Makers of lucrative TCM cast net wider for future success

Producers of ejiao, a best-selling health supplement, are looking to overcome domestic difficulties, as Xin Wen reports from Liaocheng, Shandong province.

In recent years, traditional Chinese medicine has become a global phenomenon as a growing number of people in the West investigate the use of age-old remedies to treat modern ailments.

In 2016, the TCM sector earned 860 billion yuan ($137 billion), a year-on-year rise of 20 percent, accounting for about one-third of the country's medical industrial output, according to the State Administration of Traditional Chinese Medicine.

One of the most successful TCM products is ejiao, a gelatin preparation whose annual output value is estimated to be about 15 billion yuan.

The medicine, which has a history of about 2,000 years, is made from boiled donkey hides and mainly used as a treatment for anemia and menopause-related ailments.

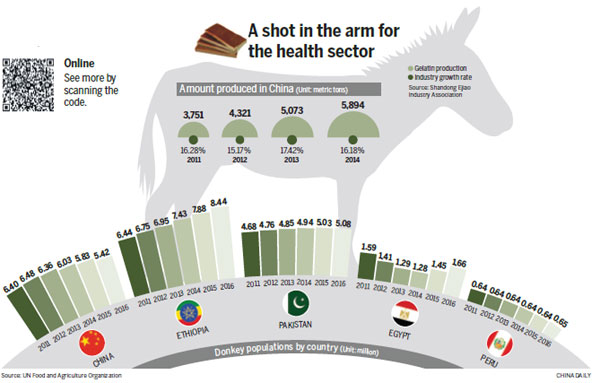

In recent years, annual production of the lucrative product - a 250-gram jar sells for $179.99 on Amazon - has totaled about 5,000 metric tons, requiring the use of 4 million donkey skins.

However, the high demand, coupled with a decline in China's donkey population, has resulted in a marked rise in the number of skins imported annually.

According to the National Bureau of Statistics, the number of donkeys in China fell from 9.4 million in 1996 to 4.6 million in 2016.

The decline is partly a result of urbanization as farmers, who used the animals as beasts of burden, migrate to cities and traditional cultivation techniques are replaced by machines. There are now only enough donkeys to meet about half the annual demand of China's ejiao industry.

In response, the General Administration of Customs lowered the tariff on imported donkey hides on Dec 27. Meanwhile, on Jan 1, the administration cut the import duty on entire hides of a certain weight from 5 percent to 2 percent.

The UN Food and Agriculture Organization estimates there are about 44 million donkeys worldwide, mainly in Asia, North Africa and South America.

The shortage of donkey skins has seen Chinese manufacturers looking further afield to source supplies.

A new venture

To further fill the gap, small donkey-breeding facilities have been springing up in China, most notably in the eastern province of Shandong, where about 90 percent of ejiao is made.

In 2014, Jiang Hongjun quit his job making gelatin for Dong-E-E-Jiao Co, China's largest producer of ejiao. The company is headquartered in Shandong's Dong'e county, which has a population of 40,000 people, many of whom work in the industry.

At the suggestion of his supervisor, Jiang left the factory and joined his mother in a venture to raise donkeys in Wangfengxuan, their home village, and exploit the rising demand for hides. Although startup costs were high, the family-run business was soon making 10 times Jiang's previous wage.

The then-35-year-old had misgivings about quitting his job, but his mother, Guo Fengxiang, had no such qualms, especially as the local government had recently introduced a policy to encourage families to establish donkey breeding cooperatives.

"I knew it was a booming industry, and the subsidy from the government basically guaranteed the farm's survival and allowed us to make more money," Guo said.

Initially, she and Jiang bought 300 foals from the Inner Mongolia autonomous region, but had no idea how to raise or breed them.

"By using common sense and the knowledge I'd gained from raising cattle, we survived the early years," the 70-year-old said.

The preparatory period was drawn out because while male donkeys, or jacks, can be fertile by the time they are 10 months old, females, known as jennys, don't come into heat until about age 2.

"Moreover, donkeys have a long gestation period - usually about 12 months - so about a year or so after the mating season I had to ask my son to consult some professionals and learn how to deliver foals. That helped lift our birth rate from 90 percent to 95 percent. However, raising the foals was hard work."

Their first batch of donkeys made a profit of 450,000 yuan. Though the sum was only equal to the average annual income of a middle-class urban family, it was a huge amount in Dong'e.

This year, Jiang and Guo will raise more than 600 donkeys and sell 90 tons of hides.

Despite his improved circumstances, Jiang still dresses in mud-splattered pants and an old jacket. He rarely discusses his earnings with his neighbors, many of whom work for Dong-E-E-Jiao.

Despite his early success, Jiang sees a black cloud looming. Last year, the price of donkey hides fell to about 20 yuan per 500 grams, compared with 23 yuan in 2016.

"In the first few years, the market price kept rising, but since 2016 it has flat-lined and even fallen" he said.

Securing supplies

Executives at Dong-E-E-Jiao said the company has long faced a shortage of hides. Ironically, the problem emerged just as the market for TCM dietary supplements, especially ejiao, began to take off.

"In 2014, things were so bad that we had a 10-day period when we had no skins to use at all," said Liu Guangyuan, the vice-president.

In response, the company began looking overseas to find new sources of hides.

"Now, about 40 percent of the skins we use every year are imported," said Qin Yufeng, Dong-E-E-Jiao's CEO.

In the past 10 years, the price of ejiao has risen from more than 100 yuan per 500 grams to 2,986 yuan for the same amount. As profits rose, demand for hides soared, as did their price.

Before 2010, an entire donkey skin cost less than 500 yuan, but by 2015, the price had rocketed to more than 26,000 yuan, according to the Shandong Ejiao Industry Association.

Despite the fall in the price of skins in the past year or so, Dong-E-E-Jiao is determined not to become a hostage to fortune or market forces. In an attempt to ensure supply and reduce costs, the company has established 20 breeding bases in 14 provinces.

"By 2020, our bases across the country will produce enough hides to meet our basic needs," Qin said.

The company is looking to branch out. Though it imports hides from 10 countries, it is planning to extend its supply chain to nations in Central Asia and South America, and also import donkeys, not just skins, according to Wang Lifei, director of the importation department.

To make full use of the donkeys it will bring into the country, the company will develop a chain of businesses nationwide to exploit all the subsidiary products.

Last year, Dong-E-E-Jiao established a plant to process donkey meat and milk products, and it plans to open a chain of restaurants across the country in the next 10 years.

"We plan to create an online trading platform for suppliers with the aim of formulating national standards for the industry," Liu, the vice-president, said.

"For the first time, customers will be able to trace every donkey product back to its place of origin."

Contact the writer at xinwen@chinadaily.com.cn

|

Donkeys are fed at a breeding facility owned by Dong-E-E-Jiao, China's largest manufacturer of ejiao.Photos By Wang Jing / China Daily |

(China Daily 03/28/2018 page6)

Shandong Culture and Tourism Consumption Season

Shandong Culture and Tourism Consumption Season Culture, tourism sectors pick up in Shandong as epidemic wanes

Culture, tourism sectors pick up in Shandong as epidemic wanes