Building a new marine economy

Chinese shipyards chart a new course by making high-end vessels for domestic and overseas customers, taking on their global competitors

After delivering frigates to the naval forces of Algeria and Pakistan, and mega-container ships, liquefied natural gas or LNG carriers and vehicle carriers to shipowners in the United States, Norway, Denmark, Germany and Singapore, Chinese shipyards have recently made inroads into the high-end ship segment, to compete with their South Korean competitors.

What's facilitating that trend is the "marine economy", whose meaning has widened in recent times to include industries like shipping, fishing, aquaculture, oil and gas.

The marine economy now includes sectors such as marine chemistry, biomedicine, ocean power, seawater use, marine tourism, ocean engineering and construction. A large variety of vessels serve these industries and sectors. Conventional vessels like bulk ships and ore carriers are no longer the kings of the marine economy transport system.

The new marine economy has created new opportunities for shipyards, and more so for Chinese shipyards because of the Belt and Road Initiative.

Many economies participating in the initiative are seeking to develop trade, regional connectivity, offshore energy, tourism and other service businesses via the 21st Century Maritime Silk Road. Additional demand for ships is coming from China's increasing resource deployment into high-end manufacturing as part of the Made in China 2025 strategy.

Lin Zhongqin, president of Shanghai Jiaotong University, says capable Chinese shipyards have already upgraded their products, having sold cheap bulk carriers and tugboats for more than a decade. They now make complex, high-value-added vessels to reach buyers in new segments through international collaboration, research and development activities.

Shanghai-based Hudong-Zhonghua Shipbuilding (Group) Co, a subsidiary of China State Shipbuilding Corp, bagged an order for four LNG carriers with tank capacity of 174,000 cubic meters each from Japan's Mitsui O.S.K. Lines, or MOL, last month. The total value of this deal is 5.2 billion yuan ($768 million; 670 million euros; £587 million).

These LNG carriers will be equipped with the latest dual-fuel system technology developed by the Chinese shipyard. The technology helps lower a ship's fuel consumption by up to 16 percent.

The vessel will be used in Russia's Yamal LNG project from 2019 or 2020 onward, through a wholly owned subsidiary of MOL. The four contracted carriers will transport European LNG to and from the project.

Hudong-Zhonghua also delivered container-carriers, vehicle-carriers and chemical tankers to clients in Sweden and the Netherlands earlier this year.

Chen Jianliang, chairman of Hudong-Zhonghua, says China, along with developed and developing countries, is eager to purchase natural gas from abroad to adopt greener energy. LNG carriers can meet the demand to secure their energy supply from overseas markets.

The American Bureau of Shipping, a Houston-based classification society, predicted that around 100 LNG carriers will be bought by different shipowners across the globe between 2017 and 2020.

"China is shifting from producing inefficient and dated vessels that are clogging up Chinese shipyards to investing heavily in the rapidly growing market of LNG and liquefied petroleum gas or LPG carriers, as well as marine fishing ships, law enforcement vessels, large icebreakers and chemical tankers," says Chen.

To date, Hudong-Zhonghua has built 13 LNG carriers on orders placed by both domestic and foreign companies, including CNOOC Energy Technology & Services, China LNG Shipping, Teekay LNG Partners and British Gas Services.

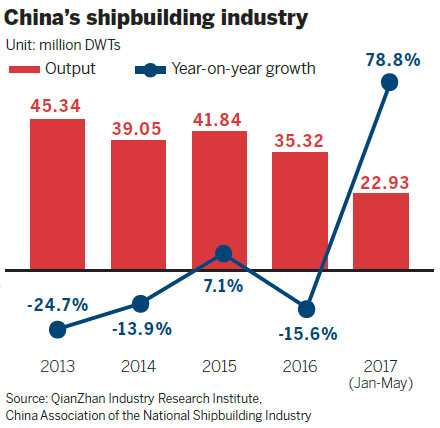

Even though many Chinese shipyards went bankrupt and were restructured last year, the operational revenue of Hudong-Zhonghua was 18.35 billion yuan, up a bit from 2015.

The new course adopted by shipyards in Jiangsu and Zhejiang provinces and Shanghai is largely the result of many global shipping companies reporting losses since 2008 because of overcapacity, declining global trading volume, falling ship prices and surging costs in labor, energy, steel, ship parts and maintenance.

Eager to enhance its earning ability, Nantong COSCO KHI Ship Engineering Co, a 50-50 shipbuilding joint venture between China COSCO Shipping Corp and Japan's Kawasaki Heavy Industries, also aims to have an annual production capacity of two LNG carriers by 2018.

In addition to LNG carriers, another Chinese shipyard, Shanghai Waigaoqiao Shipbuilding Co, is building a cruise liner, the first such vessel to be built on the Chinese mainland. It is expected to be delivered to a Hong Kong-based buyer in 2023, marking a milestone in the evolution of the country's shipbuilding industry.

The as-yet-unnamed ship will be built at Shanghai Waigaoqiao, a joint venture between CSSC and Italy-based Fincantieri SpA, the world's largest builder of cruise ships.

Waigaoqiao Shipbuilding, another CSSC subsidiary, announced earlier this month that it will inject another 720 million yuan into its cruise liner building technology company to improve its research and development strength.

The Hong Kong client will order two new liners from the CSSC-Fincantieri joint venture. It has an option to order four more home-built ships.

"The construction of China's first cruise ship will help improve various sectors of the domestic shipbuilding ecosystem, which will become part of the global supply chain," says Dong Liwan, a shipbuilding professor at Shanghai Maritime University.

Even though Chinese shipyards have recovered a bit in the first half of this year, Dong says competition with South Korean competitors will be fierce in the long term, especially at a time when the whole industry is witnessing price wars and demanding advanced ships with more functions.

South Korean shipyards received 34 percent of global orders in the first half of this year, to top the world's list by countries for the industry's giants, according to British shipping and offshore market intelligence provider Clarkson Research Services.

Three South Korean companies, including Hyundai Heavy Industries Co and Hyundai Samho Heavy Industries Co, received 72 ship orders, including 60 for oil tankers and very large crude carriers or VLCCs, with a total value of $4.2 billion.

Meantime, Samsung Heavy Industries Co received orders worth $4.8 billion to build LNG carriers, mega-container ships and VLCCs from shipowners in Southeast Asia and Europe.

zhongnan@chinadaily.com.cn