Zhongguancun listed companies performed well and gained high expectations from investors despite China's sluggish economic growth and gloomy capital markets last year, according to a report released by the Zhongguancun Listed Companies Association.

By the end of 2013, 230 Zhongguancun companies were traded on stock exchanges, according to the park's administrative committee.

The report analyzed data from 200 companies that disclosed their 2013 annual reports before July 1. The companies were engaged in fields of advanced equipment manufacturing, IT services, mobile Internet, modern services, renewable energy, new materials and biopharmaceuticals.

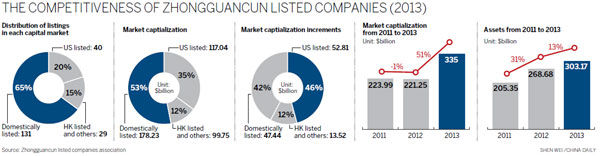

The companies are listed in major capital markets worldwide. Among them, 36 are listed on the Shanghai Stock Exchange, 95 on the Shenzhen Stock Exchange, 24 on the Hong Kong Exchange, 23 in the National Association of Securities Dealers Automated Quotations and 17 on the New York Stock Exchange.

The report showed the growth rate of market capitalization of companies in the Zhongguancun Science Park was higher than the overall growth rate of their respective capital markets in 2013.

For example, the Zhongguancun companies listed on the Shanghai Stock Exchange had a combined growth rate of 20 percent in market capitalization, while the overall growth rate in the capital market was minus 5 percent.

Zhongguancun companies' growth rate in market capitalization on the New York Stock Exchange was 132 percent, much higher than the US market's overall increase of 27 percent.

The statistics indicate that Zhongguancun companies won high recognition in both Chinese and overseas capital markets in terms of both capability and potential.

Given that the Chinese government is promoting economic transformation and restructuring, the Zhongguancun companies are expected to enjoy more opportunities and become a core driving force for the Chinese economy.

Last year, Zhongguancun companies' market capitalization surpassed 2 trillion yuan ($326.5 billion), an increase of 51 percent from 2012. From this, nearly 1.1 trillion yuan was from domestic markets.

Their total sales revenue reached 1.4 trillion yuan, up 11 percent.

Combined assets exceeded 1.8 trillion yuan, up 13 percent from the previous year. Those listed on Chinese stock exchanges held 68 percent of the total assets, which was about 1.2 trillion yuan. The US listed companies held 233 billion yuan, accounting for 13 percent of the total.

The report also provided suggestions on the future development of the Zhongguancun listed companies.

They included building a national high-tech finance and innovation center based on the companies, encouraging them to increase investment in strategic emerging industries and accelerating the initial public offering process in Chinese capital markets.

haonan@chinadaily.com.cn