|

OPINION> Commentary

|

|

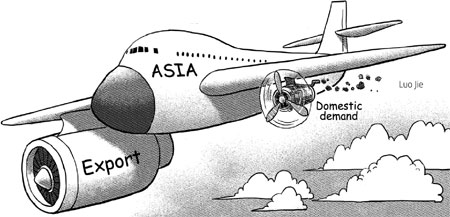

Crisis an opportunity to rebalance Asian growth

By Jong-Wha Lee (China Daily)

Updated: 2009-04-02 07:49 Today's global economic crisis is the worst since the Great Depression. And developing-Asia is being hit much harder than initially thought. It is now time-in fact it is an opportunity-to rebalance our recent rapid economic growth to help protect us from future external shocks and to strengthen our internal sources of growth. Average growth in the region declined about three percentage points last year - to 6.3 percent. Our 2009 Asian Development Outlook now forecasts that growth will slow this year again by close to 3 percentage points - to 3.4 percent. Many emerging Asian economies will suffer severe recession. The region's two giants - China and India - are also seeing their rapid economic expansions curtailed. What does this mean to the people of our region? ADB estimates that more than 60 million will remain trapped in absolute poverty - surviving on less than $1.25 a day - people who in 2008/09 would have otherwise broken through the poverty threshold had 2007 growth rates continued. Many Asian governments responded quickly to the crisis with appropriate financial, monetary and fiscal policies. And we believe Asia will weather the global recession in relatively good shape. Because external demand drives a major part of Asia's growth, our region should recover quickly when industrialized economies show signs of life. It would be easy for the region's policy makers to muddle through by relying on immediate short-term responses. But this certainly isn't the best route. We should instead tackle the fundamental cause of the crisis. Although spawned by the US subprime mortgage meltdown, the fundamental cause of the crisis was lack of discipline and regulation in the financial system and lax fiscal and monetary polices in the US. As it unravels, the crisis clearly shows that inappropriate policies and poor governance in industrialized countries can severely harm the growth and welfare of the developing world. Asia has already proven it can turn crisis into opportunity. In the 12 years since its own devastating financial turmoil, developing Asia has worked hard to improve its economic health. Fiscal and reserve positions are generally sound; external debt is more manageable; and exchange rates are more flexible. With the luxury of hindsight, Asia may have pursued its export-oriented strategy a bit too forcefully. After the 1997/98 crisis, the region developed macroeconomic imbalances while quickly transforming itself from net borrower to net saver. While our region's openness embraced and benefited much from globalization, today we also see the associated risks, particularly given Asia's large reliance on exports and external funding. As Asia's share of the global economy continues to rise, it can no longer overly rely on exports as its primary engine of growth. A more balanced approach can boost social welfare by using its savings more productively. It would mitigate the return of the unsustainable current account surpluses that helped feed the current crisis. Asia is hugely diverse. The optimal policy mix for rebalancing will necessarily differ across national economies. But the underlying principles will remain the same. Rebalancing growth will require developing Asia to adopt a judicious mix of polices to build strong domestic demand and apply its resources more efficiently. First, policy makers must strive to strengthen domestic consumption. In several economies, high savings rates have been driven largely by high corporate profits. Promoting good corporate governance, requiring firms to pay dividends, and applying appropriate taxes to move undistributed profits to households can work. In addition, expanding health, education, and pension systems can help reduce incentives for precautionary household savings.

Second, investment climate and social infrastructure must be improved. Rather than seeking greater investment for its own sake, policy makers should concentrate on building a climate conducive to efficient investment. For the most part developing Asia still lags far behind the world's most competitive economies. Government investments in public infrastructure (like roads and ports) and social infrastructure (education) will raise returns to private investment. Third, financial development needs to be accelerated. A mature financial system will better channel Asia's savings into Asian investment - as opposed to investing in low-yielding foreign government bonds. It will also lessen the need for precautionary savings and encourage greater consumption. On the supply side, efficient financial systems help new small and medium businesses, particularly in services. And fourth, Asia must strengthen regional integration and cooperation. Although trade within the region has grown rapidly, much of it has been feeding China's assemblers who export final goods outside Asia. So for the moment, intra-Asian trade remains hostage to extra-regional demand. Asia must build more substantive intra-regional trade. We should also strengthen our regional monitoring and surveillance initiatives within existing regional arrangements to provide additional resilience against even larger external shocks. For example, the expansion and multilateralization of the Chiang Mai Initiative by ASEAN+3 can help meet any members' emergency liquidity requirements. At the same time it reduces accumulation of excess foreign exchange reserves. Developing-Asia's policy makers must make rebalancing growth a central medium- and long-term objective, even as they grapple with short-term responses to the economic crisis. The region came out of the 1997/98 crisis stronger. It must use this crisis as an opportunity to strengthen itself further. I believe that lessons from the current crisis will lead to a more balanced growth path, one that benefits not only our region's economies, but also contributes to both the global recovery and a return to sustained growth. The author is the Acting Chief Economist of the Asian Development Bank in Manila. The views and opinions expressed are those of the author and do not necessarily represent the views of the ADB, or the countries they represent. (China Daily 04/02/2009 page9) |