'Credit cities' make inroads in China

(China Daily) Updated: 2017-07-25 07:42HANGZHOU - Zhang Hao found a job at a securities company in the eastern city of Hangzhou after graduation.

The 28-year-old then saw an apartment he liked online before logging on to the mobile payment app Alipay, which is part of the sprawling e-commerce powerhouse Alibaba Group Holding Ltd.

Alipay rates a customer's credit based on their consumption and investment habits on the app.

Zhang had a high score and was exempted from the rental deposit of 2,600 yuan ($380) and the brokerage fee of 1,300 yuan.

The whole experience not only saved him time and energy in renting an apartment, which is often complicated in China, but also gave him a fresh look at the city where he was about to build a career. It gave him a "sense of belonging".

In China, more and more cities have offered credit-based services to citizens. And more and more people, such as Zhang, have begun to own their credit scores.

At a forum on credit system building in Hangzhou earlier last week, representatives from more than 300 Chinese cities jointly released a declaration. Their aim will be to improve people's well-being by enhancing credit building in the country.

"The credit economy has kicked off in China," said Lian Weiliang, deputy head of the National Development and Reform Commission.

The central government has issued several documents encouraging and guiding the social credit system during the past three years.

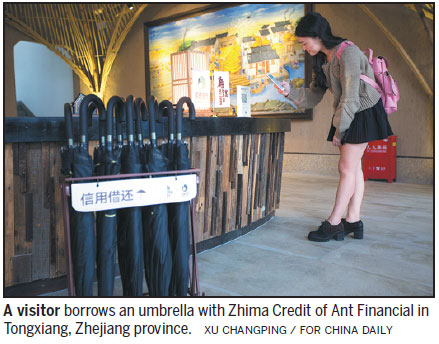

Without any deposit, one can borrow a bike, power bank, library book or umbrella with the help of a smart phone.

"The building of a credit city has made urban life easier and city governance more efficient," said Zhu Dehai, deputy secretary of the city government of Huaibei in Anhui province.

"In Hangzhou, credit is cash," said Peng Lei, president of Alibaba's financial arm Ant Financial. She said citizens with good Alipay credit could enjoy privileges in various public services and urban living.

According to Ant Financial, Alipay has exempted more than 38 billion yuan of deposits for its users, including 4 billion yuan in bike-sharing fees.

Experts said that due to an unsound credit system in China, deposits were amounting to trillions of yuan, leading to heavy social management costs.

There are more than 3,000 public libraries in China. But most of them have few visitors. According to Guangzhou Library, local citizens visited it just 1.15 times on average last year.

But because of the credit borrowing service, citizens in many cities can now visit digital libraries, place orders online and have their books delivered to the door step.

A survey targeting more than 100 city mayors and managers in the country revealed that 81 percent felt it would take up to 10 years before China became a credit society.

But more than half said their city had already started credit building.

Statistics from Ant Financial showed that nearly 300 million Chinese had enquired about their credit records or enjoyed credit services.

Xinhua

- 'Cooperation is complementary'

- Worldwide manhunt nets 50th fugitive

- China-Japan meet seeks cooperation

- Agency ensuring natural gas supply

- Global manhunt sees China catch its 50th fugitive

- Call for 'Red Boat Spirit' a noble goal, official says

- China 'open to world' of foreign talent

- Free trade studies agreed on as Li meets with Canadian PM Trudeau

- Emojis on austerity rules from top anti-graft authority go viral

- Xi: All aboard internet express