The report goes on to show Z-Park's performance in capital markets.

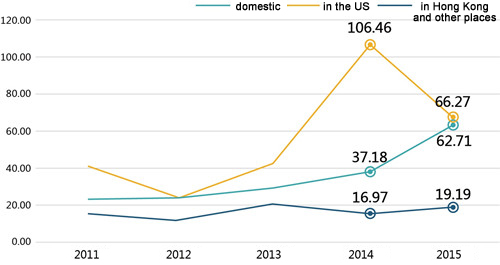

The P/E (price/earnings) ratio of Z-Park companies amounts to 53.41, with domestically listed companies having a ratio of 62.71, those listed in the US having one of 66.27, and those listed in Hong Kong or elsewhere having one of 19.19.

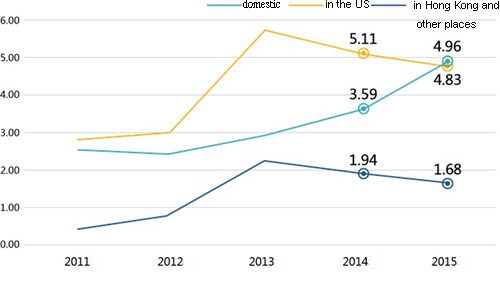

The P/B (price/book) ratio amounts to 4.25: 4.96 for the domestic listed companies, 4.83 for companies listed in the US and 1.68 for companies listed in Hong Kong or other places.

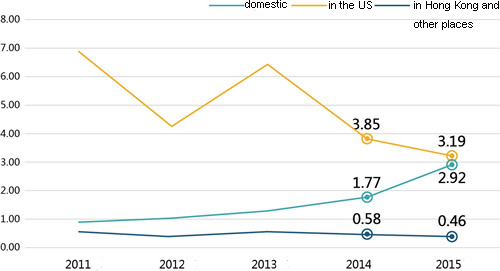

The P/ S (price/sales) ratio amounts to 2.06: 2.92 for domestic listed companies, 3.19 for companies listed in the US, and 0.46 for companies listed in Hong Kong or other places.

The data show that the P/E, P/B and P/S ratio all increased in 2015. The domestic listed companies have caught up with the companies listed in the US, which means that the domestic capital market has improved to the level of the US market.

Diagram 5: The P/E ratio of Z-Park companies listed on different exchanges in 2011-2015

Diagram 6: The P/B ratio of Z-Park companies listed on different exchanges in 2011-2015

Diagram 7: The P/S ratio of Z-Park companies listed on different exchanges in 2011-2015