Home> Specials

2016 Lujiazui Forum

Updated: 2016-06-20

( chinadaily.com.cn )

|

|

|

| About | |

|

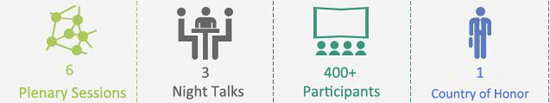

The 2016 Lujiazui Forum is held in Shanghai from June 12-13, carrying the theme of "Global Economic Growth Challenge and Financial Reform". This annual event started in 2008 as a joint effort of the Shanghai municipal government, the People's Bank of China, China Banking Regulatory Commission, China Securities Regulatory Commission, and China Insurance Regulatory Commission. It aims to open a window on the world and to let it better understand China's economy and financial progress.

Country of Honor: UK |

|

|

Figure |

Schedule |

|

|

June 12 09:00-11:00 Plenary Session I: Global Economic Growth Challenge and Financial Reform |

|

News |

June 12 11:00-12:30 |

|

Lujiazui Forum opens in Shanghai The 2016 Lujiazui Forum, themed "Global Economic Growth Challenge and Financial Reform", opened in Shanghai on June 12. >>> more |

|

Plenary Session II: the Golden Era of Sino-UK Financial Cooperation (Special Session for the Country of Honor) June 12 14:00-15:30 |

|

Lujiazui Forum focusing on finance reform This year's Lujiazui Forum is scheduled for June 12 - 13, with the focus on challenges in global economic growth and financial reform. >>> more |

|

Plenary Session III: Supply-Side Structural Reform, Financial Innovation and Macro-prudential Regulation June 12 15:45-17:15 |

|

Shanghai Insurance Exchange launched The Shanghai Insurance Exchange was launched on Sunday, which will boost transparency and efficiency in the world's third-largest insurance market. >>> more |

|

Plenary Session IV: The First Year of China Risk Oriented Solvency System(C-ROSS): A New Starting Point of China’s Insurance Industry Reform June 12 19:00-20:30 |

|

London-Lujiazui financial talks Global investment was the focus of roundtable discussions between policy heads and financial bosses from the City of London and Lujiazui financial district on June 13. >>> more |

|

Night Talk I: Internet Finance Innovation and Risk Mitigation June 12 19:00-20:30 Night Talk II: New Opportunities for Financial Capital in the Era of Mass Entrepreneurship and Innovation |

|

Financial supply-side reform and risk aversion Leaders from PBOC and insurance, banking, and securities regulatory commissions all delivered speeches on financial supply-side reform and risk aversion. >>> more |

|

June 12 19:00-20:30 Night Talk III: China’s Strategy for Inclusive Finance and Green Finance June 13 09:00-10:30 |

|

Shanghai to add shares for foreign JV investors Shanghai is working on increasing the proportion of shares owned by foreign investors in joint ventures, said Zheng Yang at the 2016 Lujiazui Forum on June 13. >>> more |

|

Plenary Session V: Outlook on Global Economic Growth and Macro Policy Coordination June 13 11:00-12:30 |

|

C-ROSS a boon for insurance sector The China Risk-Oriented Solvency System has already played a part in improving the development of China's insurance market. >>> more |

|

Plenary Session VI: New Dimensions for China’s Financial Opening up June 13 13:30-15:30 Closing Forum |

|

What experts say |

|||

|

Zhang Tao (President of People’s Bank of China) Financial institutions with business failures shall be allowed to claim bankruptcy orderly. |

|

Xiang Junbo (Chairman of China Insurance Regulatory Commission) The insurance sector shall focus on supply-side reform to respond to the national strategy. |

|

Guo Ligen (Vice chairman of China Banking Regulatory Commission) Inclusive finance does not mean that all the people need to be involved in finance. |

|

Jiang Yang (Vice chairman of China Securities Regulatory Commission) Avoiding systematic risks is a focus of the current capital market. |

|

|

Wang Yincheng (President of PICC) The China Risk Oriented Solvency System (C-ROSS) is a landmark for the country's insurance system innovation. |

|

Wu Xiaoling (Professor of Tsinghua University) Systemic financial risk would not occur in China in the current climate. |

|

Lord Ashton of Hyde (Representative of UK Chancellor) The London and Shanghai stock exchanges are pushing forward mutual cooperation in finance. |

|

Sean Kidney (CEO and Co-founder of the Climate Bond Initiative) Developing a green bond market will be an effective solution to air pollution, and will also yieldeconomic returns. |

|

Mark Tucker (CEO of AIA Group) Solvency is a good regulatory approach and is suitable for Asia. |

|

George Sartorel (CEO of Asia-Pacific region of Allianz Group) The C-ROSS will affect the entire business model, making company leaders pay more attention to corporate governance. |