Research divines the economics of play

China's toys and games industry boomed in pace with the economy from 2006 to 2012.

Sales revenue increased 57 percent between 2006 and 2012, at an 8 percent compound annual growth rate, according to the data firm Euromonitor International.

Parents have more money than ever to spend on their children because of rapid development and the family-planning policy.

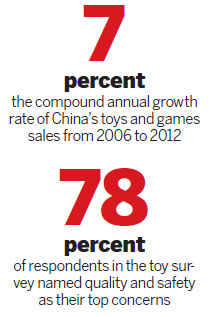

Households are the major buyers. They accounted for 53 percent of total revenues in 2012 and increased their spending on toys and games by a 7 percent compound annual growth rate from 2006 to 2012.

The 2007 baby boom fed increased demand for toddler toys in China until at least 2012, the Euromonitor survey found.

Young parents are increasingly likely to recognize the role toys and games can play in child development, particularly during the early years, Euromonitor experts said.

Euromonitor also found domestic manufacturers were still the leading players in the Chinese toys market. Guangdong Alpha Animation and Culture Co Ltd took up the lion's share of the Chinese market, accounting for 4.4 percent in 2012. Shanghai Yaoji Playing Cards Co Ltd and Ningbo Three A Group Co Ltd took the second and third places.

Mattel Inc from the United States, Lego Group from Denmark and Nikko Group from Japan are catching up with their Chinese peers.

But most mainland consumers have low recognition of toy brands, the Hong Kong Trade Development Council found.

About 31 percent of the parents it surveyed in 2010 couldn't name a toy brand. About 47 percent said they seldom paid attention to brands when buying toys for their children. Their purchasing decisions were determined more by design, quality and price.

The 2012 Survey on Toy Consumption, conducted by the China Toy and Juvenile Products Association, showed "quality and safety" rank atop decision-making criteria, with 78 percent of respondents naming this as their primary concern, followed by function. Price was not consumers' main consideration, the national survey also found.