Op-Ed Contributors

APEC's role in recovery vital

By Mei Xinyu (China Daily)

Updated: 2010-11-13 06:42

|

Large Medium Small |

Bilateral, regional and multilateral channels should be used to stop Washington from transferring its troubles to others

The 18th informal Asia-Pacific Economic Cooperation (APEC) economic leaders' meeting will be held in Yokohama, Japan on Saturday and Sunday.

Established in 1989 in Canberra, capital of Australia, APEC now has 21 member economies (19 sovereign states and two regions). Among its members are the world's top economic power and economies of a region with the fastest growth rate. Its members account for about 57 percent of the world's GDP, making it the largest regional economic cooperation forum. And before the global financial crisis, APEC members accounted for 45.8 percent of the world trade.

Since China depends on foreign trade more than most other economies, it is crucial for it to promote regional trade liberalization to ensure a relatively steady and secure market. Except for the European Union, China's largest trade partner, largest export market and major import sources are APEC members.

Therefore, the importance of the informal APEC meeting cannot be understated. That brings us to the question: What should China do at the Yokohama meetings?

To begin with, China has to ensure that APEC's aims and the "Bogor Goals" are not undermined. Liberalizing regional trade and investment (and facilitating trade), and intensifying economic and technical cooperation are the two main aims of APEC. The "Bogor Goals", adopted at the 1994 APEC meeting at Bogor, Indonesia, require developed economies to achieve trade and investment liberalization by 2010. Developing economies have to achieve it by 2020.

APEC has been saying all along that the best way of overcoming the global financial crisis is by strengthening cooperation. In fact, at its 2008 meeting, held under the theme, "A New Commitment to Asia-Pacific Development", APEC declared: "The current global financial crisis is one of the most serious economic challenges we have ever faced. We will act quickly and decisively to address the impending global economic slowdown. We welcome the monetary and fiscal stimulus provided by APEC member economies and will take all necessary economic and financial measures to resolve this crisis."

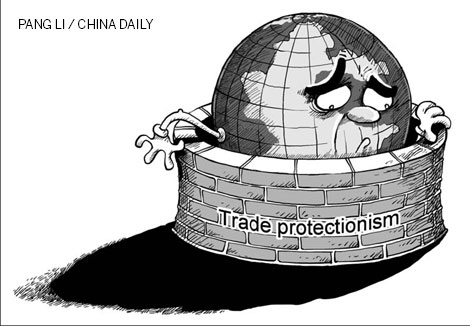

The 2009 APEC meeting in Singapore, which had "Sustaining Growth, Connecting the Region" as its theme, too, focused on how to deal with the crisis. But the financial turmoil that engulfed the entire world affected the trade liberalization process. Taking a cue from the "Buy American" slogan of the United States, some economies began resorting to trade protectionism, undermining the liberalization process.

The number of trade protection cases, however, began falling from the fourth quarter of last year. In fact, global trade remedy cases in the fourth quarter of 2009 dropped by about 20 percent year-on-year. And in the first quarter of this year, new temporary import trade remedy cases (including anti-dumping, anti-subsidy and countervailing safeguard cases) declined by 20 percent year-on-year.

But because the pace of recovery of the real economy in developed countries has been slow, leaders of some advanced economies have tried to fall back on protectionism once again to increase their popularity ratings at home. Such moves are creating obstacles for APEC members to realize the "Bogor Goals" of trade and investment liberalization.

From the middle of this year, the Barack Obama administration began taking protectionist measures to garner more public support for the Democrats in the US midterm elections. In the first half of October, the US began 24 trade remedy cases against China. In such a situation, China has to emphasize that economies have to honor their promises on regional trade liberalization.

The developed member economies of APEC such as the US usually focus on promoting trade and investment liberalization but ignore economic and technical cooperation. China, on the other hand, insists that equal attention should be paid to both aspects.

Hence, at the informal APEC meeting in Yokohama China should highlight the need to create a more equitable and stable development environment for developing countries' foreign direct investment. The prevailing situation and possible course of development make it incumbent for APEC to accept microeconomic policy coordination as one of its themes along with promoting regional trade liberalization and economic and technical cooperation.

The problem is that post-crisis era macroeconomic policies of some economies are highly uncoordinated. For example, the US' quantitative easing monetary policy is harmful for the entire world. Moreover, because of the Republicans' victory in the midterm elections and the strengthening "Tea Party" movement "against big finance and big government" in the US, the Obama administration will find it more difficult to pass (let alone implement) financial measures to stimulate the economy. Instead, it has to rely more heavily on quantitative easing monetary policies, which means printing more dollar notes.

Hence using bilateral, regional and multilateral channels to stop the currency flood generated by the US and to prevent Washington from transferring its troubles to other economies under the pretext of "macroeconomic policy coordination" will be in the interest of all countries and regions.

The author is a research scholar with the Chinese Academy of International Trade and Economic Cooperation, with the Ministry of Commerce.

China Forum