|

|

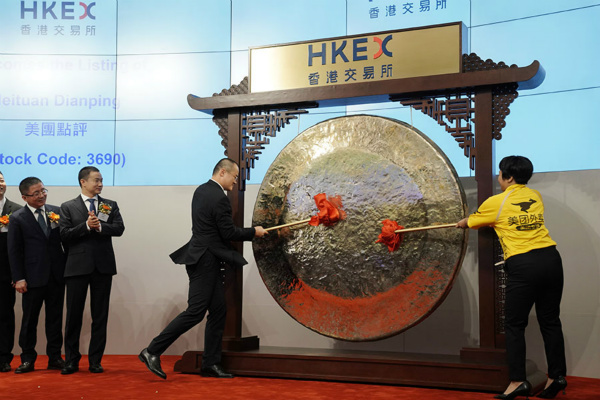

Wang Xing, chairman and CEO of Meituan Dianping, and Qiu Xuexue, a member of the company's delivery staff, strike a gong at the company's listing ceremony in Hong Kong on Sept 20, 2018. [Photo/VCG] |

Chinese tech company Meituan Dianping made a splash in its stock market debut, closing up 5.29 percent on Thursday, giving it a market value of nearly HK$400 billion ($51 billion), wallstreetcn.com reported.

Shares in Meituan jumped as high as 7 percent during morning trading in Hong Kong, briefly touching HK$74 per share. The stock ended the day at HK$72.65, up 5.3 percent from its IPO price of HK$69.

Surpassing China's second-largest e-commerce company JD.com, Meituan Dianping became the fourth-largest tech giant after BAT (Baidu, Alibaba, Tencent) in China.

The company also became the ninth-largest company in terms of market value on the Hong Kong stock market, following the Industrial and Commercial Bank of China worth about HK$482.6 billion, Sina.com reported.

|

|

Wang Xing,chairman and CEO of Meituan, poses for a photo in Hong Kong on Sept 20, 2018. [Photo/IC] |

Wang Xing, chairman and CEO of Meituan, saw his 10.44 percent stake in the company rise to HK$41.65 billion by close of business, making him the 30th richest man in China, South China Morning Post reported, citing data from Bloomberg.

"In the past eight years we have built the largest food delivery platform in China, and now every day we have 20 million people order food from us. We deliver in under 30 minutes. I think it is a huge market, because everyone needs to eat and most people eat three times a day, so now I think we are going to build a even bigger platform. Meituan Dianping is going to become one of the most important technology companies in people's lives in China, " Wang told Bloomberg TV.

Jason Tan, Chief Investment Officer at Jeneration Capital Management and an early investor in Meituan, is bullish about the company's long-term prospects and believes the company is revolutionizing China's service industry.

"We have been long-term investors in the company for quite a bit. We started investing back in late 2015 and early 2016. I think in the service industry the opportunities in China abound, especially in the online-offline combined business model, " Tan told Bloomberg TV.

Tan said a combination of online-offline business models had not really been seen in China and other parts of the world, and it was an exciting opportunity to see technology disrupting traditional business models in the service sectors.