Stocks go lower as catalysts awaited

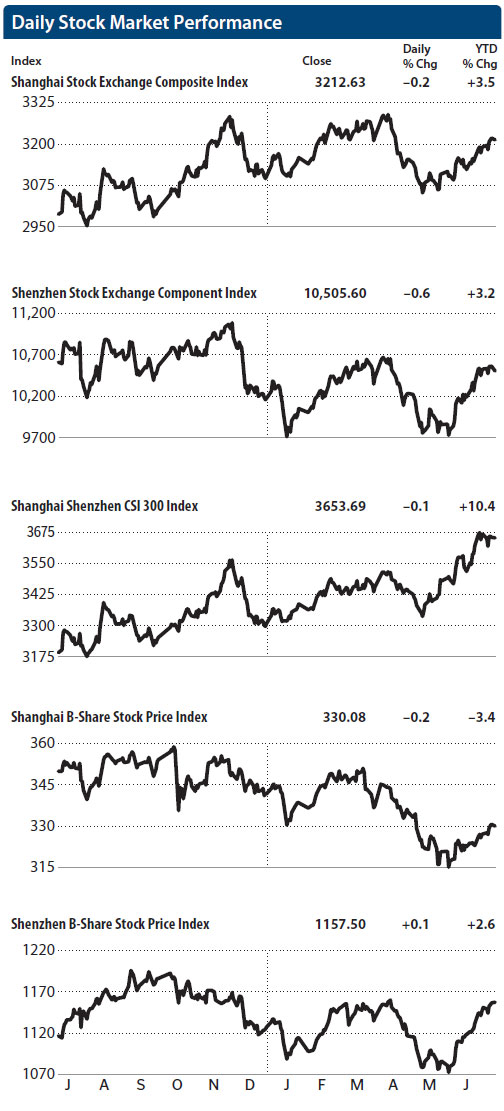

(China Daily) Updated: 2017-07-11 08:02BEIJING - China's main stock indexes were little changed on Monday, as investors awaited fresh catalysts ahead of a burst of data due over the next week. The blue-chip CSI300 index fell 0.1 percent, to 3,653.69 points, while the Shanghai Composite Index slipped 0.2 percent to 3,212.63 points.

Small-caps far underperformed, with the startup board ChiNext sliding 1.8 percent, after the securities regulator approved more initial public offerings over the weekend, raising fears the pace of listings could accelerate.

The CSI300 index futures also closed mixed, with the contract for July 2017 up 0.1 percent to finish at 3,634 points.

Markets shrugged off China's June inflation data, which met expectations and did little to alter the view that economic growth is cooling after a solid first quarter. June consumer prices rose 1.5 percent from a year earlier.

Capital Economics China economist Julian Evans-Pritchard said that "with slowing credit growth likely to weigh on economic activity in coming quarters ... inflation will start falling again before long".

Most economists expect growth to cool in the next few quarters as the key real estate sector slows, while Beijing's crackdown on debt risks raises financing costs in a generally tighter funding environment.

On July 17, China will release second-quarter gross domestic product, along with June industrial output, retail sales and January-June fixed asset investment.

UBS Securities analyst Gao Ting said that investor views have started to diverge, as some see limited upside for quality consumer stocks as valuations touch five-year highs, while others remain upbeat on the re-rating potential of leading players.

Reuters - Xinhua

- 'Cooperation is complementary'

- Worldwide manhunt nets 50th fugitive

- China-Japan meet seeks cooperation

- Agency ensuring natural gas supply

- Global manhunt sees China catch its 50th fugitive

- Call for 'Red Boat Spirit' a noble goal, official says

- China 'open to world' of foreign talent

- Free trade studies agreed on as Li meets with Canadian PM Trudeau

- Emojis on austerity rules from top anti-graft authority go viral

- Xi: All aboard internet express