|

OPINION> Commentary

|

|

China primed to turn danger into opportunity

By Stephen S. Roach (China Daily)

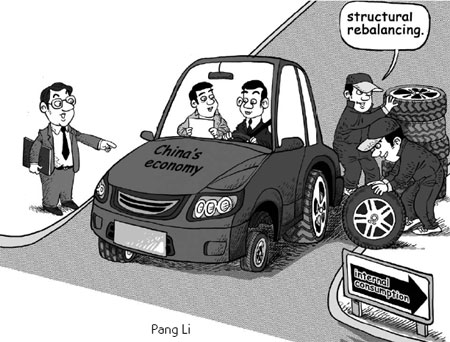

Updated: 2009-03-27 07:40 The world is in the midst of the most wrenching crisis and economic downturn since the 1930s. These circumstances have profound implications for all major economies. China is no exception. I would like to underscore three aspects of the Chinese economic outlook that could bear critically on the nation's development and reform in the midst of this severe global crisis. I will focus on strategy, execution, and credibility. First, on strategy, I worry that China does not fully appreciate its vulnerability to a massive external demand shock. China's export sector has nearly doubled since the turn of the century, rising from 20 percent of GDP in 2001 to 36 percent in 2007. That means, of course, that China is heavily dependent on external demand as a major source of economic growth. Unfortunately, the world is in the midst of a severe demand shock that will not end quickly. In large part, that is because the post-bubble American consumer - by far, the biggest and long the most dynamic of the large consumers in the world - is still in the early stages of what I believe will end up being a major multi-year compression of consumer demand. Moreover, China's unbalanced growth structure is rigid and can't be changed overnight. This makes it even more exposed to a protracted global slowdown. Most importantly, China must recognize that this disruption of the global environment is not like the circumstances in 1997-98 and again in 2000-01. During those periods, China was brilliantly successful in embracing proactive fiscal stimulus strategies that bought time until external demand kicked back in. This time, external demand is not coming back as it did in these two earlier episodes. That means the time-honored strategy of the past will not work in the years immediately ahead. If China is counting on that, I think it will be in for a very rude wakening. Second, on execution, China's macro policies must now be framed with a major emphasis on structural rebalancing. It is finally time to shift away from the export-led growth model to one more balanced and more supported by internal private consumption. The Chinese government has been talking about this for three years since the enactment of the 11th Five-Year Plan. But it simply hasn't happened. Like the rest of us, you appear to have been seduced by the boom of the past several years. Unfortunately, that boom has now gone bust - and you have been caught without a back-up plan. As much as I am in great admiration of China's spectacular successes over the past 30 years, I have been very disappointed in the execution failure in this key aspect of the Plan. It is now high time for China to get much more serious about promoting internal private consumption. I am not talking about more shopping vouchers. I think China needs to take major initiatives in reducing precautionary saving by finally making a commitment to build its long neglected social safety net. In particular, I expect the government to expand significantly the National Social Security Fund, which has an embarrassingly small amount of assets under deposit - only about US$75-80 billion, or less than $100 for each Chinese worker in terms of lifetime social security benefits. I strongly encourage the government to announce an immediate doubling of the assets under management of the social security fund. At the same time, I also hope the government set an explicit target of taking the private consumption share of the Chinese economy from 36 percent at present to 50 percent of GDP in five years. Only then can China speak with confidence about its rebalancing imperatives. I am fully confident that this nation can hit such a target - especially if it puts its mind to the task. My third point is the issue of credibility. China is one of the world's most open economies. In 2007, exports and imports, combined, were 65 percent of China's economy. Given the nation's openness, it can hardly be expected to be an oasis of prosperity in an otherwise sharply contracting world. China most assuredly does not get special dispensation from an external demand shock. In that context, the government's steadfast insistence on hitting its official 8 percent GDP growth target for 2009 is simply no longer credible in a sharply faltering global climate. This is evident on careful examination of China's quarterly GDP growth pattern. On a quarterly basis, the +6.8 percent year-over-year growth rate as officially reported for the Chinese economy in the fourth quarter of 2008 turns out to be a number very close to "zero" if it is recalculated on a sequential basis compared with the third quarter of 2008. Moreover, given the sharp declines in exports in January and February, the economy remained quite weak in early 2009. As a result, it is almost mathematically impossible for China to grow by eight percent growth for the year as a whole. This needs to be recognized and communicated both within and outside of China. Five percent is probably a more credible and realistic estimate of the growth outcome for this year. While that would be a disappointment relative to the official target, such an outcome would still be an outstanding accomplishment for China in the midst of the worst slowdown of the world in eight decades. If China becomes more realistic and credible about its growth target, only then can it take bold steps on strategy and execution, the hallmarks of China's truly spectacular successes over the last 30 years. The Chinese word for crisis, "weiji", includes elements of both danger and opportunity. In my opinion, China needs to be more credible in recognizing its growth risks in order to seize the opportunity in the depths of this very serious global crisis. If any nation can turn danger into opportunity, China is best positioned to do just that. Strategy, execution, and credibility are all essential to China's ongoing reform and development in the midst of this major crisis. The author is the Chairman of Morgan Stanley Asia. This essay is based on remarks presented to the 10th annual China Development Forum held in Beijing on March 21-23.

(China Daily 03/27/2009 page9) |