Daily life

Brand-new success story for buying luxury products

By Tang Yue (China Daily)

Updated: 2012-02-20

|

The Exotic Cargo Market in Tianjin was a major shopping destination for residents in North China in the 1990s. Vendors used to do good business selling secondhand clothes smuggled from overseas. Its popularity has waned, however, with most of the clothing stalls now being replaced with electronics stores. Photos by Jia Lei / for China Daily |

Designer labels are in fashion and easier for domestic customers to purchase now than at any time before, Tang Yue reports from Tianjin and Beijing.

Zhang Xiuhua ran a stall at the Exotic Cargo Market in Tianjin when it was at its peak.

"I had to get up at 3 am just to get a good booth on weekends," she recalled.

"The street was packed with customers from everywhere. It attracted far more people than any department store."

That was in the early to mid-1990s, when the market was the go-to place in North China for secondhand clothes and other goods smuggled from overseas.

By the end of the decade, the glory days were already over; crackdowns by customs authorities had severed supply chains, while brand-new foreign products were becoming readily available throughout the mainland.

Yet, as the Tianjin market declined, demand among Chinese shoppers for imported - especially high-end - goods has only grown stronger, with experts predicting that the country will this year overtake Japan as the world's largest luxury market.

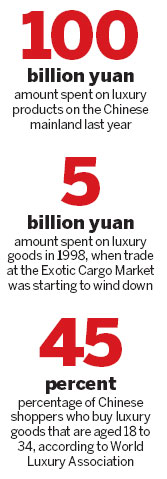

More than 100 billion yuan ($15.88 billion) was spent on luxury products on the mainland last year, a year-on-year increase of about 25 percent, according to data released by management consultants Bain & Co.

The figure is a far cry from the 5 billion yuan recorded in 1998, when trade at the Exotic Cargo Market was starting to wind down.

Stylish entrance

The first Western-style fashion show in China is widely credited to Pierre Cardin, the French designer. He arrived in 1979 with 12 models eight French and four Japanese and set up a catwalk in the capital's Cultural Palace of Nationalities.

Two years later, another show was staged at the Beijing Hotel, this time open to the general public, not just fashion professionals.

"These shows broadened Chinese people's knowledge about clothing," said Zhou Ting, executive director of the University of International Business and Economics' luxury goods and services research center. "In an age when it was all blue, black and gray, for the first time people realized that their apparel could be colorful and beautifully designed."

Cardin went on to open his first Beijing boutique in 1989, with Louis Vuitton following suit three years later.

"No one was certain about the potential of the Chinese market at that time," Zhou said. "Big brands like Louis Vuitton simply believed that they needed to open stores in such a large country. Their prices were still too expensive for most Chinese customers. So it was more about the brand's reach than the profit."

Therein lied the attraction of the Exotic Cargo Market, which had been growing since the late 1980s, when a handful of sailors began selling secondhand suits on the street.

Although referred to in Chinese as "foreign garbage", the smuggled garments were superior to China-made products in textile and design. They were also much cheaper than clothes available in the foreign-owned boutiques.

"The prices were about the same as those in department stores, but the styles were very different," said Zhang, 57. "A lot of people traveled from Beijing or even further to shop at the market."

To replenish her stock, twice or three times a month Zhang would visit Jieshi, a town in South China's Guangdong province that acted as a trading post for secondhand clothes arriving into the port of Hong Kong.

Clothes were bundled into job lots, she said, with a bag of shirts costing about 200 yuan and jackets about 50 yuan.

"We picked the good ones and dumped ones that were too old or torn. Sometimes I kept some for myself," Zhang said. "In the early days (of the market), I was making 10 times the amount I had previously earned as a construction worker," said the trader, who eventually wound up her business in 1999.

Packing up

Tianjin's Exotic Cargo Market is a lot more subdued today than it was two decades ago. When China Daily reporters visited shortly before Spring Festival, a traditional shopping season, there were few customers.

Zhang Li is among the few still selling "foreign garbage" at the market, which now has more traders pushing home appliances and other electrical equipment.

"In the 1990s, a secondhand shirt cost between 30 and 40 yuan. The price is about the same now, but the price of other commodities has doubled or even tripled," she said.

"Fewer customers are coming here, and a lot of traders have packed up and left. It's hard to make a fortune here now," she added.

Industry experts put the decline of the market down to the progress that has been made by Chinese clothes designers and the rise in people's incomes.

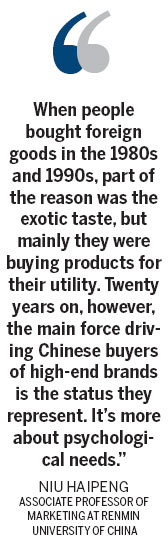

"At first, the production capacity of Chinese firms just couldn't meet demand," explained Niu Haipeng, associate professor of marketing at Renmin University of China. "Customers chose to buy secondhand foreign goods either because there was no equivalent on the domestic market or the quality was different.

"Later, when people found that Chinese manufacturers were capable of offering products with the same quality and at lower prices, they had more options," he said.

Analysis shows that the Chinese appetite for exotic goods never waned, it just changed.

Italian brand Gucci now has about 50 franchises on the Chinese mainland, while Louis Vuitton has 40 and Hermes has 30, said Zhou at the University of International Business and Economics.

Many high-end brands are also branching out into second- and third-tier cities.

Meanwhile, Chinese tourists spent a record $7.2 billion on luxury goods overseas in January, mostly during the Spring Festival holiday, according to a report by the World Luxury Association, a nonprofit organization specializing in market research.

"When people bought foreign goods in the 1980s and 1990s, part of the reason was the exotic taste, but mainly they were buying products for their utility," Niu said. "Twenty years on, however, the main force driving Chinese buyers of high-end brands is the status they represent. It's more about psychological needs."

Luxury desires

Zhu Mingxia, an expert on franchises at the UIBE, said that luxury markets develop in phases: China is still at step one, conspicuous consumption, while the second and third steps are appreciation and enjoyment.

"It's partly because luxury items weren't available in China for a long time," she said. "Also, the 'face' aspect of Asian culture has a lot to do with the boom. It also contributed to the strong desire for brands in Japan, too."

According to the World Luxury Association, Chinese shoppers who buy luxury goods are younger than those in developed nations. Data shows that 45 percent are aged 18 to 34, compared to 37 percent in Japan and just 28 percent in Britain.

"Wealth in China has grown so quickly in the past 30 years," Zhou said. "As a result, the rich are younger and are desperate to prove their social status."

Another factor for the market boom in China is the culture of buying luxury gifts for business associates.

"Foreigners are more rational and buy the things they need," said Ouyang Kun, director of the World Luxury Association's China office. "Yet, the Chinese sometimes buy four or five of the same thing for their family or business partners.

"It is a Chinese characteristic," he added.

Li Xiang and Wang Wen contributed to this story.

Contact the reporter at tangyue@chinadaily.com.cn