Nissan reduces its profit forecast due to recalls in Japan

(China Daily) Updated: 2017-11-13 07:46Nissan Motor Co cut its annual profit forecast by almost 6 percent after announcing a recall of vehicles in Japan that went through an inspection process deemed faulty by the government.

The company halted production at domestic plants for local sales since Oct 19, sending deliveries down by about 50 percent in October, according to the car dealers association in the country.

All six factories - which produce about 1,000 vehicles a day for the Japan market - restarted output and shipments on Wednesday, the automaker said.

The inspection by unauthorized officials is the first major crisis for CEO Hiroto Saikawa, who took the helm in April and has personally pledged to get to the bottom of the lapses.

|

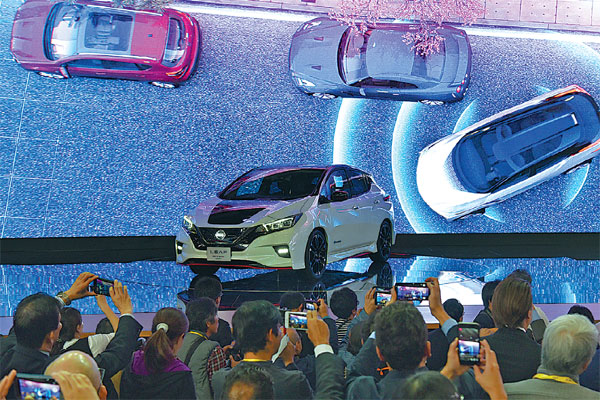

Nissan unveils its new electric vehicle LEAF during Wednesday's media preview of the 2017 Tokyo Motor Show at Tokyo Big Sight. |

Nissan conducted vehicle inspections that did not comply with Japanese regulations for almost four decades, according to a person familiar with the situation.

Incidents at Nissan add to the problems for Japan Inc, already reeling under a scandal at Kobe Steel.

"Manufacturing excellence in Japan is at the core of our operations, so we need to reinforce it," Saikawa told reporters in Yokohama, where Nissan is based.

"Undermining it will rock the foundation of the company's growth." Operating profit in the year through March may be 645 billion yen ($5.7 billion), Nissan said Wednesday, lowering it from the 685 billion yen forecast earlier.

The recall of about 1.2 million vehicles in Japan is likely to cost the company 26 billion yen, while compensation payments in the US for Takata Corp airbag-related cases also dented the year's outlook.

Shares of Nissan, which dropped as much as 1.5 percent immediately after the earnings announcement, reversed the day's losses on optimism the vehicle inspection crisis will only have a temporary impact on earnings.

Saikawa, who succeeded Carlos Ghosn as CEO, is seeking to reach the 8 percent goal for global market share and operating profit margin in the next mid-term plan after failing to reach the targets in the previous period.

Saikawa will steer a company whose future earnings growth is tied to the synergies it can draw from its alliance with Renault SA and Mitsubishi Motors Corp.

In a new mid-term plan, Nissan said it targets to boost revenue 29 percent to 16.5 trillion yen by 2022.

Details will be shared after recovery in Japan operations, Saikawa said.

Nissan's sales in Japan jumped 34 percent in the first half this fiscal year, as an electric motor-powered version of the Note compact became a hit in the country and the new Serena minivan's ProPilot autonomous driving features lured consumers.

Minicar sales rebounded 94 percent from a year earlier, when Nissan suspended sales of the models supplied by Mitsubishi Motors Corp after the latter was found fabricating fuel economy data.

That momentum ended in October as customers canceled some orders after Nissan was found using unauthorized personnel to sign off on quality.

The impact on sales will wane in December, said Asako Hoshino, Nissan's head of Japan.

The automaker has been boosting incentives to find buyers in the United States, a major drag on profitability in its largest market.

While the automaker bucked an industry-wide slump by increasing its deliveries 1.1 percent this year through September, its average incentives in the January-September period jumped 18 percent to $4,179 per vehicle - the highest among Asian auto brands.

"Incentive competition in the US is very fierce," Saikawa said. "So we have to focus on steady profit growth rather than stretching ourselves to hit sales targets."

Nissan will have to fend off increasing competition especially in the midsize sedan market as Toyota updated its Camry and Honda introduced a new Accord this year.

The Camry and Accord are the best-selling midsize cars in the US, while Nissan's Altima trails with sales falling 18 percent this year through September.

Nissan is stepping up introduction of SUVs to make up for the declining demand for sedans and benefit from faster growth in the crossovers and trucks segments.

Jose Munoz, Nissan's chief for North America, has said the company will be generate 60 percent of sales from SUVs, which should help improve profitability.

Rivals Toyota Motor Corp and Honda Motor Co both raised their annual profit forecast, partly lifted by a declining yen.

Bloomberg

- 'Cooperation is complementary'

- Worldwide manhunt nets 50th fugitive

- China-Japan meet seeks cooperation

- Agency ensuring natural gas supply

- Global manhunt sees China catch its 50th fugitive

- Call for 'Red Boat Spirit' a noble goal, official says

- China 'open to world' of foreign talent

- Free trade studies agreed on as Li meets with Canadian PM Trudeau

- Emojis on austerity rules from top anti-graft authority go viral

- Xi: All aboard internet express