Is a currency war unavoidable?

US monetary policy will fail to cut its huge current account deficits and will create bubbles in emerging economies

One of the policy issues at the top of the agenda at the recently concluded G20 summit was global rebalancing. Achieving strong, balanced and sustained growth was identified by the G20 leaders as a key policy objective.

While G20 officials agreed to allow greater roles for market forces in exchange rate formulation, they also emphasized the need for structural reforms in order to resolve global imbalances. The G20 leaders must be commended for not taking the wrong policy path. The agreements reached by the G20 finance ministers' and central bank governors reduced the risk of a global currency war.

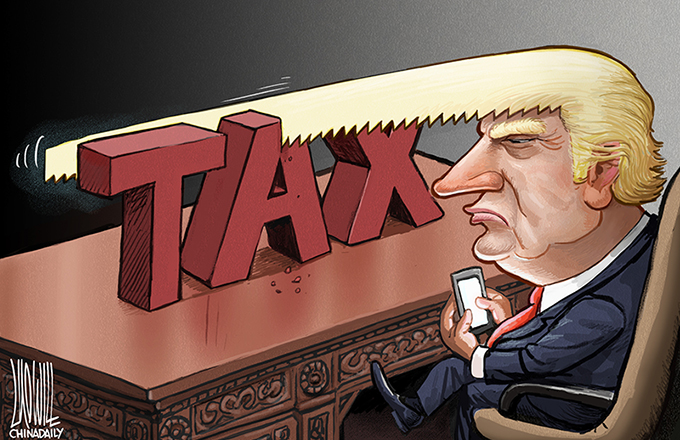

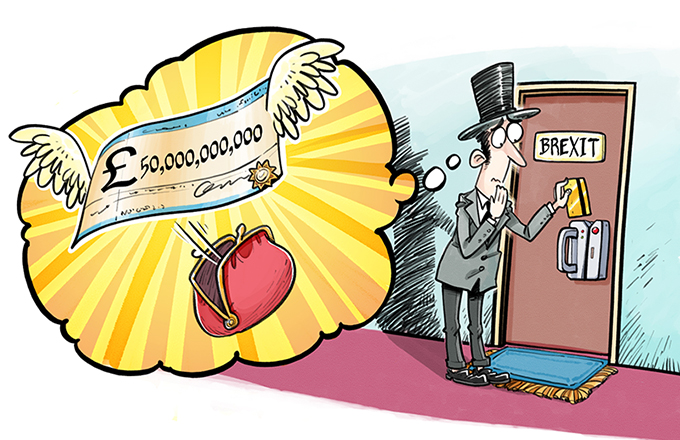

But the possibility of a currency war has not yet been completely averted. Opinion leaders in the West continue to contemplate various options for the US to wage a currency war with China. These include a new version of the Plaza Accord that would focus on exchange rate and fiscal policies in major surplus and deficit countries; punitive import tariffs; restrictions on access to the US Treasury market by countries with surpluses; countervailing intervention by the US; and the Fed flooding the world with dollar liquidity.

In my view, none of these options would be effective in addressing the root cause of the global imbalances. Some are even impossible to implement. Even if the US is able to ban China from accessing the primary Treasury bonds markets, it has not the means to restrict China from buying Treasury bills in the secondary market. Given that China is already the largest holder of Treasury debt, banning China from the market could mean significantly higher costs of capital. Countervailing intervention is even more difficult. Since China still maintains capital account controls, it would be extremely difficult for the US to source renminbi in international currency markets.

A trade war is possible, for example, through the import tariffs suggested by the Congress. But such measures would have to pass scrutiny by the World Trade Organization. Import tariffs would certainly reduce Chinese exports to the US. But, whether China continues to export to the US or the gap is filled by exports from other low-income countries, such import tariffs would lead to higher prices of basic consumer goods and probably higher inflation in the US. Given the differences in comparative advantages between China and the US, it is doubtful that the lost jobs would go to the US.

A new version of the Plaza Accord would not work, either. The essence of the Plaza Accord was currency appreciation and expansionary fiscal policies in surplus countries and currency depreciation and contradictory fiscal policies in deficit countries. Such an approach, however, could lead to excessive currency adjustments, which would create significant adjustment difficulties. More importantly, the Plaza Accord certainly did not root out the causes of global imbalances.

The US can certainly flood the world with massive dollar liquidity by running its printing presses. In the current environment, this serves at least three purposes. One, increases in liquidity may be able to reduce the premiums on risky assets and, therefore, effectively lower the cost of capital. Two, eventual inflation could help to reduce the burden of US public debt, which is currently more than 90 percent of GDP; and, finally, massive dollar liquidity would push down the dollar exchange rates against all other world currencies.

Since the US is the issuer of the global reserve currency, it can print the greenbacks as much as it wants. But it would generate negative impacts on the rest of the world. The most likely outcome would be super-bubbles in emerging market economies. Despite massive liquidities in the US, it is not creating inflation expectations or asset bubbles at the moment. Instead, since its interest rate is low and its value is falling, the dollar is the best currency for carry trade. Investors borrow in the US but buy assets overseas. Emerging market economies including China look attractive places to invest.

But we have seen similar situations before. In the early 1990s when US maintained loose monetary policy conditions, investors poured liquidity into East Asia and helped to create big bubbles. After the Fed began to tighten monetary policy from 1996, capital flows reversed and the East Asian asset bubbles burst. Therefore, the most likely victim of the Fed's second round of quantitative easing (QE2) is probably not the US itself but the emerging market economies.

Global imbalance problems are caused by a range of factors, including exchange rate misalignment and domestic market distortions, therefore, it is better to adopt more comprehensive policy approaches to deal with the problems. Currency is important, but certainly we should not expect depreciation of the dollar to be sufficient to eliminate the US current account deficits.

The same is true for China. During the past 30 years we have adopted an asymmetric market liberalization approach. While product markets are almost completely liberalized, factor markets remain heavily distorted. These distortions lower costs of production, subsidize producers, exporters, and investors and are behind China's structural imbalance problems. Therefore, completion of factor market liberalization should be a critical part of the reform program for rebalancing the Chinese economy.

But the exchange rate also has to move more quickly. Increasing exchange rate flexibility is consistent with our announced policy goals. We have to do our part by introducing a more flexible exchange rate and reducing the current account surplus. Steady but faster appreciation of the renminbi could also be part of the effort to prevent China from becoming the victim of the Fed quantitative easing policy.

When the dollar liquidity flows outside the US, China will be one of the favorite destinations because of its strong growth, high interest rates and expectations of currency appreciation. If we don't adjust our current policy, China could be the next big bubble.

In order to avoid that unhappy outcome, the central bank should let the currency rise steadily. That might attract more hot money inflows, but it is better than a one-step adjustment. The central bank also needs to raise interest rates more swiftly. Again, it might encourage more capital inflows because of the wider interest rate differential between China and the rest of the world, but if rate hikes introduce caps on asset prices, then the net impact on hot money is unclear.

Finally, the authorities need to consider temporary measures to control capital accounts. An exchange rate adjustment will take some time and tighter controls of capital flows may provide a better environment for that adjustment.

More importantly, capital account controls can help stop US dollar liquidity at the border. But of course, such controls should be temporary and for the adjustment period only. Once a large part of the adjustment is done, we should abolish those controls and re-accelerate capital account liberalization.

The author is professor of economics at the China Macroeconomic Research Center of Peking University.

(China Daily 11/19/2010 page8)