|

Companies access new financing channels and currency exchanges

Qingdao, a port city in Shandong province, is on track to become a financial hub of wealth management.

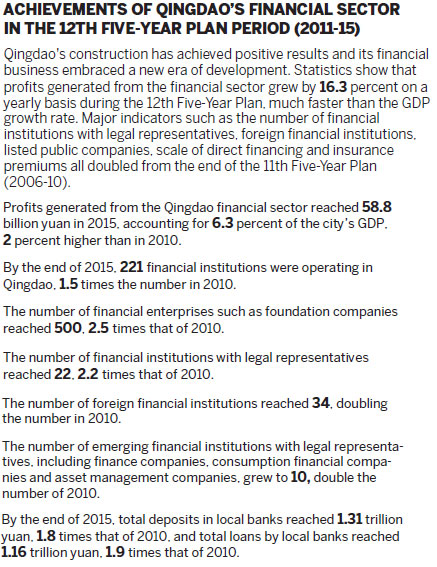

Since it was approved by the State Council to build the Qingdao Wealth Management Financial Comprehensive Reform Pilot Zone in February 2014, the city has made significant progress in policy reforms, which helped spur rapid growth in financial industry profits, its number of financial institutions and the stock market.

In June 2015, Qingdao became the first pilot city to get the green light to allow domestic companies to obtain loans in renminbi from South Korean banks. One month later, Sinopal Electric Co obtained a low-interest loan of 2 million yuan from Hana Bank in Korea with the help of the Bank of Qingdao.

"We were the first company to try this new financing channel, and it only took two weeks from application to reception," said Wang Yuanyuan, deputy general manager of Sinopal.

"The interest is also lower than loans from domestic banks, which are about 4.5 percent while the interest rate ranges from 3.8 percent to 4 percent from overseas banks."

Trading in Korean won sped up in Qingdao, with a surge of over-the-counter cash transactions in won-yuan currency exchange.

Qingdao Rural Commercial Bank was the first bank in the province to be authorized to offer loans in South Korean currency under a currency swap in China.

So far, 24 companies in Qingdao have obtained loans in renminbi from South Korean banks, with a contract amount of 2.65 billion yuan, while 2.33 billion yuan has been loaned. Those loans have helped save a combined financing cost of 53 million yuan for those enterprises.

The new policy doesn't only reduce financing costs and expand financing channels, but also facilitates bilateral trade and mutual investments between Qingdao and South Korea.

In October, top leaders in China and South Korea expanded the cross-border loan practice to the entire province of Shandong, given the success of the pilot program in Qingdao.

To play the role of a pioneer in financial reform, Qingdao also launched new policies in comprehensive financial supervision, cross-border investment and financing and further opened up its financial market. It streamlined many administrative procedures and registration processes to facilitate financial operations.

Last year, Qingdao launched the country's first expansion of the qualified domestic limited partner program, which allows foreign institutions to raise yuan in China and invest it abroad.

In addition to the QDLP, Qingdao launched the qualified foreign limited partner scheme, which allows overseas investors to establish renminbi private equity funds in Qingdao converted from foreign currency or yuan raised in China. This can be invested in unlisted domestic enterprises, non-publicly traded equity of listed companies, convertible bonds and industry investment funds.

The city also launched a pilot program for centralized management of foreign currencies for Qingdao-based multinational companies, such as Haier and Hisense. So far the program has collected $23.4 billion, providing financing support of $4.86 billion, and saving financing costs of 100 million yuan for participants.

By the end of 2015, there were 221 financial institutions operating in Qingdao, of which 22 have legal representatives. There are nearly 500 financial companies in various forms, including funds, asset management companies and consumption financial companies.

There are currently 34 foreign financial institutions, including 17 foreign banks, such as Cathay United Bank Qingdao Branch, DBS from Singapore and ANZ Bank from Australia.

Local banks are also growing rapidly, with the Bank of Qingdao the province's first to be listed on the stock market. As a pilot zone highlighting wealth management, Qingdao has attracted 11 bank headquarters to set up private banks, which currently manage a combined asset worth 70 billion yuan.

Official microblog of Qingdao Financial Affairs Office: Fortune Qingdao (in Chinese); Twitter: Fortune Qingdao.

zhuanti@chinadaily.com.cn

|