Business

Industrial profit growth ebbs

By Chen Jia and He Wei (China Daily)

Updated: 2011-12-28

Rising costs and tight monetary policy squeeze manufacturers

BEIJING - Growth in China's industrial profits slowed in the first 11 months of this year, in what analysts said was a sign of deteriorating economic conditions that could push the government to do more to support business expansion.

|

|

|

A coking plant in Huaibei city, Anhui province. In November, total industrial profits climbed 17.9 percent year-on-year to 542.1 billion yuan, data from the National Bureau of Statistics show. [Photo/China Daily] |

|

|

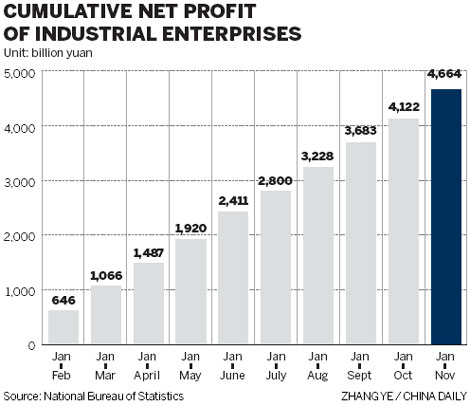

The profits of industrial companies rose 24.4 percent year-on-year to 4.66 trillion yuan ($737 billion) in the January-to-November period, slowing from 25.3-percent growth in the first 10 months and a 27-percent increase in the first three quarters, the National Bureau of Statistics (NBS) announced on its website on Tuesday.

In November alone, total industrial profits climbed 17.9 percent year-on-year to 542.1 billion yuan, compared with an expansion of 12.5 percent in October, according to the NBS.

But State-owned companies' net income declined 14.2 percent last month to 102.4 billion yuan.

Surging production costs, tight monetary policy and shrinking overseas demand have squeezed industrial companies' profits, in line with the dimming global economic growth outlook and the European debt crisis, analysts said.

The slowing profit growth will exacerbate operating pressures on industrial companies and pressure the government to loosen policy, said Qu Hongbin, chief China economist and co-head of Asian Economic Research at HSBC Group.

Mark Norris, general manager of Knauf Plasterboard (Tianjin) Co Ltd in China, a German-backed manufacturer of plasterboards, said that a big challenge for his company, as well as the whole industry, was soaring costs - energy, electricity, raw materials and labor.

"The company has to raise its selling prices continually to respond to soaring energy costs and satisfy stakeholders with good returns," he noted.

The Ministry of Industry and Information Technology said on Monday that in the first 11 months of this year, the price of imported crude oil rose 37.6 percent year-on-year. Import prices were up 30.8 percent for iron ore and 53.2 percent for rubber.

Miao Wei, the industry minister, said on Monday that China's industrial production was expected to further slow next year, with decreasing business profits.

"Industrial output in 2012 is likely to rise by 11 percent year-on-year," said Miao.

Industrial production rose 14 percent in the first 11 months of this year, 0.1 percentage point less than in the January-to-October period, the NBS said.

The fast cooling in the industrial sector is a warning to the government that policy easing should be accelerated, said Qu with HSBC.

"The central bank may reduce the amount of cash that lenders must set aside as reserves before the Spring Festival holidays, and two more cuts may emerge in the first six months of next year," he said. Spring Festival begins in late January.

Qu also forecast that the interest rate might decrease in mid-2012.

Earlier this month, the People's Bank of China lowered the required reserve ratio for commercial banks and allowed more lending to companies, especially small businesses.