors access fast and efficient services.

"This will only be an issue when it comes to getting licenses and approvals. Otherwise, dealing with the private sector is fast and easy," Adel says.

Ambassador Higazy, on the other hand, says that special construction funds should be made available by partners such as Africa Development Bank and international organizations to support Africa's urbanization ambitions. He is excited with the establishment of the Asia Infrastructure Investment Bank, of which Egypt is a board member.

"This means that Africa's concerns are taken into consideration. The availability of affordable loans is an important tool for mutual cooperation. Infrastructure is very important for Africa's success," he says.

lucymorangi@chinadaily.com.cn