High-value future

By David Blair (China Daily Europe) Updated: 2017-06-11 13:55Improving information systems in China's traditional industries seen as crucial to upgrading

Countries, like companies, have to change their business models as world circumstances change. In the early 2000s, China's development model was based on low-wage manufacturing combined with high savings and investment rates. The very success of that model in drastically raising living standards has now led the Chinese government to adopt an ambitious set of policies to upgrade China's industry, to escape the so-called middle-income trap and to support a green environment.

At a meeting of the State Council, China's Cabinet, in May 2016, Premier Li Keqiang said of the country's industrial business model: "China is already a big manufacturing nation, but far from a manufacturing power. ... Integration of manufacturing and the internet is an inevitable path of modern industry."

|

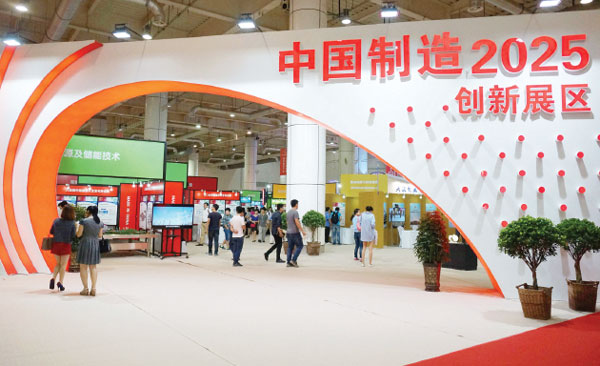

The area for showing innovation products at an exhibition in Dalian, Liaoning province. The Internet Plus and Made in China 2025 policies introduced by Premier Li Keqiang in 2015 aim to redirect China's model by using technology to move traditional industries to higher value-added products. Provided to China Daily |

China has enormous manufacturing capabilities. According to the Ministry of Industry and Information Technology, China's output ranks first in the world in 220 out of 500 major types of industrial products. It also has world-leading infrastructure, which puts it in a different class from other middle-income countries.

But China's comparative advantage no longer lies with low-wage mass manufacturing. According to a study by the Boston Consulting Group, manufacturing costs in China rose from about 86 percent of the US level in 2004 to about 96 percent in 2014.

"China is being pressured from both sides," an unnamed MIIT official told Xinhua. "Advanced economies such as the United States, Germany and Japan have all formulated policies supporting further development of their own manufacturing. At the same time, emerging economies such as India and Brazil are catching up with their own advantages."

Over the past 15 years, China's real wages have gone up eightfold. This is a good thing in that it raises the living standard of the people, but it forces companies to find higher value-added products.

During the same period, many Western manufacturing companies, particularly in Germany, Japan, the UK and the US, invested heavily in becoming automated and efficient. Meanwhile, fracking technology cut energy costs in the US.

"The government knows clearly that manufacturing is the existing competitive advantage. For the past few years, people have been saying that China's manufacturing is big but not that strong. Given the scale, the government is trying its best to upgrade it to a new shape. They want to do it fast because time is very constrained. In five years, 10 years at most, we will see a new structure of leading countries. The fourth industrial revolution is already going on," says Zhai Xin, associate professor at Peking University's Guanghua School of Management.

The 13th Five-Year Plan (2016-20) concentrates on a set of policies to create an "optimized modern industrial system" that can deal with this new environment:

"With a focus on carrying out deep structural adjustment and revitalizing the real economy, we will move ahead with supply-side structural reforms, foster new industries while upgrading traditional ones, move faster to put in place a new modern industry system that has strong innovative capabilities, provides quality services, is based on close collaboration and is environmentally friendly."

The Internet Plus and Made in China 2025 traditional ones, move faster to put in place a policies introduced by Premier Li in 2015 aim to new modern industrial system that has strong redirect China's model by using technology to move traditional industries to higher value-added products and to invest in creating new capabilities in 10 new high-tech industries.

Advanced systems

He Weiwen, senior fellow at the Center for China and Globalization in Beijing, stresses the need to reform traditional industries.

"Of course we have made achievements in upgrading and new high-tech industries. But the focus should be on the traditional industries because, last year, according to the National Bureau of Statistics, the high-tech and emerging industries accounted for only 12 percent of industrial added value. So nearly 90 percent was traditional industry," He says.

"Some people say that restructuring is only high-tech. That is wrong because the traditional industry is most of the employment, and there is no sunsetting the traditional industry. Agriculture, husbandry, fishing, apparel, shoe-making, furniture will never die. It is thus essential to upgrade the traditional industries with high-tech and emerging technologies. If we look at the United States, we see that the traditional industry is still going pretty well."

Robots are sexy, and China is making big advances in robotics. But management experts say that robotics and other high-tech components are just part of creating efficient high value-added companies.

One essential element of production efficiency is creating a company information system that provides managers with real-time information on suppliers, input costs, production lines, finances, human resources and customers.

Companies have achieved astonishing cost reductions using enterprise resource planning, or ERP, software to integrate and optimize their operations.

Liu Licheng, a general manager at Chongqing An Mai Technologies Co, an industrial management consulting company, says, "Most US companies have implemented ERP systems, cutting their costs by 30 percent."

Zhai, of Peking University, agrees: "If you look five years into the future, the percentage of costs saved could be even more than 30 percent. It takes six months, on average, to see some positive results after implementing the software. It's usually about sorting out the data to be sure all the processes are on the same page. After three years, they start to see results on the financial statements."

