Chinese fur coat dealer Sun Yanchun celebrated his happiest day in two years last week, when he heard that the ruble and the yuan could be directly traded.

Sun is from Xinji, a town in North China's Hebei province, which is also a leather and fur manufacturing hub that exports goods to Russia. The town had been hit hard by the financial crisis, which caused the ruble to depreciate more than 50 percent against the dollar by the end of 2008.

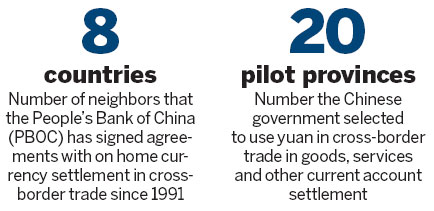

The direct yuan-ruble trading, launched on Dec 15 at the Moscow Interbank Currency Exchange, shows that China has made great efforts to push its currency in the international market. Woo He / For China Daily

The weak ruble has shrunk demand for Sun's fur coat exports. While the currency gradually appreciated along with Russia's economic recovery this year, his business still suffers occasionally from the volatility of the foreign exchange markets and the cost of currency exchange.

When the businessman shipped $200,000 (152,280 euros) worth of fur coats to Russia on Aug 1, the yuan was traded at 6.81 against the dollar. By the time he received his payments from clients on Dec 20, the yuan was being traded at 6.66 against the dollar. This had brought him a loss of 30,000 yuan (3,432 euros).

"For every settlement, my Russian clients have to change rubles to dollars as required by banks. It makes transactions very inconvenient and vulnerable to the volatile exchange rate," he said.

But since China and Russia kicked off the direct exchange of their currencies, Sun has begun to feel new business opportunities.On Dec 15, the Moscow Interbank Currency Exchange (Micex) officially started direct trading of the yuan and the ruble, making trade operations between Russia and China cheaper by bypassing conversion into euros or dollars.

It marked the first time that the yuan could be directly traded in another country. Up to 60 Russian banks have participated in the trading. A total of 22.7 million rubles (562, 279 euros) were traded with the yuan on Micex on the first trading day.

It is widely believed that the move will boost economic and trade cooperation between China and Russia.

"Widespread use of the yuan in foreign trade and investment can help import- and export-oriented enterprises save costs and reduce exchange rate risks," said Lu Zhengwei, an economist from Industrial Bank.

Figures from Customs show that China's trade with Russia totaled $49.96 billion in the first 11 months, an increase of 44 percent from the same period last year.

Bilateral trade volume could reach $55-57 billion for the whole year of 2010, entering the resumption of the growth phase, said Russia's trade representative Sergey Tsyplakov earlier this month in Beijing.

The two countries lifted the last restrictions on trading in the ruble and the yuan last month, following a meeting between Premier Wen Jiabao and his Russian counterpart Vladimir Putin in St. Petersburg.

Li Hui, China's ambassador to Russia, has called the move a "serious catalyst for economics and trade".

"This will hasten the process of internationalizing our currencies," Li said at the opening ceremony in Moscow, Xinhua News Agency reported.

Source: chinadaily.com.cn |