Telecom reformer rides sharing economy model

China Tower Corp gets busy optimizing infrastructure of the country's mobile companies

In a quiet street in western Beijing stands a building, not new, not tall, not clad in fancy glass common to modern high-rise office towers. In fact, the building is so ordinary looking that you would barely notice it when passing by. Even two nearby restaurants had to close due to the sparse human traffic.

But this building is where China experiments with one of the most drastic reforms in State-owned enterprises. It is the headquarters of China Tower Corp, a company with more than 300 billion yuan ($43.5 billion) assets. The enterprise is a pilot project for China to restructure State-owned enterprises and to give the market a bigger role in the telecoms sector.

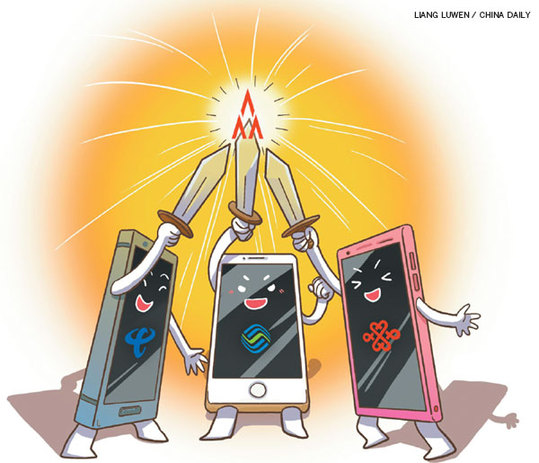

China Tower came into existence in 2014 to handle the tower assets of the country's top three mobile telecoms carriers. By adopting the "sharing economy" model, the plan was to avoid overlapping construction in telecoms infrastructure and to boost efficiency.

"From the first day China Tower was established, we shouldered the mission of reform," Liu Aili, chairman of China Tower, said in the company's sparsely decorated office. The company rents four floors of the building as offices.

In 2015, China Tower marshalled 203.5 billion yuan worth of existing telecoms tower assets from its clients and shareholders China Mobile Communications Corp, China United Network Communications Group Co and China Telecommunications Corp.

Since then, it has been working hard to make the most of existing towers and to promote the sharing rate of newly built ones. By installing multiple base stations on one tower, the company has saved the three carriers the expense of 500,000 towers.

That equals 88 billion yuan less in infrastructure costs and helps reduce the land use by 15 square kilometers.

"The model has significantly lowered costs and boosted efficiency," said Xiao Yaqing, chairman of China's State-Owned Assets Supervision and Administration Commission of the State Council.

The reform also goes deeper than sharing infrastructure resources. Compared with other State-owned enterprises that are overstaffed, China Tower only has 91 management personnel, overseeing roughly 18,500 employees. In comparison, the average level among SOEs of an equal size is 300.

Even by the standard of its US counterpart, the American Tower Corp where one employee manages 25 towers on average, the China Tower is leaner, with one person overseeing 125 towers, the company said.

"We recruit online, process procurement online and coordinate work via our IT system," said Tong Jilu, general manager of China Tower. The company has a procurement team of only eight members responsible for laying down purchasing standards, while leaving local staff with the final say.

"With all processes listed online, each tower has its own balance book to ensure fairness and transparency," said Tong. "I can't recall any supplier coming to us for questions in the past couple of months."

Tower manufacturers are also quick to embrace the all-going-online strategy. The Hebei province accounts for 60 percent of all towers made in China. Shortly after China Tower was established, it signed a deal with the Hebei provincial government to help upgrade the traditional manufacturing sector.

China Tower set up unified standards for towers, and encouraged the province's more than 100 tower constructors to form five big groups.

Wang Changchun, general manager of Hebei Yixin Communication Equipment Co Ltd, a key tower manufacturer in China, said after China Tower set up the online purchasing platform, the company's operating costs went down significantly.

"Thanks to the guiding role by China Tower, we are transforming from small-and-scattered family workshops to standardized production plants," Wang added.

masi@chinadaily.com.cn