Liu, who advises manufacturing companies in the city of Chongqing, in Southwest China, says that the government's industrial upgrading policies are urgently needed. He estimates that Chinese manufacturers are 10 years behind US companies in implementing ERP. Small and medium-sized manufacturers, especially, don't have the money or expertise to implement these systems.

"Ten years ago, it was easy to make money, so the companies did not feel any pressure. Now they are suffering, but they don't know how to reduce costs. They move from Guangdong to central China to western China to Vietnam, but they don't know how to reduce costs. They leave money on the table," Liu says.

Zhai says that some sectors are behind, but others, especially large companies, are advancing. She notes that Gold wind, the No 3 wind power manufacturer in the world, is currently reworking its ERP software and business processes.

"The problem is not about whether they can afford it, or whether they can decide to implement it, or how to use it. It's more about how to connect the information, how to manage and use the information. Everybody is talking about big data now, but we need to think about small data. Some Chinese companies don't have a clear vision of how to build the information structure to support their decision-making," she says.

However, some Chinese companies have used enterprise resource planning to improve their business sharply. For example, Dongeejiao Group, a leading manufacturer of traditional Chinese medicine, increased its revenue by 67 percent one year after implementing an ERP system, according to a research study by Liang Huigang of Florida Atlantic University and his co-authors.

According to ChenJia, former president of Dongeejiao, "Some thought the probability of successfully implementing ERP in China was zero. This statement is inaccurate. The case of Dongeejiao can serve as proof."

Worldwide, the German company SAP now has 70 percent of the market for ERP software, and US-based Oracle sells another 20 percent. In China, however, SAP and Oracle together control only 21 percent of the market, as they are challenged by domestic products from Yonyou, Indpur, Kingdee and others, according to Macquarie Research. Furthermore, Chinese purchases of management software have grown by more than 15 percent each year since 2013, while worldwide sales have seen about 3 percent growth.

Many Chinese companies started out as manufacturers for Western brands. Zhai stresses that many are continuously upgrading to higher value-added work.

"They continuously upgrade their technology step-by-step to see what cuts costs and increases efficiency," she says. "The big players are already extending their activities along the value chain. For example, the garment industry goes to designing, then procurement for all kinds of materials, then distribution and branding. They can help the brand owners realize their concept design, realize a prototype."

Financing the upgrade

Recognizing that industrial upgrading is key to the future economy, the government is putting big money behind its policies, but it's also striving to ensure a high level of market input.

In August, the government announced the creation of a $30 billion ( 26.7 billion euros; £23.3 billion) equivalent venture fund especially targeted to boost industrial technology. Somewhat smaller funds have more specific targets.

According to the research company Merics, the Advanced Manufacturing Fund will insert capital worth $3 billion into industrial technology upgrading. The National Integrated Circuit Fund has $20 billion and the Emerging Industries Investment Fund holds almost $6 billion.

In addition, local and provincial governments will set up funds to support industrial upgrading in their regions. By comparison, the German government is devoting only $225 million, and German companies plan to spend about $12 billion over the next decade on the so-called Industry 4.0 upgrading, according to Experton Group, a business consultancy.

The government funds seek to guide market investors, not to provide majority state funding. According to Chen Shaozhi, a senior journalist who heads the Made in China 2025 team at Xinhua News Agency's Economy and Nation Weekly: "The government may lead the industrialization fund, but it is very commercialized. The government puts in a little money. Then the banks, investment companies and venture capital funds all can invest together.

"This type of guidance is similar to the way the government has encouraged private investment in high-tech Silicon Valley-like areas such as Zhongguancun in Beijing. The main goal in traditional manufacturing is to help the entrepreneur make money and survive in the market."

Policy and leadership

"Everyone, government officials and businesspeople, understand that industry has to upgrade. If you don't upgrade, you will be expelled from the market. If you upgrade, it may bring some hurt. But, if you don't upgrade, the only question is whether you die early or die late," Chen says.

So, how does China plan to ensure the country succeeds in this critical upgrading period?

Justin Lin Yifu, director of the Center for the New Structural Economics at Peking University, in a recent article in the Journal of Chinese Economic and Business Studies, outlines the theoretical rationale for China's industrial policy:

"The middle-income trap is a result of a middle-income country's failure to have faster labor productivity growth through technological innovation and industrial upgrading than high-income countries. Industrial policy is essential for the government of a middle-income country to prioritize the use of its limited resources to facilitate technological innovation and industrial upgrading."

Similarly, Zhai, of Peking University, argues that government leadership is essential to China's upgrading.

"Government-led strategy is the most effective way. That's why the government set up 10 key sectors (One Plus X) for Made in China 2025," she says. "We don't need to succeed in each and every sector, but if we take the lead position in several of them, we win, right?"

She concludes: "Why I'm optimistic is mainly because the government has the dedication to pull up the entire sector. They know which direction to go. The government is not just planning domestically, but also globally."

davidblair@chinadaily.com.cn

- 'Cooperation is complementary'

- Worldwide manhunt nets 50th fugitive

- China-Japan meet seeks cooperation

- Agency ensuring natural gas supply

- Global manhunt sees China catch its 50th fugitive

- Call for 'Red Boat Spirit' a noble goal, official says

- China 'open to world' of foreign talent

- Free trade studies agreed on as Li meets with Canadian PM Trudeau

- Emojis on austerity rules from top anti-graft authority go viral

- Xi: All aboard internet express